Is Mileage Reimbursement Counted As Income

Standard mileage reimbursement rate is exceeded. Some business expense reimbursements are considered taxable income while others are tax-exempt.

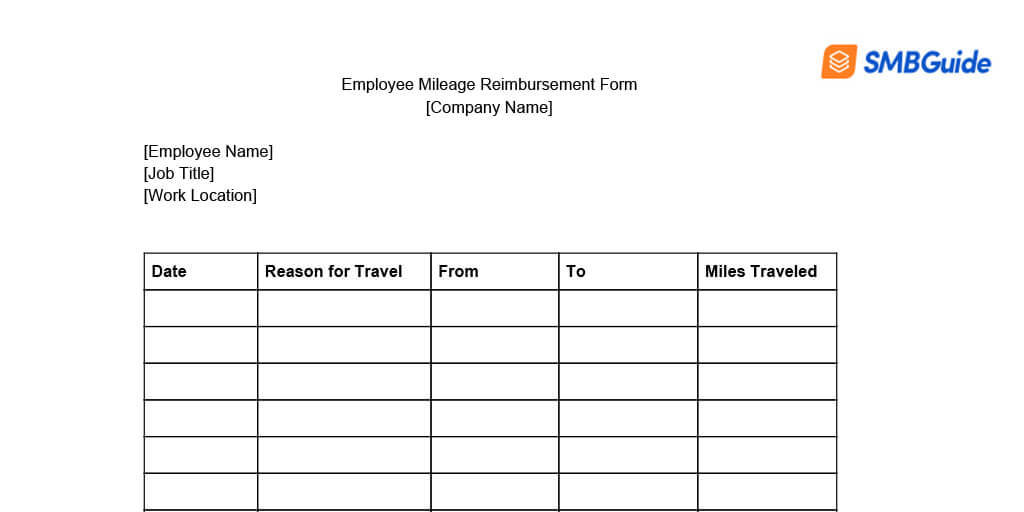

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

If the mileage is a valid business expense and has not passed this test the person deducts the mileage against the 1099-MISC income.

Is mileage reimbursement counted as income. Get every deduction you deserve TurboTax Deluxe searches more than 350 tax deductions and credits so you get your maximum refund guaranteed. If you were reimbursed for travel or transportation under an accountable plan but at a per diem or mileage rate that exceeds the Federal rate the excess should be included in the wages on your Form W-2. Taxable income can be reduced especially when it comes to mileage reimbursement.

We describe exceptions to the rule on how we count. Payments by an employer that are reimbursement specifically for travel expenses of the employee and are so identified by the employer at the time of payment. If its not an accountable plan the mileage reimbursement can count as taxable wages.

A When we count unearned income We count unearned income at the earliest of the following points. In the case of mileage reimbursement the dollar amount received is not taxable as income as long as it does not exceed the IRS limit which is 55 cents per mile in 2009. Lenders will assess all of your income sources and monthly debts to figure out what mortgage you can afford and have the likely ability to pay back.

You just needed to itemize your deductions. How we count unearned income. The IRS requires employers to maintain proof of reimbursement expenses deducted on company tax returns.

Nonetheless states like California and Massachusetts do have a mileage reimbursement rate rule. The IRS hasnt set any official mileage reimbursement rules. If the employee receives expense reimbursement from the employer and cannot provide receipts or other documentation to back up the reimbursement the IRS will consider the reimbursement taxable income for the employee.

For 2020 the federal mileage rate is 0575 cents per mile. Is mileage reimbursement required by law. So they are not really paying taxes on it regardless.

But theres a silver lining. Meal and entertainment expenses are only reimbursable if it can be demonstrated they had a clear business purpose. Here at Motus we understand that taxable income is a tricky thing to wrap your head around.

It all depends on your employers type of reimbursement arrangement. In the past if you had unreimbursed business expenses such as mileage you could deduct it on your federal tax return if it exceeded 2 of your adjusted gross income AGI. The mileage tax deduction rules generally allow you to claim 0575 per mile in 2020 if you are self-employed.

We determine your unearned income for each month. Where the family has net family assets in excess of 5000 annual income shall include the greater of the actual income derived from all net family assets or a percentage of the value of such assets based on the current passbook savings rate as determined by HUD. Yes its included in your taxable income because thats how its being reported to the IRS.

After all there are several things the IRS classifies as taxable income including things like lottery winnings and jury duty fees. More importantly is your office manager truly an independent contractor and not an employee. While it is permitted to reimburse employees at any rate reimbursements in excess of the IRS standard rate are considered taxable income.

There is no required mileage reimbursement rate companies have to pay. View solution in original post. Any amount reimbursed over the IRS standard mileage rate is technically wages.

A car allowance is considered as taxable income but the mileage driven may be tax-deductible. Total qualifying income supplemental income plus the temporary leave income. Extent the withdrawal is reimbursement of cash or assets invested by the family.

But you can deduct business mileage as a business expense which will subtract it from your taxable income. Funds needed to complete the transaction. Determining whether your income is sufficient to get a home loan isnt as simple as just looking at your pay stub.

Total verified liquid assets. Although you will pay income tax on your reimbursements you can deduct all mileage expenses despite receiving reimbursements. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons.

Is mileage that was reimbursed and included on 1099 counted as taxable income. The IRS allows two types of. Employees must claim this at tax time.

When you receive it or when it is credited to your account or set aside for your use. The total qualifying income that results may not exceed the borrowers regular employment income. Reimbursements based on the federal mileage rate.

The IRS sets a standard mileage reimbursement rate. Payments to an employee as reimbursement or allowance for moving expenses if they are not counted as wages for Social Security purposes see 1333.

Mileage Reimbursement Form Template Mileage Reimbursement Form 9 Free Sample Example Mileage Reimbursement How To Memorize Things Funeral Program Template

Mileage Reimbursement Form Template Mileage Reimbursement Form 9 Free Sample Example Mileage Reimbursement How To Memorize Things Funeral Program Template

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

The Basics Of Employee Mileage Reimbursement Law Companymileage

The Basics Of Employee Mileage Reimbursement Law Companymileage

How Much To Reimburse For Employee Mileage Timesheets Com

How Much To Reimburse For Employee Mileage Timesheets Com

Business Mileage Tracking Log Business Plan Template Free Daycare Business Plan Mileage Tracker

Business Mileage Tracking Log Business Plan Template Free Daycare Business Plan Mileage Tracker

Policy Considerations For Mileage Reimbursement I T E I Fyle

Policy Considerations For Mileage Reimbursement I T E I Fyle

Free Printable Mileage Log Mileage Tracker Printable Mileage Log Printable Mileage Tracker

Free Printable Mileage Log Mileage Tracker Printable Mileage Log Printable Mileage Tracker

Keeping Track Of Your Mileage Install Mileiq Make Life Easy Business Expense Tracker Budgeting Money Smart Money

Keeping Track Of Your Mileage Install Mileiq Make Life Easy Business Expense Tracker Budgeting Money Smart Money

Taking A Mileage Deduction After Reimbursement Mileiq

Taking A Mileage Deduction After Reimbursement Mileiq

Mileage Reimbursement For Employees Considered Taxable Wages

Mileage Reimbursement For Employees Considered Taxable Wages

What Do Most Companies Pay For Mileage Reimbursement

What Do Most Companies Pay For Mileage Reimbursement

Mileage Log Reimbursement Form Templates 10 Free Xlsx Docs Pdf Samples Mileage Invoice Template Excel Templates

Mileage Log Reimbursement Form Templates 10 Free Xlsx Docs Pdf Samples Mileage Invoice Template Excel Templates

Mileage Reimbursement Rules For Uber Drivers And Turo Owners

Mileage Reimbursement Rules For Uber Drivers And Turo Owners

Mileage Reimbursement Form Template Mileage Log Printable Mileage Printable Mileage

Mileage Reimbursement Form Template Mileage Log Printable Mileage Printable Mileage

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement For Employees Info Free Download

Mileage Deduction Standard Mileage Rate Workful Blog

Mileage Deduction Standard Mileage Rate Workful Blog

Mileage Reimbursement Calculator For 2018 2019 Https Www Irstaxapp Com Mileage Reimbursement Calculator 2018 Mileage Reimbursement Finance Saving Mileage

Mileage Reimbursement Calculator For 2018 2019 Https Www Irstaxapp Com Mileage Reimbursement Calculator 2018 Mileage Reimbursement Finance Saving Mileage