How To Register An Employee For Uif And Paye

The monthly contribution for UIF is two percent of your workers gross salary per month. Complete the EMP101e Payroll taxes - Application for Registration taxes form.

The Unemployment Insurance Fund UIF gives short-term relief to workers when they become unemployed or are unable to work because of maternity adoption leave or illness.

How to register an employee for uif and paye. Furnish the trading or other name andor PAYE numbers of ALL branchesdivisions including those for which an application for separate registration will be made on an EMP102e form. You can do this from the department of labour website. You must deduct one percent of your workers gross salary per month and you as the employer contributes one percent.

To apply for UIF benefits during the COVID-19 disaster period please visit the Department of Employment and Labours UIF Online Portal. How to register for PAYE on eFiling. You need to accept the terms and conditions and then click on Continue to proceed.

Based on Legislation in Section 56 of the Unemployment Insurance Act. The employee returns must provide the details of all employees employed for the period in question. Employers must register themselves and their worker s as soon as they employ someone.

Step 2 Complete all the required information and click on Register. Call the UIF at 012 337 1680 or your nearest labour centre to find out whether they have received your form and have de-registered you or your workers. Get the necessary information ready.

You are currently viewing. Hand in the forms. How to Declare Pay.

Start using your UIF PAYE SDL Numbers. Employers must complete the forms for both themselves and their workers. Once registered the Employer must declare employees to UIF monthly and pay required amount through SARS EMP201 or through E-filing if employees are below the PAYE Threshold.

New workers appointed or changes in salary before the 7th of every month. The form for the registration of workers asks for an employer reference number. Select Maintain SARS Registered Details.

Telephonically at 012 337 1680. Our SARS UIF Department will ensure your UIFPAYESDL Registration is successful in the quickest possible timeframe. Registering as an Employer.

Fill in the forms. What is the UIF. Navigate to SARS Registered Details functionality.

All registered employers are required to submit employee returns as per the UIF Act. Registration of your entity with both SARS and The Department of Labour for UIF. Unemployment Insurance Fund UIF Please note.

Advantages to be Registered for UIF PAYE SDL. Employers must also inform the UIF of changes eg. Any employee including a domestic worker who works for you for more than 24 hours per month must be registered with the Unemployment Insurance Fund UIF.

Name 7 Name 7 Name 7 Name 7 SurnameCompany name Initials Postal code Tel no. The UIF will create a reference number and send it to you. You can register your employee through one of the following methods.

You need to register with HMRC so you can pay tax and national insurance for your employees. UFiling Login Registration uFiling is a secure Online system introduced to Employers to register declare and pay UIF contributions. In order to capture the return information you would need the following information.

You are required by law to register with the Unemployment Insurance Fund UIF and contribute towards the fund if you have employed people for more than 24 hours per month. Register as an employer and set up PAYE. Employees can also use the system to apply for benefits such as unemployment maternity and illness.

We will also email you the Payroll Tax Notice of Registration this document contains your UIF PAYE and SDL numbers. You would need to register for payment of UIF for the employees however no PAYE would be paid as they are under the annual tax threshold R63 556 per annum for 2013. For assistance in completing the form see the Guide for completion of Employer Registration application.

CLICK HERE to apply. Click on REGISTER in the top right-hand corner to review the terms and conditions for use of the Unemployment Insurance Fund portal. The Maintain SARS Registered Details screen will display.

Keep your employer reference number and the date when your workers stopped working ready when. Select I Agree to confirm that you are authorised to perform maintenance functions of the. State the number of branchesdivisions for which separate registration is required.

Employers who do not have a reference number yet can leave this part open. Choose how to run payroll. A minimum of one employee is required.

Dividend Withholding Tax Return Submission Creative Cfo

Dividend Withholding Tax Return Submission Creative Cfo

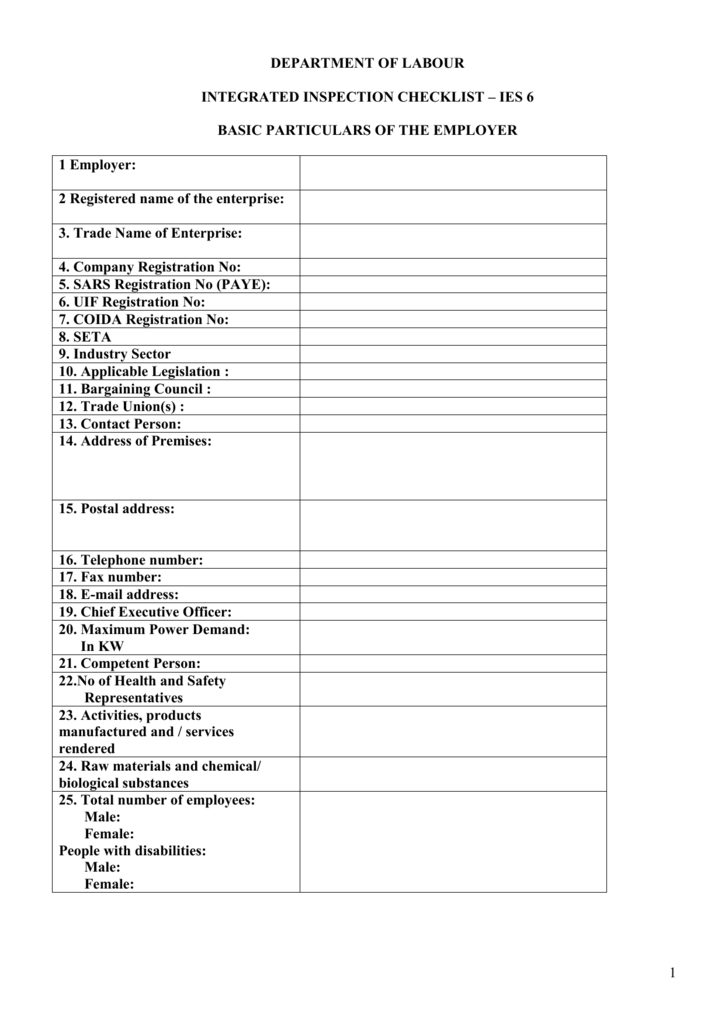

Basic Particulars Of The Employer

Basic Particulars Of The Employer

Sars Paye Uif Sdl Registration The Accounting Village

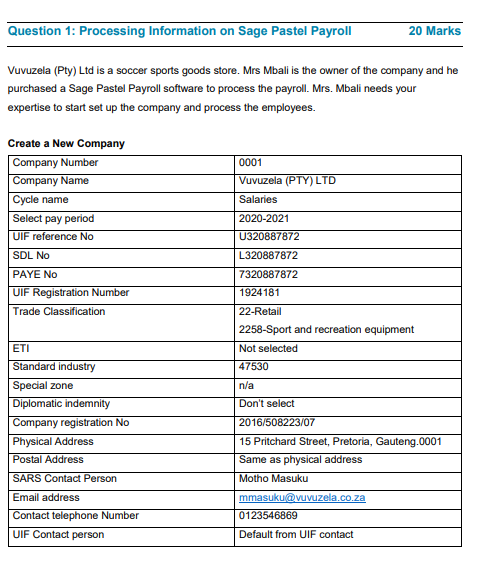

Question 1 Processing Information On Sage Pastel Chegg Com

Question 1 Processing Information On Sage Pastel Chegg Com

3 Steps To Get Your Uif Number Bc Accounting

3 Steps To Get Your Uif Number Bc Accounting

How To Register For Paye On Efiling

How To Register For Paye On Efiling

Https Assets Kpmg Content Dam Kpmg Us Pdf 2021 03 Tnf Sa Mar9 2021 Pdf

Register Uif Domestic Workers Step By Step Guide 2020 Youtube

Register Uif Domestic Workers Step By Step Guide 2020 Youtube

Welcome To The Sars Tax Workshop The Purpose Of This Presentation Is Merely To Provide Information In An Easily Understandable Format And Is Intended To Ppt Download

Welcome To The Sars Tax Workshop The Purpose Of This Presentation Is Merely To Provide Information In An Easily Understandable Format And Is Intended To Ppt Download

How To Register For Paye On Efiling

How To Register For Paye On Efiling

Https Assets Kpmg Content Dam Kpmg Us Pdf 2020 04 Tnf Sa1 Apr2 2020 Pdf

External Guide A Step By Step Guide To The Employer Reconciliation Process Pdf Free Download

External Guide A Step By Step Guide To The Employer Reconciliation Process Pdf Free Download