How To Get Wells Fargo 1099

Customers who switched to online statements before December 31 2020 will be among the first to receive their documents. Repeated customer service and supervisor requests all yield the same reply.

Pin By Carol On Wells Fargo Checking Account Summary Statement Template Bank Statement Wells Fargo Account

Pin By Carol On Wells Fargo Checking Account Summary Statement Template Bank Statement Wells Fargo Account

This information is general in nature is not complete and may not apply to your specific situation.

How to get wells fargo 1099. If you have multiple qualifying accounts with Wells Fargo you might receive multiple forms. Click Portfolio and then Statements Docs. Not enrolled in Wells Fargo Online.

If youre eligible for a payment and the account the US. Assistance with existing accounts including contributions rollovers and distributions. The bank foreclosed on our old house.

Call 1-800-SAVE-123 or 1-800-728-3123. Wells Fargo Employer-Sponsored Accounts. We will mail your 2020 IRS Form 1098 no later than January 31 2021 please allow for delivery time.

If you were not insolvent in 2020 you have two choices pay the income tax on the forgiven debt or attempt to go back to Wells Fargo to get details on the transaction. I do have a Wells Fargo account but its a retirement account which has no money in it and I dont use it. Search for 1099-B and select the Jump to link in the search results.

The Wells Fargo Tax Center and all information provided here are intended as a convenient source of tax information. Retirement Help and IRA Management. You may not have access to all of your brokerage tax documents on Wells Fargo Online.

Create your e-signature and. I received a irs form1099-a from Wells Fargo bank. I imported all my friends Wells Fargo 1099 including 1099B.

Securities are identified as covered or noncovered or unknown on the Form 1099-B to assist your filing. Follow the step-by-step instructions below to e-sign your wells fargo 1099 sa form. Asset statements Assignment of lease.

Select the document you want to sign and click Upload. There are three variants. Oddly some people are getting a Form 1099-INT from Wells for the bonus while others have not.

You can always call the IRS and attempt to open a case requesting a 1099-C correction. If youre a Wells Fargo customer receiving a 1099R form from Wells Fargo the bank should mail it to you early in the following year giving you time to file your taxes. You should consult your own tax advisor regarding your tax needs.

In early 2020 I brought savings bonds that Ive had as a kid into a Wells Fargo branch to cash out. Existing Wells Fargo IRAs. Then in June I went over and deleted the imported 1099 to download the corrected 1099 from Wells.

Decide on what kind of e-signature to create. That one connected on the first time. They did it with no problem and I left with cash in hand.

Wells Fargo customer who had a First Draw PPP Loan with a different lender. Select Statements Documents then Tax Docs1099s. Visit Wells Fargo Advisors for access to all of your brokerage tax documents.

Wells Fargo Home Mortgage is a division of Wells Fargo Bank NA. Wells Fargo Clearing Services LLC only reports the cost basis to the IRS for covered securities. If using 2020 to calculate loan amount this is required.

Treasury directed your payment to was closed prior to the date the funds were received Wells Fargo has returned the funds to the US. Help with retirement plans 401k 403b Defined Benefit Profit Sharing etc serviced by Wells Fargo. But it eventually worked.

Wells Fargo wont give me my 1099 for Savings Bonds. Your tax advisor should. If you use Wells Fargo online banking you can access tax forms online as well.

Find 10 answers to Does Wells Fargo allow 1099 contractors work at home jobs from Wells Fargo employees. From the Document Type drop-down menu choose Tax Documents1099s. Treasury and they may redirect funds to you via check to the address they have on file for you.

Balance of principal isv - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. Your account is a non-interest bearing account and is not subject to a 1099 even on the signup bonus. The applicable gain or loss by completing IRS Form 8949 along with Schedule D of your IRS Form 1040.

No problem at all. IRS Form 1099-MISC detailing nonemployee compensation received box 7 IRS Form 1099-K invoice bank statement or book of record establishing borrower was self-employed during relevant time period. Get answers to your biggest company questions on Indeed.

Follow the screens and youll be able to import your form Please keep in mind that your financial institution has until March 31 2020 to provide you with the form. Sign in to TurboTax and open or continue your return. A typed drawn or uploaded signature.

Good luck with that. What if the Wells Fargo account I previously used to receive my IRS tax refund has since been closed. A lot of us did the 250 Wells Fargo personal checking bonus during 2017 since it was easy and a nice bonus.

It took several tries and we had to pick the right WF partner.

How To Change A Wall Outlet To Double Outlets Business Checks Payroll Checks Cashier S Check

How To Change A Wall Outlet To Double Outlets Business Checks Payroll Checks Cashier S Check

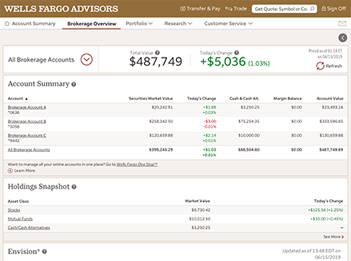

![]() Online Investing Online And Mobile Overview Wells Fargo

Online Investing Online And Mobile Overview Wells Fargo

Statement Wells Fargo Wells Fargo Wells Fargo Account Doctors Note Template

Statement Wells Fargo Wells Fargo Wells Fargo Account Doctors Note Template

Wells Fargo Bank Statement Template Free Download Statement Template Credit Card Statement Bank Statement

Wells Fargo Bank Statement Template Free Download Statement Template Credit Card Statement Bank Statement

Online Investing Online And Mobile Overview Wells Fargo

Online Investing Online And Mobile Overview Wells Fargo

Wells Fargo Mortgage Login Online Wellsfargo Com Wells Fargo Mortgage Paying Bills Wells Fargo

Wells Fargo Mortgage Login Online Wellsfargo Com Wells Fargo Mortgage Paying Bills Wells Fargo

Income Statements Page 1 Document Store Statement Template Wells Fargo Account Bank Statement

Income Statements Page 1 Document Store Statement Template Wells Fargo Account Bank Statement

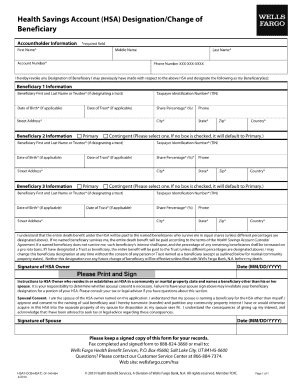

Wells Fargo Consumer Account Application Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Consumer Account Application Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Scandal 5 Thing You Need To Know Wells Fargo Mortgage Wells Fargo Home Mortgage Online Mortgage

Wells Fargo Scandal 5 Thing You Need To Know Wells Fargo Mortgage Wells Fargo Home Mortgage Online Mortgage

Wells Fargo Ppp Loan Available Today Ppploans

Wells Fargo Ppp Loan Available Today Ppploans

Wells Fargo Bank Statement Template Free Download Statement Template Credit Card Statement Bank Statement

Wells Fargo Bank Statement Template Free Download Statement Template Credit Card Statement Bank Statement

Https Saf Wellsfargoadvisors Com Emx Dctm Marketing Marketing Materials Brokerage Accounts E6307 Pdf

Pay Stub 1 Payroll Checks Payroll Template Business Checks

Pay Stub 1 Payroll Checks Payroll Template Business Checks

Online Investing Online And Mobile Overview Wells Fargo

Online Investing Online And Mobile Overview Wells Fargo

Tax Return Fake Tax Return Income Tax Return Income Statement

Tax Return Fake Tax Return Income Tax Return Income Statement

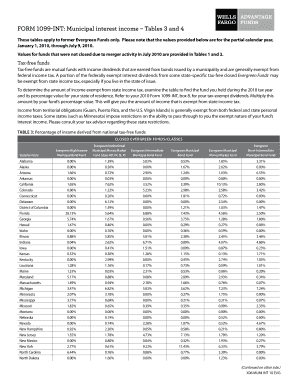

1099 Int Wells Fargo Fill Online Printable Fillable Blank Pdffiller

1099 Int Wells Fargo Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Personal Login Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Personal Login Fill Online Printable Fillable Blank Pdffiller

Wells Fargo Personal Loan Personal Loans Wells Fargo Loan

Wells Fargo Personal Loan Personal Loans Wells Fargo Loan

Wells Fargo Mortgage Review 2020 Smartasset Com

Wells Fargo Mortgage Review 2020 Smartasset Com