How To File Late 1099-nec

You can request an extension to file 1099 NEC through sending a letter to the IRS. Timely filing with the IRS.

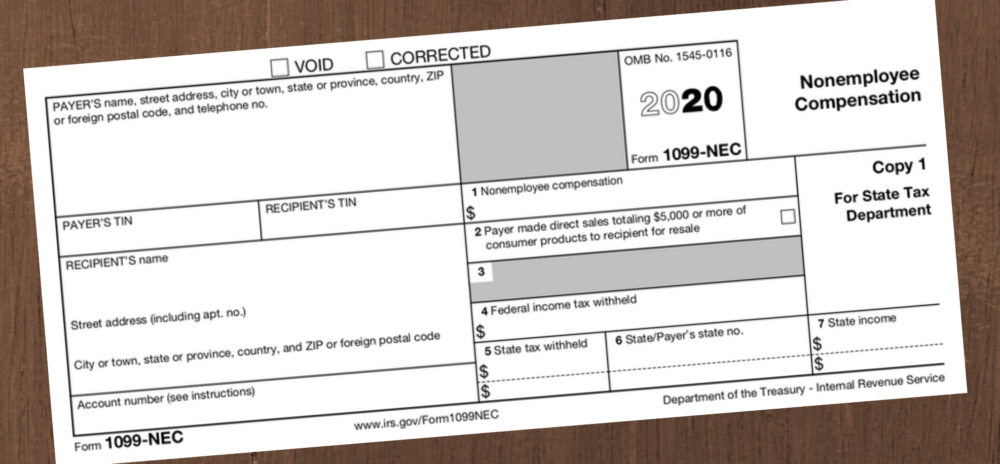

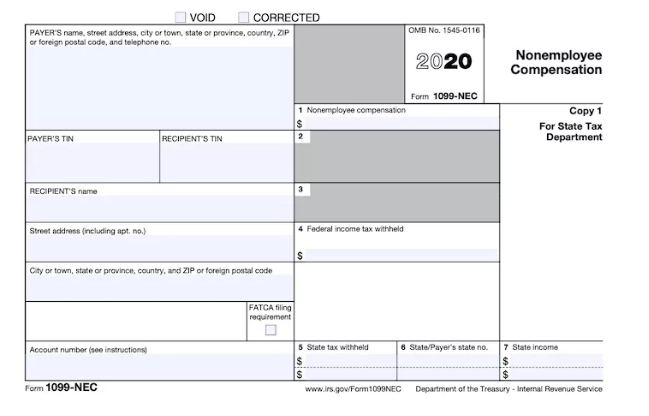

Irs Update New Form 1099 Nec Alfano Company Llc

Irs Update New Form 1099 Nec Alfano Company Llc

You can fill out the form manually and mail it to the IRS mailing address before the due date.

How to file late 1099-nec. If you file Form 1099-NECs after August 1 2021 you could be penalized up to 270 per form. Complete your return in minutes and get your filing status instantly. If you had income under 600 from that payer you wont receive a 1099-NEC form but you still must include the income amount on your tax return.

In the past you used 1099-MISC but for 2020 payments use new Form 1099-NEC for consulting payments and any other form of. There is no automatic 30 days extension for filing 1099 NEC. You can apply for a 30-day extension for filing a 1099 form by completing Form 8809 an Application for Extension of Time to File Information Returns.

The fastest most efficient way to meet your reporting obligations is through efile4Biz. Also prepare early for next year and make sure you collect W-9 Forms from your contractor before making any payments. Filing form 1099-MISC after the deadline you will use the same process as if you were not past the deadline.

However you may not be able to get the status of your return whether its accepted or not. 31 2021 is a Sunday the 2020 tax year. Beginning with tax year 2020 use Form 1099-NEC to report nonemployee compensation.

To minimize the penalty you may receive the fastest option is e-file with the IRS. Beginning with tax year 2020 Form 1099-NEC must be filed by January 31 of the following year whether you file on paper or electronically. Follow these steps to meet your Form 1099-NEC deadline easily.

For example if you file your forms late but within 30 days of the original deadline February 1 2021 you could be charged up to 50 per form. Form 1099-NEC due date. You can either file 1099-NEC electronically with the IRS using the IRS FIRE system or you can mail it to your local Department of the Treasury Internal Revenue Service Center.

Transmit Form 1099-NEC Directly to the IRS. You might be able to get an extension for filing Form 1099-NEC with the IRS by completing IRS Form 8809. The penalty for late filing of forms 1099-MISC is 50 per form if late for 30 days or less and 100 per form if late more than 30 days.

You can wait to receive a letter from the IRS to pay the penalty. Form 1099-NEC can be filed either electronically or by paper. 201 accelerated the due date for filing Form 1099 that includes nonemployee compensation NEC from February 28 to January 31 and eliminated the automatic 30-day extension for forms that include NEC.

The PATH Act PL. Enter your Information Easily. Based on the option you choose at checkout simply enter your data and the forms are mailed to recipients and electronically filed with the IRS.

Then there is the new Form 1099-NEC for independent contractors. Most Forms 1099 arrive in late January or early February but a few companies issue the forms throughout the year when they issue checks. If you are doing your own tax return using a tax software program you will be asked if you have any 1099 income.

Whenever Forms 1099 arrive dont ignore them. However since January 31 2021 is a Sunday the 2020 tax year deadline is moved to Monday February 1 2021. State-Specific Guidance for Form 1099-NEC.

How to pay penalty for late 1099-MISC. You are required to furnish the payee statement to recipients by January 31 February 1 for 2021 and file with the IRS on either paper or electronically. Mail the form to.

A business must file the 1099-NEC form with the IRS on paper or preferably electronically and must provide a statement to the contractor or individual receiving the payment. Beginning with tax year 2020 Form 1099-NEC must be filed by Jan. Also you can postal mail the recipient copies with the postal mailing option.

You can avoid late-filing penalties by furnishing 1099 NEC Forms to the recipients timely by starting the month of February. Be certain that you properly address and mailout forms on or before the due date. Extension requests for reporting nonemployee income in Box 1 of Form 1099-NEC must be submitted by paper not online.

Payments to Independent Contractors If you are reporting payments made to indepedent contractors during a tax year you must fill out forms 1099-MISC or form 1099-NEC non-employee compensation and file it by January 31st of the following calendar year. If you file 1099-NEC anytime past 30 days late and August 1 2021 the penalty could be as high as 110 per form. Get the lowest price in the industry when you e-file Form 1099-NEC for just 149 per form.

31 of the following year whether you file on paper or electronically. Easily File 1099-NEC and 1099-MISC Forms. At this point you can include the information from the form you received.

There will be no interest on the penalty if you pay the penalty by the date indicated in the IRS letter. Due dates to file 1099 NEC with the IRS are the same for paper forms and electronic forms. This can be done through either a tax service provider such as a CPA or directly through the IRS website.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

What Is Form 1099 Nec Nonemployee Compensation

What Is Form 1099 Nec Nonemployee Compensation

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Form 1099 S Substitute 2017 2018 Irs Forms Electronic Forms Estate Tax

Form 1099 S Substitute 2017 2018 Irs Forms Electronic Forms Estate Tax

When To File 1099s And How To Do It Blue Summit Supplies

When To File 1099s And How To Do It Blue Summit Supplies

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Get Ready For Your 1099 Misc Reporting Requirements Harper Company Cpa Plus

Get Ready For Your 1099 Misc Reporting Requirements Harper Company Cpa Plus

Delayed Payment Of Particular Payroll Taxes And Self Employment Taxes Payroll Taxes Efile Self Employment

Delayed Payment Of Particular Payroll Taxes And Self Employment Taxes Payroll Taxes Efile Self Employment

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs 1099 Misc Vs 1099 Nec Inform Decisions

1099 Misc Or 1099 Nec What You Need To Know About The New Irs Requirements Northeast Financial Strategies Inc

1099 Misc Or 1099 Nec What You Need To Know About The New Irs Requirements Northeast Financial Strategies Inc

Filing 1099s Who Gets One Capforge

Filing 1099s Who Gets One Capforge

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center