How To Create A 1099 Form In Quickbooks Online

If you want to sort the report by 1099 vendors. Time to prepare your 1099-MISCs.

Create And Print Timesheets In Quickbooks In 2020 Quickbooks Accounting Software Print

Create And Print Timesheets In Quickbooks In 2020 Quickbooks Accounting Software Print

The procedure to create 1099s in QuickBooks Desktop involves the following steps.

How to create a 1099 form in quickbooks online. However creating 1099 forms for your contractors inside the program is unavailable. To help with end-of-year filings run a report of all the payments you made this year to your 1099 vendors. Select Expenses Vendors.

Review your 1099 Forms and make sure that the information brought over from QuickBooks Online is correct. Select all or select only the 1099 forms you want to submit. Create Multiple Invoices In Quickbooks Online.

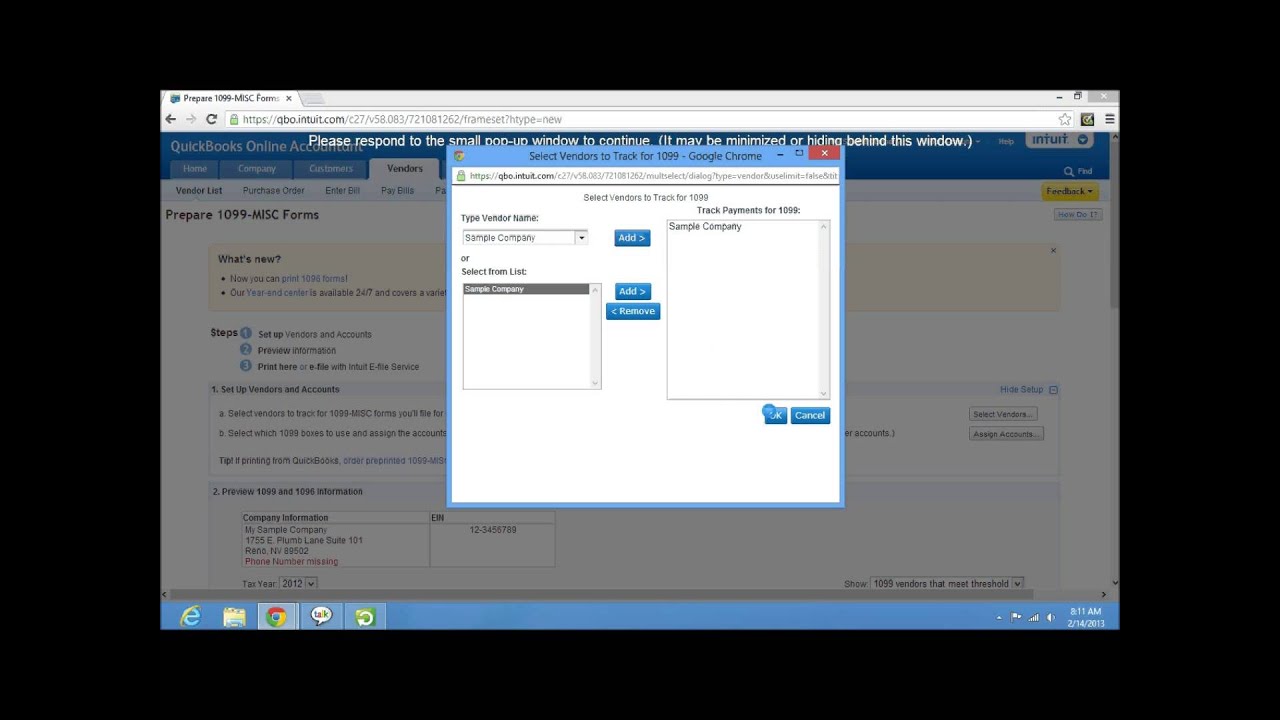

To change whether you track a vendor for 1099s update the vendor on your vendor list. Launch the QuickBooks 1099 wizard from the File menu by clicking Print Forms and 1099s1096 Step 2 Check the Create Form 1099-MISC box for each 1099 vendor. Select Contractors from the sub-menu and then click Add your first contractor Enter the name and the email of the contractor in the Name and Email.

Click on PrintE-File 1099 Forms. Select the Sort drop-down menu. From the main dashboard click the Workers tab on the left-hand side.

In this video we will review the 1099 wizard that QuickBooks Online Plus provides for processing 1099 forms for your independent contractorsIf you enjoyed t. Click the Vendors tab in the main menu then select Vendor Center from the pull-down menu. To set up a 1099 employee in QuickBooks Online follow the below steps.

Select anywhere to refresh the report. This information isnt imported from QuickBooks Online. Select or remove the Track 1099 payments checkbox.

Check off Track Payments for 1099 on the bottom right. Create Batch Invoices In Quickbooks Online. Go to the Expenses Module and select the Vendors Tab click the Prepare 1099s button and then Lets Get Started.

How to Prepare 1099 Tax Forms with QuickBooks Desktop. Select Lets get started or Continue your 1099s. You can also fill in their address email and EIN numbers in this window.

Enter your billing info then select Approve. Edit the Vendor Card over in the Expenses Vendors list. Prepare your 1099s in QuickBooks Now that your records are in order the hard part is over.

How to prepare and print 1099 forms from QuickBooks Online. QuickBooks Self-Employed QBSE helps track your income expenses mileage and tax info. Once this is checked off the Vendor will also appear on the Contractors list for use in the 1099 tools.

This way you can add your contractors details and file their 1099-MISC forms to the IRS. To create a report of payments to vendors that need to go on Form 1099-MISC. How To Create 1099 Forms In Quickbooks Online.

From the Expenses menu select Vendors. Select the Track 1099 checkbox. From the Sort by drop-down menu select Track 1099.

Verify your 1099 Forms then select Continue. Although you can sign up to our E-file service standalone website. Click on Get started and select 1099-NEC or 1099-MISC depending upon the type of your contractors.

Create Custom Invoice Template Quickbooks. Start QuickBooks and go to Vendors. Step 2 Double-click the name of the independent contractor in the vendor list to.

Quickbooks Chart Of Accounts In 2020 Quickbooks Chart Of Accounts Accounting

Quickbooks Chart Of Accounts In 2020 Quickbooks Chart Of Accounts Accounting

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

Learn How To Prepare Form In Quickbooks 1099 Wizard For More Information Dial Our Quickbooks Support Phone Num Quickbooks Mobile Credit Card Quickbooks Online

Learn How To Prepare Form In Quickbooks 1099 Wizard For More Information Dial Our Quickbooks Support Phone Num Quickbooks Mobile Credit Card Quickbooks Online

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

How To Prepare And E File 1099s In Quickbooks Desktop In 2020 Quickbooks Filing Preparation

How To Prepare And E File 1099s In Quickbooks Desktop In 2020 Quickbooks Filing Preparation

Irs Form 5 B Irs Form 5 B Will Be A Thing Of The Past And Here S Why Irs Forms 1099 Tax Form Tax Forms

Irs Form 5 B Irs Form 5 B Will Be A Thing Of The Past And Here S Why Irs Forms 1099 Tax Form Tax Forms

Qb 941 Printing Error Tax Forms Quickbooks Quickbooks Payroll

Qb 941 Printing Error Tax Forms Quickbooks Quickbooks Payroll

Here You Find Full Detail About Quickbooks 1099 Forms Quickbooks Quickbooks Online Bookkeeping Software

Here You Find Full Detail About Quickbooks 1099 Forms Quickbooks Quickbooks Online Bookkeeping Software

How To Prepare Quickbooks 1099 Misc Forms Crop Insurance Quickbooks Preparation

How To Prepare Quickbooks 1099 Misc Forms Crop Insurance Quickbooks Preparation

Quickbooks Online Reports Only User View Quickbooks Online Quickbooks Online

Quickbooks Online Reports Only User View Quickbooks Online Quickbooks Online

Quickbooks Desktop Pro 2018 Small Business Accounting Software Pc Download Cli Business Accounting Software Small Business Accounting Software Quickbooks

Quickbooks Desktop Pro 2018 Small Business Accounting Software Pc Download Cli Business Accounting Software Small Business Accounting Software Quickbooks

Quickbooks Tutorial How To Print 1099 Form In Quickbooks Online Quickbooks Quickbooks Online Quickbooks Tutorial

Quickbooks Tutorial How To Print 1099 Form In Quickbooks Online Quickbooks Quickbooks Online Quickbooks Tutorial

Change Ein Number In Quickbooks Online Quickbooks Quickbooks Online Online Tutorials

Change Ein Number In Quickbooks Online Quickbooks Quickbooks Online Online Tutorials

Quickbooks Payroll Update Error E G 15240 15270 15222 15271 Ps036 15204 These All Errors Are Getting While Quickbooks Quickbooks Payroll Payroll Software

Quickbooks Payroll Update Error E G 15240 15270 15222 15271 Ps036 15204 These All Errors Are Getting While Quickbooks Quickbooks Payroll Payroll Software

1099 W 9 Wtf How To Track File The Correct Forms For Independent Contractors Creative Entrepreneurs Things To Come Quickbooks Online

1099 W 9 Wtf How To Track File The Correct Forms For Independent Contractors Creative Entrepreneurs Things To Come Quickbooks Online

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

Doug Sleeter On About Me Quickbooks Quickbooks Online Small Business Accounting

Doug Sleeter On About Me Quickbooks Quickbooks Online Small Business Accounting

Quickbooks Online Support Is Specialized Accounting Software Help You Run Your Business With Great Ease And Very Ea Quickbooks Online Quickbooks Online Support

Quickbooks Online Support Is Specialized Accounting Software Help You Run Your Business With Great Ease And Very Ea Quickbooks Online Quickbooks Online Support

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms