W8 Form For Canadian Business

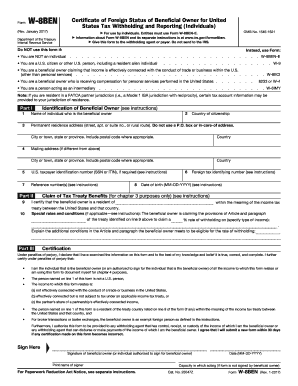

Part V Affidavit of Unchanged Status. The W-8BEN-E is used to confirm that a vendor is a foreign entity and must be provided even if the vendor is not claiming a tax treaty reduction or exemption from withholding.

Filing Of W 8ben E By Canadian Service Provider With A Sample

Check the corporation box.

W8 form for canadian business. In order to determine whether to withhold taxes for the payments they send the withholding agent must obtain a Form W-8BEN from the foreign payee. Check the active NFFE box on the right column of the list NFFE standing for Non-Financial Foreign Entity. For instructions and the latest information.

Before retaining a US tax specialist or planning your getaway from the IRS there are a few things you should know about the form. In the past we used to charge 150 CAD for our work to prepare this form. We provide the service for the Canada office but US office reports we have to complete a W8 tax form to get paid.

If any information on Form W-8BEN becomes incorrect you must submit a new form within 30 days. Income tax treaty by filling out whats commonly known as Form W-8BEN. We perform services for a US-based company with an office in Canada.

Sellers who sell on Amazon Shopify eBay WooCommerce and other eCommerce platforms are often required to present this form to identify themselves as a foreign company in the US. Therefore payment to an overseas recipient by US entity is subjected to reporting under FATCA and the form W-8BEN-E needs to be provided by Canadian business including corporation partnership trust estate tax-exempt organization in order to receive payment from US company. Certificate of Foreign Persons Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States Section references are to the Internal Revenue Code.

Does a Canadian based business require filling out a US W8 form to be paid by a US company. 13 rows Instructions for Form W-8ECI Certificate of Foreign Persons Claim That Income Is. To certify that you have the.

Part I 1 Enter your corporations name Part I 2 Enter the country of incorporation Canada Part I 4 Check Corporation Part I 5 Check Active NFFE. How to complete W-8BEN Form for an individual in Canada. The form sometimes referred to as a certificate of foreign status establishes that the individual is both a foreign person and the beneficial owner of the business in question.

Therefore all foreign vendors must provide a W-8BEN-E even if no EIN ITIN or SSN exists unless another W-8 series form. If you are a resident of a country that has an income tax treaty with the United States and would like to make a claim for reduced tax withholding rates enter the country of a treaty with the US a Canadian tax. Federal income taxes withheld.

How to complete W-8BEN-E Form for a Small Canadian Corporation. Form W-8BEN is a tax form that foreign persons who receive income from US. Canadian independent contractors can use it to claim exemption from tax withholdings due to an income tax treaty between the US.

July 2017 Department of the Treasury Internal Revenue Service. If youre a Canadian business with a customer in the US you may have been asked to fill out a W8-BEN-E form. This form contains information such as payee name address and tax identification number.

Page 1 Part I. Complete Part XXV See Definition of Active Passive NFFEs. We frequently receive requests to assist with filling out the form W-8BEN-E from Canadian eCommerce sellers.

However if youre already paying tax on your income to the Canadian Revenue Agency CRA you can complete the W8-BEN form and give it to your client to confirm that they should release your full payment with nothing withheld. Instructions for the Substitute Form W-8BEN-E for Canadian Entities. For general information and the purpose of each of the forms described in these instructions see those forms and their accompanying instructions About Form W-8 BEN Certificate of Foreign.

This is called backup withholding. This certification must be completed by an authorized representative or officer. Fill in 1 companys name and 2 HQs country Fill in 3.

Companies must submit to their employer in order to have US. These instructions supplement the instructions for Forms W-8 BEN W-8 BEN-E W-8 ECI W-8 EXP and W-8 IMY. Client so they can file it with their corporate taxes.

Part I 6 Enter. Let us review the typical case of Small Canadian Corporation carrying an active business in Canada and as part of. Clients can claim exemption from tax withholdings thanks to the Canada-US.

This is usually issued directly to your US. Identification of Beneficial Owner. If a taxpayer identification number or Form W-8 or substitute form is not provided or the wrong taxpayer identification number is provided these payers may have to withhold 20 of each payment or transaction.

Form W-8 or substitute form must be given to the payers of certain income. This works because the US and Canada have a tax treaty which is in place to stop double taxation². Canadian sole proprietors with US.

W 8ben Form Instructions For Canadians Cansumer

How To Fill Out A W 8ben Form As A Canadian Author Michelle Cornish Author

Canadians Stop Paying 30 To The Irs Diana Tibert

What Is A W 8 Form The Dough Roller

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

How To Complete W 8ben Form Youtube

Why Have I Been Asked To Fill Out A W 8 Ben E Form Virtual Heights Accounting

Form W8 Instructions Information About Irs Tax Form W8

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

How To Fill Out A W 8ben Form As A Canadian Author Michelle Cornish Author

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Irs W 8ben Substitute Form 2009 Fill Out Tax Template Online Us Legal Forms

Filing Of W 8ben E By Canadian Service Provider With A Sample

W 8ben E Form Instructions For Canadian Corporations Cansumer