How To Deregister A Vat Group

You will need to download forms VAT 50 and VAT 51 from the HMRC website which are required for making changes to the Group. If necessary you will also need form VAT 53 which gives you authority to.

How Will Vat Affect The Construction Sector In Uae Gcc Vat Filings Construction Sector Audit Services Vat In Uae

How Will Vat Affect The Construction Sector In Uae Gcc Vat Filings Construction Sector Audit Services Vat In Uae

Form VAT 56 to change the representative member of a VAT group.

How to deregister a vat group. Form VAT 51 to provide details of the companies involved. What happens after I cancel my VAT registration. Thus if a Swedish company say chooses to register for UK VAT under distance selling to benefit from the favourable UK VAT rate and in the unlikely event Swedens rate goes lower than the UKs the entity cannot simply de-register unless it has been registered for at least two years.

A taxable person cannot have more than one active registration. Where the value of its future annual taxable supplies will be R1 million may request the Commissioner for SARS in writing to cancel his registration. Form VAT 50 to change or disband the group.

Section 242 of the VAT Act determines that every vendor who wishes to have his registration cancelled in the circumstances contemplated in section 241 of the VAT Act ie. Adding or removing companies from your group. You stop trading or making VAT taxable supplies you join a VAT group You must cancel within 30 days if you stop being eligible or you may be charged a.

A sole trader incorporates his business. Businesses which make sales to the public B2C are usually better off leaving the VAT club even if this means not being able to recover input tax incurred. 25 If youre already VAT registered and intend to create or join a VAT group.

These rules apply to businesses belonging in the UK. A vendor will be deregistered only if all outstanding liabilities or obligations incurred under the VAT Act have been settled or resolved. Discover more about the people wholl be working alongside you to make the most out of your VAT opportunities on our team page.

So when a group is created its founder members. However there are situations when a business must deregister on a compulsory basis. FTA can also approve the VAT deregistration for the group if the companies in the group are no more financially associated with the group.

Normally it usually takes three weeks for HMRC to confirm your de-registration and the official de-registration date ie when the reason for your cancellation took effect for example you stopped trading or when you asked to de-register if this was. You can apply online or via a written form in the mail. C What is the VAT Registration Number of the group if known.

If you apply for deregistration online HMRC will send confirmation to your VAT online account. Go to question 15. FTA can also take the initiative to cancel the VAT registration of a group if it foresees the tax status as a group can result in any sort of tax evasion.

A business applies for deregistration online through its VAT account or it can also complete a form VAT7 to deregister by post. The business has been sold. Should you prefer to deregister for VAT by post you can fill in and send form VAT7 to the address stated.

The procedure that must be followed in order to deregister from VAT is to submit a completed VAT123 form at the SARS branch office where the vendor is registered. It has ceased to trade and has no intention of making future taxable sales. Go to question 15 13 Please give the date the VAT group disbanded DD MM YYYY go to question 15 14 Please provide the date you want to deregister from DD MM YYYY Please give the reason why you want to deregister from this date on the back of this form.

If you are being forced to deregister for VAT through compulsory deregistration HMRC may allow the registration to remain open for up to six months to allow time to tie up all the loose ends. A business joins a VAT group or a VAT group is disbanded The legal status of the business changes eg. For assistance deregistering for VAT contact us today by calling 0333 3637 395 or fill out an online enquiry form and we will be in touch.

Irish Vat Registration Deregistration A Three Minute Overview

Irish Vat Registration Deregistration A Three Minute Overview

Vat Services Financial Planning Business Registered Company

Vat Services Financial Planning Business Registered Company

Economic Substance Notifications Due Dates Are Declared In The Uae Accounting Services Accounting Firms Bookkeeping And Accounting

Economic Substance Notifications Due Dates Are Declared In The Uae Accounting Services Accounting Firms Bookkeeping And Accounting

Vat Penalty Reconsideration In Dubai Dubai Vat In Uae Uae

Vat Penalty Reconsideration In Dubai Dubai Vat In Uae Uae

Complete Procedure Of Vat Deregistration In Uae Audit Services Vat In Uae Uae

Complete Procedure Of Vat Deregistration In Uae Audit Services Vat In Uae Uae

Vat Deregistration In Uae Accounting Services Uae Accounting

Vat Deregistration In Uae Accounting Services Uae Accounting

Vat In Uae What Is Vat Exempt Vat In Uae Uae Emirates

Vat In Uae What Is Vat Exempt Vat In Uae Uae Emirates

Deregistering For Vat Caseron Cloud Accounting

Deregistering For Vat Caseron Cloud Accounting

Registration Of Tax Group Under Uae Vat Gccfilings In 2020 Audit Services Indirect Tax Uae

Registration Of Tax Group Under Uae Vat Gccfilings In 2020 Audit Services Indirect Tax Uae

How To Deregister For Vat Some Benefits And Disadvantages

How To Deregister For Vat Some Benefits And Disadvantages

What Is Vat Deregistration And When Should A Company Apply For It Sdac Consulting

What Is Vat Deregistration And When Should A Company Apply For It Sdac Consulting

Need For Conducting Internal Audit Internal Audit Corporate Management Audit

Need For Conducting Internal Audit Internal Audit Corporate Management Audit

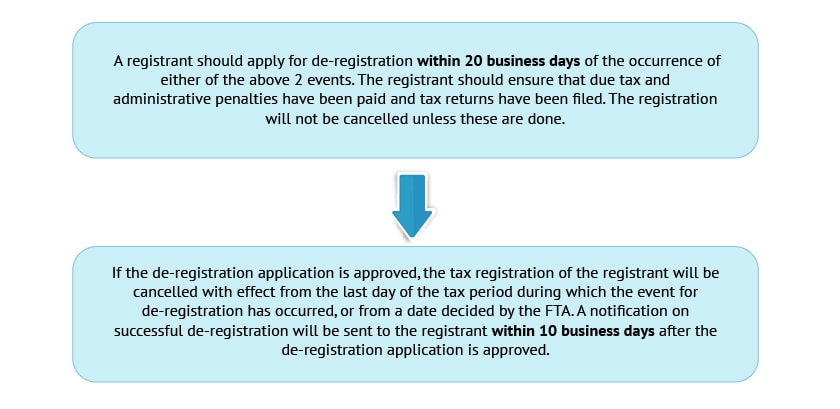

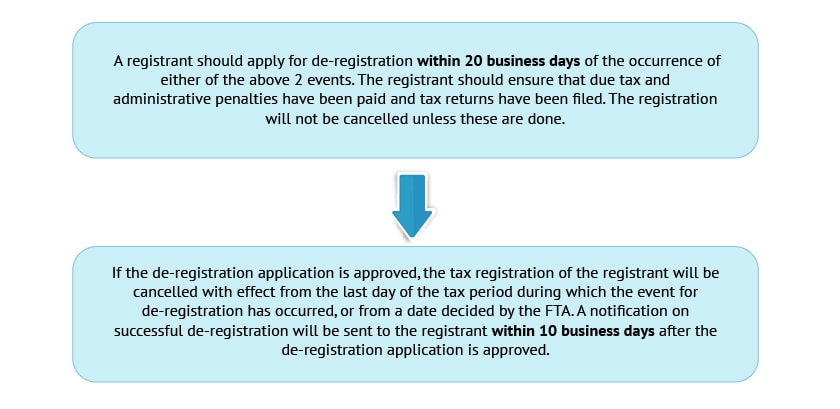

3 Simple Steps In De Registering Or Amending A Tax Group Vat In Uae De Registration Of Vat

3 Simple Steps In De Registering Or Amending A Tax Group Vat In Uae De Registration Of Vat

Guide On Deregistering Or Cancelling Vat Registration In Uae Vat Deregistration Penalty

Guide On Deregistering Or Cancelling Vat Registration In Uae Vat Deregistration Penalty

Fta Clarifies Vat On Healthcare Of Employees Families Health Care Employee Vat In Uae

Fta Clarifies Vat On Healthcare Of Employees Families Health Care Employee Vat In Uae

Questions Relating To Vat Deregistration

Questions Relating To Vat Deregistration

Vat Audit Services Audit Services Audit Accounting Services

Vat Audit Services Audit Services Audit Accounting Services

How To Deregister Under Vat Uae Vat

How To Deregister Under Vat Uae Vat

Why Audit Is Crucial For Project Developers Development Audit Accounting And Finance

Why Audit Is Crucial For Project Developers Development Audit Accounting And Finance