Do I 1099 Credit Card Payments

What if I paid them with the PayPal Friends and Familyoption. Select 1099 Summary.

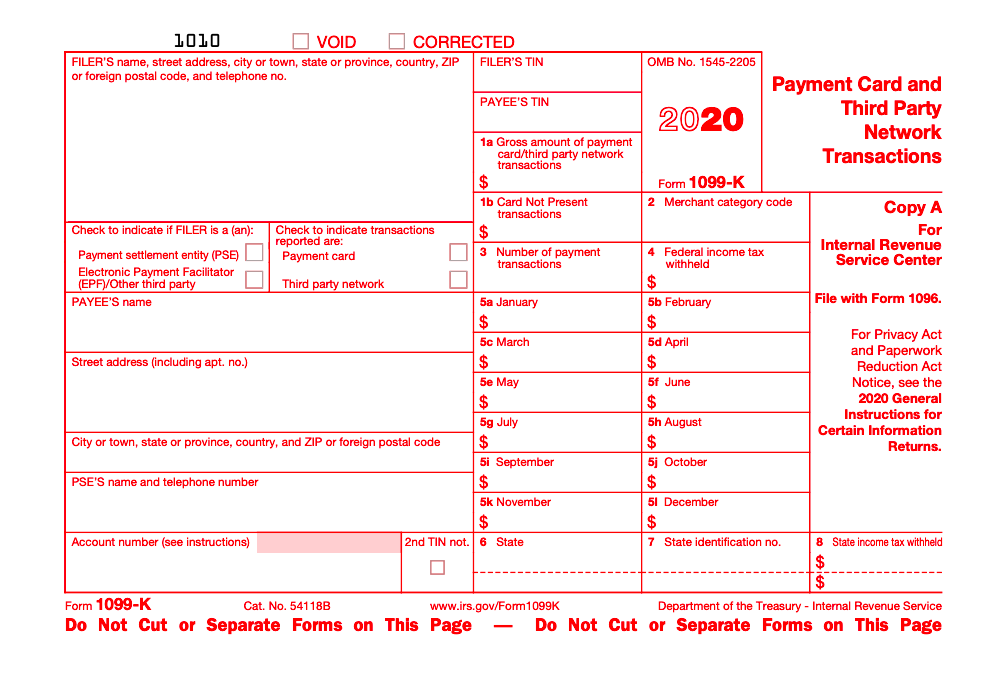

Payments made with a credit card or payment card and certain other types of payments including third-party network transactions must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-NEC.

Do i 1099 credit card payments. At its most basic level a 1099-C reports a debt that was canceled forgiven never paid back or wiped out in bankruptcy. In the 1099 Detail report make note of the Accounts in the Account column. If you paid an unincorporated vendor using PayPal credit card or other third party merchant the payment service is responsible for reporting this information usually by issuing a 1099-K.

Persons receiving credit card payments and payments from other providers like PayPal are already having those payments. If you are set up to accept payment cards as a form of payment you will receive a Form 1099-K for the gross amount of the proceeds for the goods or services purchased from you through the use of a payment card in a calendar year. Details of Credit Card and Merchant Payment Reporting Banks and other payment settlement services must report gross annual receipts for each merchant.

For more information read this article. Who reports payment card transactions when a payment settlement entity contracts with a third party such as an electronic payment. If you paid the contractor using two forms of payment one being either cash or check and the other credit card debit card gift card or PayPal.

Credit card payments are reported using Form 1099-K. You had a student loan or part of a student loan forgiven. You cut a deal with your credit card issuer and it agreed to accept less than you owed.

You dont have to do a thing. Delete the original payment in your Payroll product re-enter the payment using the amount you paid by cash or check then e-file a Form 1099-MISC for that amount. When both a merchant acquiring entity and a processor have a contractual obligation to pay the merchant the entity that submits the instructions to transfer funds to the merchants account is responsible for preparing and furnishing a payee statement to the participating payee and filing the Form 1099-K with the IRS.

Payments made with a credit card or payment card and certain other types of payments including third party network transactions must be reported on Form1099-K by the payment settlement entity under section 6050W and are not subject. Many entities that process card payments on behalf of their customers will issue a Form 1099-K when the amount of payments and number of payments are far below this threshold. How to File 1099s.

Further if you accept payments from a third party settlement organization you should receive a Form 1099-K only if. In other words Form 1099-MISC should not include the portion of what you paid the contractor by credit card debit card gift card. In the 1099 options drop-down menu select All allowed accounts.

The 1099-K is issued by third party payment processing companies such as creditdebit card processors PayPal etc. According to Weltman The instructions to Form 1099-MISC say Payments made with a credit card or payment card and certain other types of payments including third party network transactions must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC. See the separate Instructions for Form 1099-K.

For payments to vendors and contractors. 1099-MISC forms issued should include only payments made by cash check wire transfer electronic check ACH online bill pay bank to bank only or direct deposit. Understanding Your Form 1099-K.

In this case if youve paid by credit card you dont have to do 1099 for them. Copies of the form are sent to both the business and to the IRS. Payments made with a credit card or payment card and certain other types of payments including third party network transactions must be reported on.

If you find the missing vendor find the Account and determine if it was used to make credit card payment. Here are some reasons you may have gotten a form 1099-C. The Credit Card Company will report the 1099-k to them.

Double-click the amount in the Total column for your Vendor. If you paid your vendor directly through your bank account check debit card ACH you are responsible for sending them a 1099. Taxation of Amounts from Form 1099-K.

If payments are reportable on both a Form 1099-MISC and 1099-K they are only reportable on a 1099-K According to IRS guidance on form 1099-K. Follow this 1099 Decision Tree to help you decide who you need to supply a form to. Months after successfully resolving credit card debts consumers may receive 1099-C Cancellation of Debt tax notices in the mail.

Payments made with a credit card or payment card and certain other types of payments including third-party network transactions must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC. If you paid your vendor through PayPal or a Credit Card the merchant will issue them a 1099K and you wont have to. The IRS 1099-MISC instructions in the section titled Form 1099-K state Payments made with a credit card or payment card and certain other types of payments including third-party network transactions must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC.

Some will even issue the form when there is a little as one transaction processed during the year.

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions Tax Forms W2 Forms Ways To Get Money

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

Irs Approved 1099 H Tax Forms File Form 1099 H Health Coverage Tax Credit Hctc Advance Payments If You Received Any Pension Benefits Tax Forms Tax Credits

Irs Approved 1099 H Tax Forms File Form 1099 H Health Coverage Tax Credit Hctc Advance Payments If You Received Any Pension Benefits Tax Forms Tax Credits

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 Misc Form 2018 Credit Card Services Electronic Forms Tax Forms

1099 Misc Form 2018 Credit Card Services Electronic Forms Tax Forms

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Form 1099 K Everything You Need To Know Bench Accounting

Form 1099 K Everything You Need To Know Bench Accounting

1099 K Software To Create Print And E File Form 1099 K Irs Forms Irs Tax Forms

1099 K Software To Create Print And E File Form 1099 K Irs Forms Irs Tax Forms

Those Credit Card Bonuses May Be Taxable Cash Rebates Credit Card Credit Card Website

Those Credit Card Bonuses May Be Taxable Cash Rebates Credit Card Credit Card Website

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition