1099 Nec Business Name

Then you can use their Form W-9 to fill out Form 1099-NEC. Examples of this include freelance work or driving for DoorDash or Uber.

What Is An Irs Schedule C Form And What You Need To Know About It

What Is An Irs Schedule C Form And What You Need To Know About It

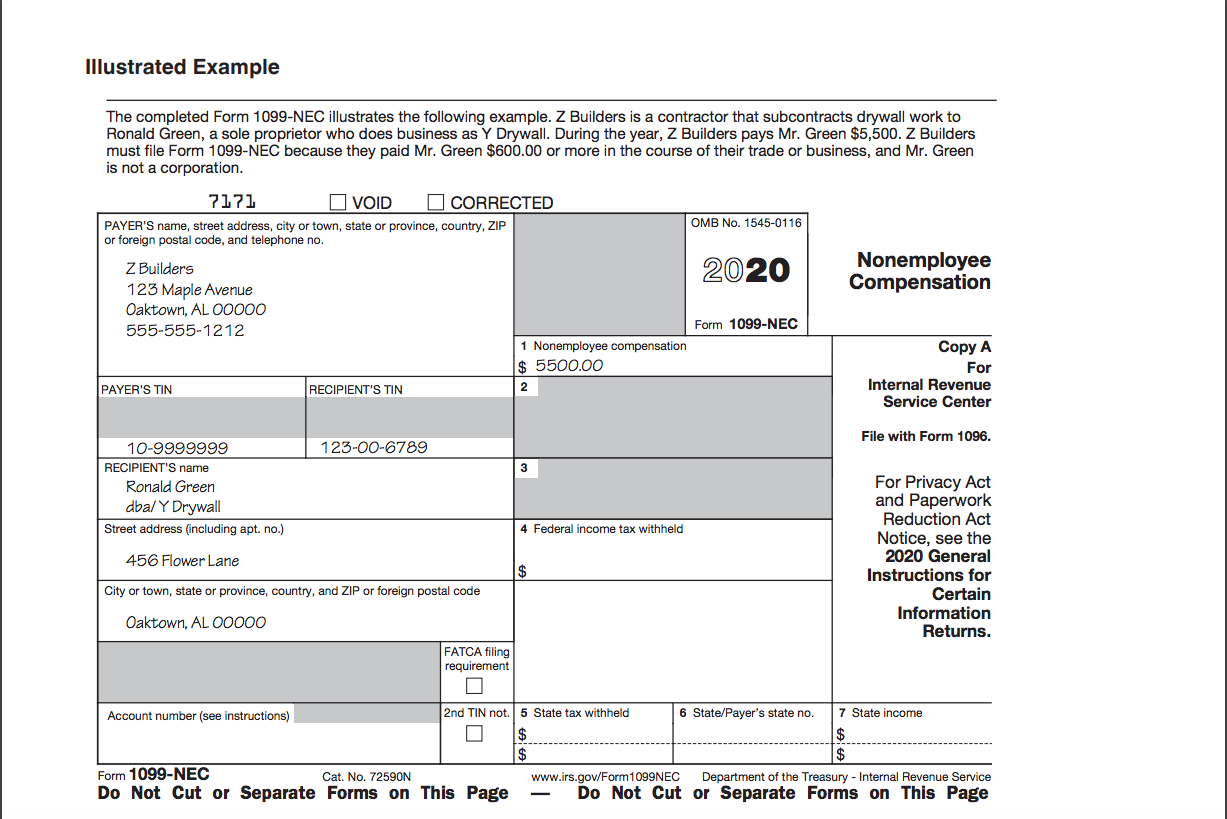

To complete a 1099-NEC youll need to supply the following data.

1099 nec business name. Basic 1099-NEC Filing Instructions. Businesses must also file Form 1099-NEC for each person from whom they have withheld any federal income tax report in Box 4 under the backup withholding rules regardless of. Form 1099 NEC is a new federal tax form that payers must file with the Internal Revenue Service to report payments paid to none-employees such as contractors vendors consultants and the self-employed.

2018 2019 2020 2021 Select the tax year for which you are filing. Enter the full name details First Middle and Last name. Since this type of income is considered self-employment non-employee compensation it must be linked to a Schedule C even if there are no expenses being claimed.

Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return. In the Less Common Income section click on the StartUpdate box next to Miscellaneous Income 1099-A 1099-C. Open or continue your return in TurboTax.

TheStreet What is Form 1099-NEC. On 1099 nec can I put payer name dba xyz creation As payer name As the software is putting only owner name not dba name - Answered by a verified Business Lawyer We use cookies to give you the best possible experience on our website. When filling out Form 1099-NEC include the following information.

The 1099-NEC is the new form to report nonemployee compensationthat is pay from independent contractor jobs also sometimes referred to as self-employment income. Before using this eForm you must authenticate. Click on Federal Wages.

Form 1099-NEC for reporting nonemployee compensation starting with tax year 2020 filing. What do you include on Form 1099-NEC. As a reminder newly hired independent contractors must fill out Form W-9.

Go to the Expenses menu and then choose the Vendors tab. If you are self-employed. The formal name of the Form 1099-NEC is Nonemployee Compensation How does form 1099-NEC work.

Your TIN Taxpayer Identification Number Recipients name address and TIN. Enter the Payers 9-digit FEIN. 1 The IRS has separated the reporting of payments to nonemployees from Form 1099-MISC and redesigned it for tax year 2020.

A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made. Even though the 1099k should have been made out to your business include it in your 1040 as Other Income using these steps. Previously companies reported this income information on Form 1099-MISC Box 7.

Type your LLC name on the Company field. Look for and select the name of the vendors youll want to modify and then click the Edit button at the top. Beginning with the 2020 tax year the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC.

Businesses will need to use this form if they made payments totaling 600 or more to a nonemployee such as an independent contractor. On the Miscellaneous Income screen click on the StartRevisit box next to Other reportable income. Your name address and phone number.

Heres what the form does. Any income reported on Form 1099-NEC is not reportable directly on your tax return. Enter the Payers legal business name.

You can use individual name listed as the name shown on the tax return. Beginning with the 2020 tax year the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC. Business information Your Federal Employer ID Number EIN your business name and your business address.

Nonemployee compensation was previously located in Box 7 of the 1099-MISC form and is now located in Box 1 on the new 1099-NEC form. If the W9 has an individual name listed as the name shown on the tax return and a business name as the business name what name should be listed on the 1099 or should both be included. To add a Schedule C so your 1099-NEC can be linked.

Recipients ID Number The recipients Social Security number or Federal Employer ID Number EIN. The new Form 1099-NECwhich is actually an old form that hasnt been in use since 1982is used to report any compensation given to nonemployees by a company.

What Is Form 1099 Nec For Non Employee Compensation

What Is Form 1099 Nec For Non Employee Compensation

New 1099 Nec Form For Independent Contractors The Dancing Accountant

New 1099 Nec Form For Independent Contractors The Dancing Accountant

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

New 2020 Form 1099 Nec Non Employee Compensation Virginia Cpa

New 2020 Form 1099 Nec Non Employee Compensation Virginia Cpa

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Irs Update New Form 1099 Nec Alfano Company Llc

Irs Update New Form 1099 Nec Alfano Company Llc

What Is Form 1099 Nec For Nonemployee Compensation

What Is Form 1099 Nec For Nonemployee Compensation

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block