W2 Employer Summary Form

30 rows Heres where youll learn about W-2 reported information and a few reports in. Reminder Tax Year 2020 wage reports must be filed with the Social Security Administration by February 1 2021.

Amazon Com Complete Laser W 2 Tax Forms 2020 And W 3 Transmittal Kit For 25 Employees 6 Part All W 2 Forms In Value Pack W 2 Forms 2020 Office Products

Amazon Com Complete Laser W 2 Tax Forms 2020 And W 3 Transmittal Kit For 25 Employees 6 Part All W 2 Forms In Value Pack W 2 Forms 2020 Office Products

Alternatively request Form 4852 as this allows you to estimate your wages and deductions based on the final payslip received.

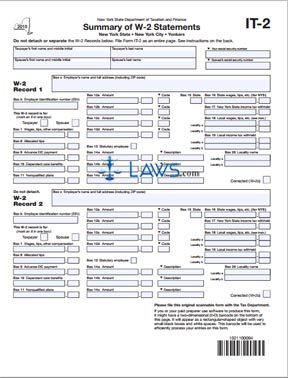

W2 employer summary form. Complete one W-2 Record section for each federal Form W-2 you and if filing jointly your spouse received even if your. This report serves two purposes. W-2 Record 2 Employers name Employers name Box c Employers information Box cDo not detach.

Wage reports for Tax Year 2020 are now being accepted. Please visit our Whats New for Tax Year 2020 page for important wage reporting updates. About Form W-2 Wage and Tax Statement.

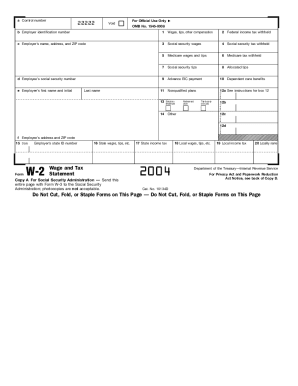

Your W-2 form reports your years wages and the taxes withheld and is also sent to the IRS. Employers information Employers address number and street Employers address number and street City State ZIP code Country if not United States City State ZIP code Country if not United States Do not detach or separate the W-2 Records below. Who must file this form You must complete Form IT-2 Summary of W-2 Statements if you file a New York State NYS income tax return and you received federal Forms W-2 Wage and Tax Statement.

Your employer is required to provide you with Form W-2 Wage and Tax Statement. 2020 Enhanced Form IT-2 Summary of W-2 Statements Enhanced paper filing with a fill-in form Electronic filing is the fastest safest way to filebut if you must file a paper Summary of W-2 Statements use our enhanced fill-in Form IT-2 with 2D barcodes. Failing that you can also download Form 4506-T which has a breakdown of the W-2 information that has been reported by your employer.

A W-2 earnings statement from an employer is a key document for completing your taxes. If you are not sure if you have online access please check with your company HR or Payroll department. To determine the number of Forms W-2 that you will need for your year-end activities.

Be sure to get your copies of Form W-2c from your employer for all. Learn how to e-file your form W-2s with the IRS and send copies to your employeesMy Gusto link the BEST payroll software. Your last paystub is NOT the same thing as your W-2.

Independent contractors will receive an IRS Form 1099-MISC. File Form IT-2 as an entire page with your. If your employer does not provide online access to your W-2 they must mail or hand-deliver your W-2 to you no later than January 31st.

Your employees will use the W-2 form that you provide as they prepare their own personal tax return for the year. The W2 Form is also known as the IRS Wage and Tax Statement. This is a tax payment form that indicates how much a self-employed individual earned.

More info What if my employer did not give me a W-2. Form W-2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes. Attention Tax Year 2020 Wage Filers.

Its a snapshot of how much an employer has paid you throughout the year how much tax theyve withheld from your paycheck and other payroll withholdings that can affect your tax obligation. The chargeable employer is responsible for issuing W-2 forms to employees who receive third-party sick pay. As required by federal regulation the Division of Temporary Disability Insurance mails benefit payment information to chargeable employers when a benefit check is issued.

Hello xxtexasxxsweethe Employers are required to send W-2s to employees by January 31. Form W-2 also known as the Wage and Tax Statement is the document an employer is required to send to each employee and the Internal Revenue Service IRS at the end of the year. Use the Print Forms W-2 Summary Report screen to generate a report that includes the number of Forms W-2 to be submitted as well as employer totals for the fields on your Forms W-2.

Employer to file Form W-2c Corrected Wage and Tax Statement with the Social Security Administration SSA to correct any name SSN or money amount error reported to the SSA on Form W-2. Its a federal tax document designed and processed by the Internal Revenue Service to let the employers report their employees for performing particular services during the year if the total of payments for. The W-2 form is crucial because its how you report the total wages and compensation for the year to both your employee and the IRS.

Download W 2 Form W 2 Employer Federal Copy A Printable Job Applications W2 Forms Employment Application

Download W 2 Form W 2 Employer Federal Copy A Printable Job Applications W2 Forms Employment Application

Amazon Com Tops W2 Forms 2020 Tax Forms Kit For 26 Employees 6 Part W2 Tax Form Sets With Self Seal W2 Envelopes Includes 3 W3 Forms Tx22904kit 20 Office Products

Amazon Com Tops W2 Forms 2020 Tax Forms Kit For 26 Employees 6 Part W2 Tax Form Sets With Self Seal W2 Envelopes Includes 3 W3 Forms Tx22904kit 20 Office Products

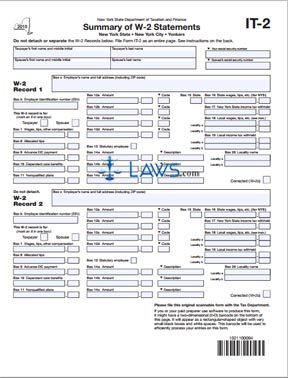

2015 Form Irs W 2 Fill Online Printable Fillable Blank Pdffiller

2015 Form Irs W 2 Fill Online Printable Fillable Blank Pdffiller

Official W2 Forms At Lower Prices Every Day Discounttaxforms Com

Official W2 Forms At Lower Prices Every Day Discounttaxforms Com

Mechanical Ventilation Design Summary Forms Mechanical Ventilation Ventilation Design Hvac Services

Mechanical Ventilation Design Summary Forms Mechanical Ventilation Ventilation Design Hvac Services

Free W2 Form 2016 3 Ways To Get Copies Of Old W 2 Forms Wikihow Irs Forms W2 Forms Job Application Form

Free W2 Form 2016 3 Ways To Get Copies Of Old W 2 Forms Wikihow Irs Forms W2 Forms Job Application Form

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

W 2 Archives File My Taxes Online

W 2 Archives File My Taxes Online

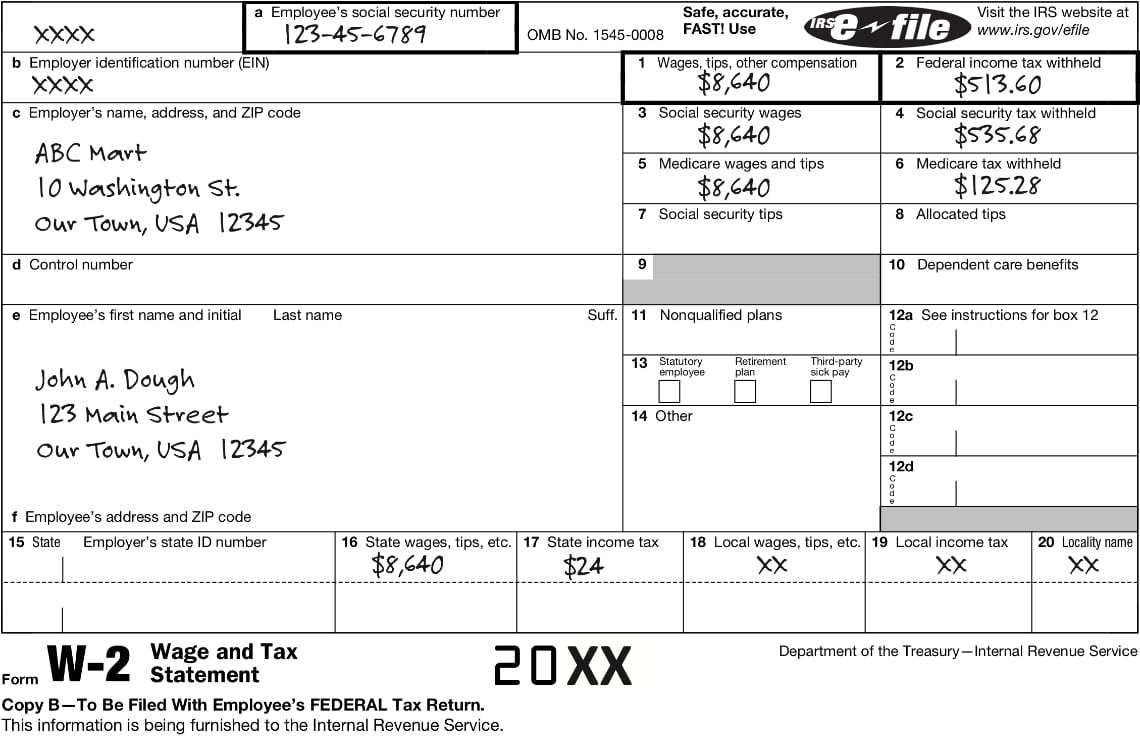

Wage Tax Statement Form W 2 What Is It Do You Need It

Wage Tax Statement Form W 2 What Is It Do You Need It

Form W 2 Explained William Mary

Form W 2 Explained William Mary

Egp Irs Approved W 3 Tax Summary Form W2 Forms Irs Tax Preparation

Egp Irs Approved W 3 Tax Summary Form W2 Forms Irs Tax Preparation

Free Form It 2 Summary Of W 2 Statements Free Legal Forms Laws Com

Free Form It 2 Summary Of W 2 Statements Free Legal Forms Laws Com

Amazon Com Tops W2 Forms 2020 6 Part W2 Forms Laser Inkjet Tax Form Sets For 50 Employees Includes 3 W3 Forms Tx22991 20 Office Products

Amazon Com Tops W2 Forms 2020 6 Part W2 Forms Laser Inkjet Tax Form Sets For 50 Employees Includes 3 W3 Forms Tx22991 20 Office Products

W2 Template Fill Out And Sign Printable Pdf Template Signnow

W2 Template Fill Out And Sign Printable Pdf Template Signnow

Instant W2 Form Generator Create W2 Easily Form Pros

Instant W2 Form Generator Create W2 Easily Form Pros