How To Get 1099-sa Form Online

IRS Form 1099-SA is typically available at the end of January. Fill out the requested boxes that are marked in yellow.

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

Get And Sign 1099 Sa Form 2012-2021 IRS forms call 1-800-TAX-FORM 1-800-829-3676 or Order Information Returns and Employer Returns Online and.

How to get 1099-sa form online. Youll be able to access your form and save a printable copy. You will receive a separate 1099-SA for each type of distribution made during the year. Click the button Get Form to open it and start modifying.

IRS Form 8889 can be downloaded from IRSgov at any time. If you get a bill or receive care from a health care professional who is not in the Aetna network and you need to submit a claim please complete and mail one of the forms below to the address on your ID card. Archer Medical Savings Account Archer MSA.

Due to the very low volume of paper Forms 1099-SA and 5498-SA received and processed by the IRS each year these forms have been converted to an online fillable format. Once you are logged in to your account select the. Where to Get Form 1099-SA.

IRS Form 1099-SA provides you with the distributions made from your HSA during the tax year. Get a copy of your Social Security 1099 SSA-1099 tax form online. If you did then that bank or financial institution owes you a form 1099-SA.

You can instantly download a printable copy of the tax form by logging in to or creating a free my. These IRS tax forms are also available in the Member Website. Sign in to your account and click the link for Replacement Documents.

A Form 1099-SA will be sent by January 31 2020 if you received any distributions from your HSA account during 2019. Health savings account HSA. Using your online my Social Security account.

If you are not sure who the account administrator is contact your employer or insurance provider. Go to Sign In or Create an Account. A separate return must be filed for each plan type.

0 1 1402 Reply. How to submit the IRS 1099-SA on the Internet. If you have online access to your HSA account you may be able to access the Form 1099-SA through that account.

Use your indications to submit established track record areas. If you did not take any money out of the account then you wouldnt be receiving a form for 2017. On the site with all the document click on Begin immediately along with complete for the editor.

Medical Claim Form English - PDF Medical Claim Form Spanish - PDF Dental Claim Form English - PDF Dental Claim Form Spanish - PDF. Medicare Advantage Medical Savings Account MA MSA. If you already have a my Social Security account you can log in to your online account to view and print your SSA-1099 or SSA-1042S.

IRS Form 1099-SA is provided for each HSA distribution you made in the current tax year. If you dont already have an account you can create one online. Give them a call because you cant do your return without it unless you had no distributions in which case you skip it in the HSA interview in TurboTax.

The distribution may have been paid directly to a medical service provider or to the account holder. The following tips will help you complete Pdf Filler 1099 Sa Form easily and quickly. You will receive a separate 1099-SA for each type of distribution made during the tax year.

It will be posted to your account and mailed if elected. Add your own info and speak to data. If you currently live in the United States and you need a replacement form SSA-1099 or SSA-1042S we have a new way for you to get an instant replacement quickly and easily beginning February 1st by.

A Form 5498-SA will be sent in May 2020 which will report contributions to your HSA account for 2019 and the fair market value of your HSA account as of 12-31-2019. Switch the Wizard Tool on to complete the procedure even simpler. 2020 Form 1099-SA Distributions from an HSA 123-456789 --0000 1 of 2 Federal ID Number.

File Form 1099-SA to report distributions made from a. If you dont have access to a printer you can save the document on your computer or laptop or even email it. You may fill out the forms found online at IRSgovForm1099SA and IRSgovForm5498SA and send Copy B to.

The five distribution types are normal excess contribution removal death disability and prohibited transaction. Need a replacement copy of your SSA-1099 or SSA-1042S also known as a Benefit Statement. You will receive the IRS Form 1099-SA and IRS Form 5498-SA either by mail or electronically based upon your elected delivery preference.

If you did not receive your SSA-1099 or have misplaced it you can get a replacement online if you have a My Social Security account. View solution in original post. Open the form in the feature-rich online editing tool by hitting Get form.

Fill out all needed fields in the selected document with our advantageous PDF editor. How to complete any Form 1099-SA online. Distributions From an HSA Archer MSA or Medicare Advantage MSA The financial institution that manages the account is responsible for sending you a copy of Form 1099-SA.

Resources for filing IRS Form 8889. A replacement SSA-1099 or SSA-1042S is available for the previous tax year after February 1. Press the arrow with the inscription Next to move on from box to box.

Is There A Free Irs Form 1099 Template Quora

File 2020 Form 5498 Sa Online E File As Low As 0 50 Form

File 2020 Form 5498 Sa Online E File As Low As 0 50 Form

All You Need To Know About The 1099 Form 2020 2021

All You Need To Know About The 1099 Form 2020 2021

Irs Form 1099 R Box 7 Distribution Codes Ascensus

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

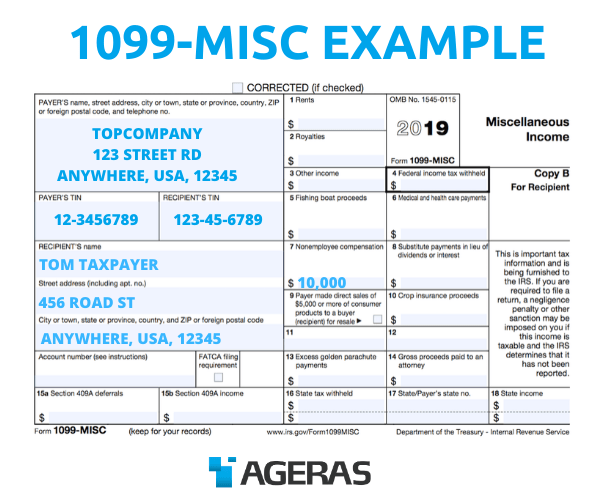

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

5498 Ira Esa Sa Contribution Information 1099r

5498 Ira Esa Sa Contribution Information 1099r

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras