How Much Does It Cost To Set Up A Holding Company In Ontario

If a future date of incorporation up to 30 days ahead is required it must be set out in the covering letter. The cost to incorporate in Ontario is 360 if you incorporate in person or by mail.

Holding Company In Canada Youtube

Holding Company In Canada Youtube

Were fond of the payroll software WagePoint which calculates and remits Workers Compensation.

How much does it cost to set up a holding company in ontario. Many personal holding companies were set up in the early 1990s to take advantage of this situation and continue to exist today. Application for reserving a name 2 working days. The costs for setting up such a company are.

Holding companies require additional set up costs and these expenses can be ongoing including the cost of preparing annual financial statements and corporate tax returns. This can result in animosity between shareholders when it comes time to declare dividends ie. In most cases this would be a Private Company Limited by Shares.

The filing fee is 100 for processing by mail or 102 if you file online. A personal holding company can reduce exposure to US. There are no business licenses or other fees due the first year.

Without a holding company in the mix each shareholder has to declare that dividend payment as income personally whether they need the money or not. Hes just saved nearly 5000. If the holding company is to have an official name it will be necessary to pay a 20 fee to obtain a NUANS report verifying that the name is permitted and not confusingly similar to another name.

No Tax Benefits or. There is only a 50 annual report due the second year. It is not necessary to have an official name and in lieu the corporation will be recognized by the number assigned to it by Corporations Canada eg.

This includes administrative costs CPP payroll on-boarding and healthcare spending accounts. Corporations generally pay tax at. The first step is to choose whether the company will be registered at a federal or regional level followed by the company name reservation with the Trade Register.

Registering your business name in Ontario. That allows profits to be flowed up and retained in the holding company Alternatively a holding company could hold marketable securities or rental property instead of the client holding those. Make cheque payable to the Minister of Finance.

Holding company to the rescue. In this way you could potentially receive proceeds as cash or debt in an amount up to the cost base of your shares without attracting any tax. 325 per month includes year-end costs billed monthly plus check-in from one of our bookkeepers Small Business We see a lot of small businesses that have annual revenue between 150k and 350k that have 1 or 2 employees and are owner managed.

1295 for one-on-one training and help with set-up. Shareholders can be individual or corporate. The cost for this package is.

Covering letter giving a contact name return address and telephone number. You also may incorporate online through a service provider under contract with the Ontario Ministry of Government and Consumer Services. WSIB costs about 10 per cent on average of a salary so about 5000 specifics if the salary is 50000.

Business names are registered with the Central Production and Verification Services Branch CPVSB of the Ministry of Government and Consumer Services MGCS and are placed on the Public Record maintained by CPVSB for public disclosureAnyone may search business name information contained on the Public Record for a fee to find the owners or. Shareholder 1 may need the money and will push for a dividend payment whereas Shareholder 2 or 3 may. A holding company is a separate legal entity whose purpose is to hold some sort of property be it land buildings marketable securities or private stock.

A NUANS search is not required if incorporating a number company. In a basic holding company strategy the holding company owns the shares of your operating company as a means of effective tax planning while protecting your wealth. The legal fees to establish a basic corporation may range from 1500 to 2500.

Application for Incorporation of a Private Company Limited by. At that time putting investments into a company provided a large tax deferral until the income was distributed to the shareholder. The annual costs for legal and accounting fees may be similar or even more.

Unless your shares are of significant value a holding company may not be worthwhile. How to set up a holding company in Canada. Due to the lower tax rate of the holding company he only has to pay 19300 in taxes on the interest income.

In simple terms a holding company would be set up for the purposes of acquiring the shares of your operating company in return for consideration equal to the ACB of your operating companys shares. The holding company is simply interposed between the business owner and the active business Golombek said in a Nov. The registration process of a holding company is no different from that of starting a company in Canada.

The Secretary of State filing fee is included in our 199 formation service. The only thing you would have to do is. Instead of holding the investments personally Harvey incorporates a holding company and invests his cash within the company.

Holding Company Structure Company Structure Org Chart Organizational Structure

Holding Company Structure Company Structure Org Chart Organizational Structure

Foreign Direct Investment In Canada By Ultimate Investing Country

Foreign Direct Investment In Canada By Ultimate Investing Country

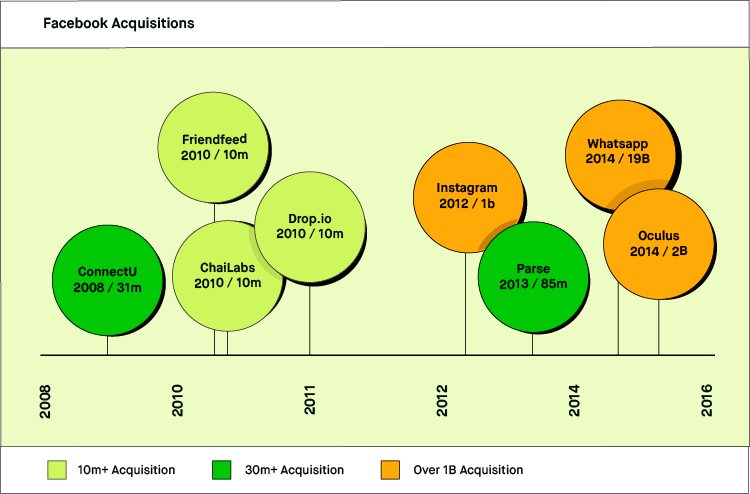

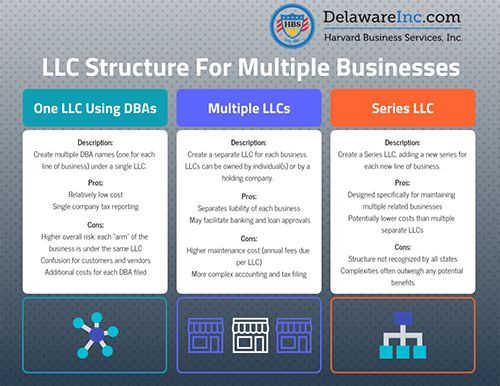

Operate Multiple Businesses Under One Llc Holding Company Harvard Business Services

Operate Multiple Businesses Under One Llc Holding Company Harvard Business Services

Consultant S Corner How To Set Up A Holding Company Gosmallbiz Com

Consultant S Corner How To Set Up A Holding Company Gosmallbiz Com

Https Ca Rbcwealthmanagement Com Documents 379556 379572 Estate Freeze 03052018 High Pdf 165f5a03 299a 40d5 95af Ee51bba5f32f

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

Sample Holding Company Holding Company Fund Management Chart Of Accounts

Sample Holding Company Holding Company Fund Management Chart Of Accounts

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

Holding Company Definition How It Works Types

Holding Company Definition How It Works Types

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow