How Do I Calculate Vat On Business Mileage

If you have an employee who has a car with a 1500cc petrol engine the fuel element of the 4525 mileage rate is 14 pence per mile September 2019. Petrol amount per mile.

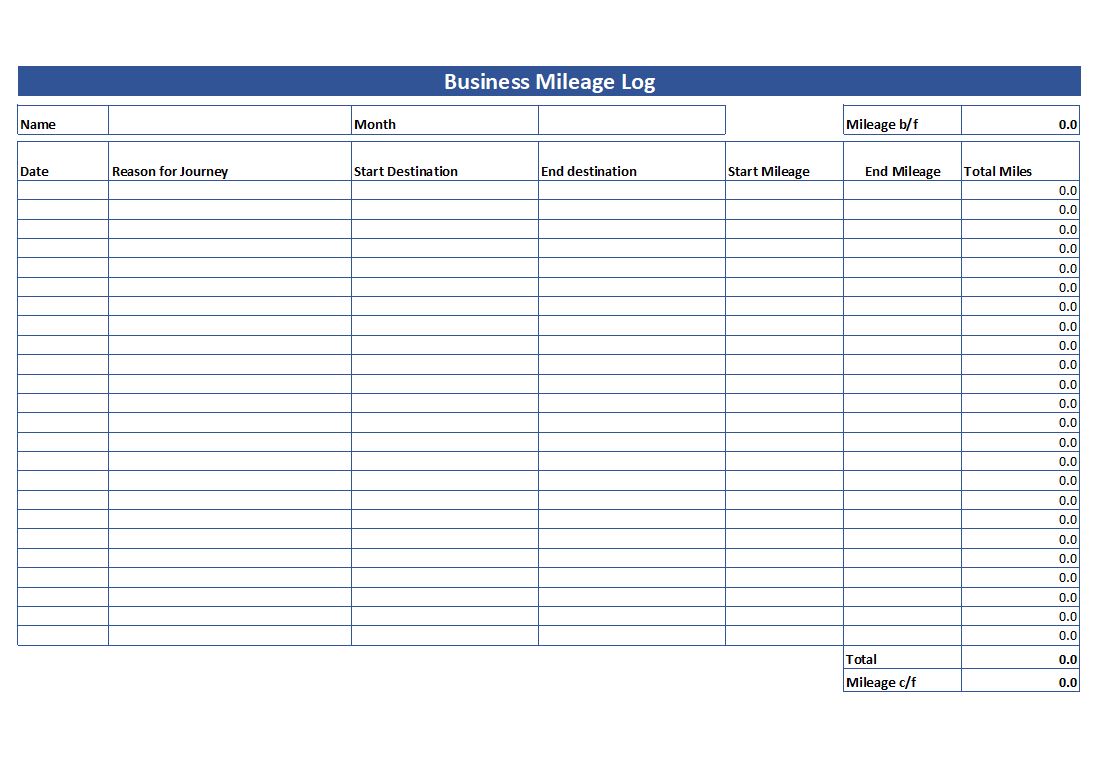

Mileage Log Tracker Business Printable Direct Sales Organizer Etsy Direct Sales Planner Direct Sales Organization Mileage Tracker

Mileage Log Tracker Business Printable Direct Sales Organizer Etsy Direct Sales Planner Direct Sales Organization Mileage Tracker

Firstly Select the country for which you want to calculate VAT from the drop-down menu.

How do i calculate vat on business mileage. To get a specific figure you need to check which of your work journeys are eligible for tax relief by considering things like if youre going to a temporary workplace and which mileage rate applies. The VAT element is 400 which can be reclaimed on the businesss VAT return. Using the current advisory fuel rates a 1400cc petrol engine allows 12p per miles for the fuel element of the mileage.

The 16p is VAT inclusive so you need to work backwards to find out the VAT claimable. The VAT on mileage is 195 6 3250. 12p x 200 24 24 is the gross amount.

Say you were claiming 100 miles at 45p for your 1600cc petrol car. This 45p is split into two parts fuel and wear and tear. It works for direct payments or in expense claims.

OK now lets put some numbers to that. If Mr A Smith of Mr A Smith Ltd has done 3000 business miles in his petrol-consuming personal car with engine size 2000 cc during the period 01012012 - 31032012 he is entitled to claim input VAT of. Then Enter the amount The price of the product Next select whether you want to.

Generally at a standard rate you have to remember one equation and that is 12 divided by 16 2p. Calculate VAT on the Mileage Claim Calculate the VAT on mileage claims by multiplying the gross fuel cost by 16. This gives us the total fuel.

So for every business mile you claim 45p for you can reclaim 267p VAT. The amount of VAT a business can claim is typically a sixth of the total cost of fuel. Multiply business miles driven by the IRS rate To find out your business tax deduction amount multiply your business miles driven by the IRS mileage deduction rate.

The fuel part is the part that a business owner can reclaim. The gross less the VAT is the net cost of fuel. 14 pence per mile represents 120 100 plus 20 VAT Therefore 20120 multiplied by the 14p results in 233 pence per mile.

If you are using any particular scheme the flat rate is applied or not. The first 10000 miles for vans and cars can claim up to 045 per mile and then its 025 per mile after that. The above method of reclaiming VAT on fuel and mileage can also be used if youre voluntarily registered for VAT and trading under the VAT turnover threshold.

To calculate VAT on your own you have to consider some of the factors. This means you do not have to keep detailed mileage records. You need to.

Fuel receipts need to be kept for the value of 195. Take the total fuel amount and multiply by the VAT fraction. As this 18 is VAT inclusive that is 18 equals 120 of the fuel cost the VAT element is calculated by dividing the figure by 6 giving an amount of 300.

Instead of keeping records of all receipts and then separating business and personal use you can simply claim 45p per mile or 25p for mileage over 10000 on business mileage. Multiply 15000 by the mileage deduction rate of 56 cents 15000 X. This is where employers can claim an extra 5p per mile for each passenger they take during a business trip.

Based on an advisory rate of 18p per mile 18 would be attributed to the fuel out of the overall 45 mileage claim. Input tax when employees are paid a mileage allowance Input tax is calculated by multiplying the fuel element of the mileage allowance by the VAT fraction VAT rate divided by 100 VAT rate. The car you drive.

Input VAT on mileage Business miles x Advisory fuel rate x VAT Fraction 3000 bus. This is because the standard VAT rate is 20 of the purchase. How to calculate VAT on mileage claims.

The Business Mileage Calculator gives you an estimated amount of business mileage tax rebate that you could be owed. The gross fuel cost for VAT purposes is the number of miles travelled multiplied by the applicable advisory fuel rate. Lets say you drove 15000 miles for business in 2021.

When youre looking to claim VAT on mileage allowance the amount you receive depends on the number of miles. Once you select the country it will automatically enter the VAT rate for that country in the VAT Rate Field. The VAT rate is currently 20 so the VAT fraction.

So 16p represents 120 100 plus 20 VAT. Your business is treated as having made VATable purchases of fuel of 195 inclusive of VAT and your VAT bill is reduced by 3250. The sensible figure worked out by the Business Mileage Calculator gives you a taste of how much tax you can save with a Business Mileage.

You can use fuel scale charges to work out how much VAT to pay back on fuel if you use a business car for private purposes. To calculate this they use their advisory fuel rate which estimates the amount of fuel used per mile based on engine size. As VAT is charged on fuel HMRC allow you to claim back the VAT from the fuel portion of the mileage.

Take the fuel advisory rate and multiply by the number of business miles claimed. Example Two paying employer for private fuel on a company car. Line 1 I call Mileage fuel rate 100 18p post to your travel code using 20 VAT code Line 2 I call Mileage base rate 10027p post to the expense code but select no VAT That will give a total of 45 with VAT worked out only on the first line.

The Advisory Fuel Rates from 1 September 2019. So the VAT element is 1612020 267p.

What You Need To Know How To Claim Business Mileage As An Expense Xu Hub

What You Need To Know How To Claim Business Mileage As An Expense Xu Hub

A Beginner S Guide To Mileage Expenses And Small Business Zervant Blog

A Beginner S Guide To Mileage Expenses And Small Business Zervant Blog

Premium Vehicle Auto Mileage Expense Form Mileage Tracker Mileage Tracker Printable Mileage Tracker App

Premium Vehicle Auto Mileage Expense Form Mileage Tracker Mileage Tracker Printable Mileage Tracker App

Mileage Log Template For Self Employed Impressive Blank Mileage Form Log Forms Of 38 Luxury M Mileage Log Printable Mileage Monthly Budget Template

Mileage Log Template For Self Employed Impressive Blank Mileage Form Log Forms Of 38 Luxury M Mileage Log Printable Mileage Monthly Budget Template

Mileage Log Business Mileage Tracker Auto Mileage Tracker Etsy In 2021 Mileage Tracker Mileage Tracker Printable Mileage Log Printable

Mileage Log Business Mileage Tracker Auto Mileage Tracker Etsy In 2021 Mileage Tracker Mileage Tracker Printable Mileage Log Printable

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Tracker Printable Mileage

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Tracker Printable Mileage

Vehicle Mileage Log Form Mileage Tracker Mileage Log Printable Mileage

Vehicle Mileage Log Form Mileage Tracker Mileage Log Printable Mileage

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Professional Templates Business Template

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Professional Templates Business Template

Personal Vehicle Mileage Log Mileage Log Printable Mileage Tracker Printable Business Mentor

Personal Vehicle Mileage Log Mileage Log Printable Mileage Tracker Printable Business Mentor

Download The Free Biz Finance Survival Kit Tax Prep Checklist Tax Prep Small Business Bookkeeping

Download The Free Biz Finance Survival Kit Tax Prep Checklist Tax Prep Small Business Bookkeeping

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

Calculate Business Mileage Using Hmrc S Rates For 2018 Mileiq Uk

Simple Mileage Log Free Mileage Log Template Download

Simple Mileage Log Free Mileage Log Template Download

Mileage Log Form For Taxes Inspirational Free Mileage Log Templates Blog Business Plan Template Business Plan Template Mileage

Mileage Log Form For Taxes Inspirational Free Mileage Log Templates Blog Business Plan Template Business Plan Template Mileage

How To Claim Business Mileage Why It S Ok For The Business

How To Claim Business Mileage Why It S Ok For The Business

Self Employed Guide How To Claim For Business Mileage

Self Employed Guide How To Claim For Business Mileage

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Mileage Log Form For Taxes Awesome Mileage Tracker Printable Bud More Mileage Tracker Printable Mileage Tracker Mileage Log Printable

Gas Mileage Log And Calculator Mileage Log Printable Gas Mileage Mileage Chart

Gas Mileage Log And Calculator Mileage Log Printable Gas Mileage Mileage Chart

Free Biz Finance Survival Kit Tax Prep Checklist Finance Tax Prep

Free Biz Finance Survival Kit Tax Prep Checklist Finance Tax Prep

Vat On Fuel Business Mileage 2021

Vat On Fuel Business Mileage 2021