Do International Vendors Get 1099

However foreign corporations are not issued this document. If the foreign contractor is not a US.

You should get a form W-8BEN signed by the foreign contractor.

Do international vendors get 1099. Taxpayer and all of the contracted services were performed outside the US a Form 1099 is not required. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. 1099-MISC Minimums The IRS requires businesses to issue Form 1099-MISCs to most non-corporate independent contractors or service providers foreign.

A 1099 is normally issued to individuals living in the US. If you paid a vendor more than 10 in interest youve got to send out a 1099-INT. They are not an employee so they do not receive hourly or salary wages for each payroll period.

Withholding certificate to document their foreign status for US. An exempt recipient is any payee that is exempt from the Form 1099 reporting requirements. Any medical expenseshealthcare payments made in excess of 600.

If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. Instead you will need to ask the contractor to complete a Form W-8BEN. May 31 2019 450 PM As long as the foreign contractor is not a US.

The company then sends the resulting 1099 form to the supplier which the supplier should use for tax filing purposes. Instead a 1099 vendor will send you a 1099 invoice after performing work for your business. Tax withholding on US-source income payments to nonresident aliens and foreign entities collectively foreign personsAs a result foreign vendors are being asked by their clients to provide them with a US.

So you dont have to complete 1099s for non-US. Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required. However they are not specific about foreign entities on that form.

An invoice is an electronic or paper request. Philadelphia PA 19104 267 941-1000 6 am2 am Eastern 35 When to File Forms 1099-MISC. It may mean a phone call to the person who entered the vendor or a phone call to the vendor directly.

You only issue 1099s to non-corporate entities contractors consultants some LLPs and similar entities - read the specifics on the form that are US. Any person making more than 600 per year is issued a 1099-MISC for income earned in the US. Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required.

If You Paid Someone 10 Or More In Interest. The exception to this rule is with paying attorneys. Tax purposes or to request an.

11441-1 b 3 it is generally easier to. The 1099-INT form is usually used by banks brokerage firms credit unions and sometimes even the companies handling your student loans. The Form W-8BEN certifies that the foreign contractor is not a US.

You will need to provide a 1099 to any vendor who is a. All payments made to attorneys law firms irrespective of whether they are incorporated or not will need to be issued 1099 in excess of 600. Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099.

Vendors Backup Withhold from Vendor Payments if Necessary. You can get official forms at IRS offices or by calling 1-800-TAX. Subject to Form 1099 reporting requirements the IRS suggests that you request the recipient complete the.

If a vendor is entered as a 1099 vendor and it doesnt look correct the Vendor Maintenance team will research the problem. IRS Tax Forms in the W-8 Series W-8BEN W-8BEN-E W-8ECI W-8EXP W-8IMY International vendors must submit a US withholding certificate W-8 series of forms with an Employer Identification Number EIN Individual Taxpayer Identification Number ITIN or Social Security Number SSN in order to claim an exemption from or reduction in withholding. January 15 2019 0653 AM As long as the foreign contractor is not a US.

International Taxpayers Government Entities If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. They are not subject to this filing since they are foreign. Rent payments made in excess of 600.

You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent. Forms W-8 Series and W-9. If the foreign recipient is non-exempt ie.

This is only a partial listing of accepted 1099 MISC Vendors. However in the US. The IRS is in the process of enforcing compliance of long-standing rules requiring US.

All vendors will need to receive 1099 unless they are incorporated as a S or C Corporation. All that the foreign contractor needs to do is to complete the basic information in Part I and sign in Part III attesting that the information is true correct and complete. Vendors who operate as C- or S-Corporations do not require a 1099.

No Form 1099 then needs to be filed for payments to foreign persons. If you designate a supplier as a 1099 vendor the system will print a Form 1099 for the supplier as part of the 1099 batch processing that follows the end of the calendar year. If you hire a 1099 vendor to perform work at your business do not include them on your companys payroll.

And who are also citizens of the country.

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

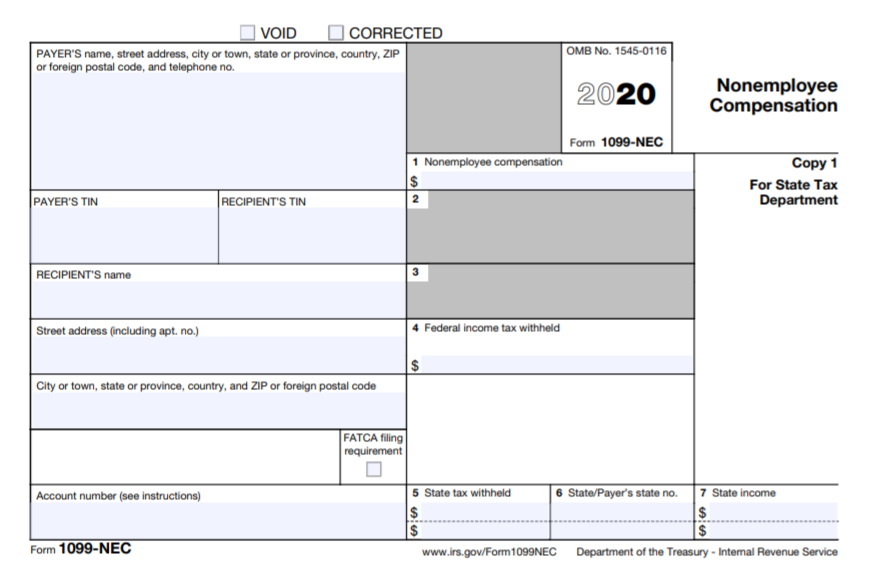

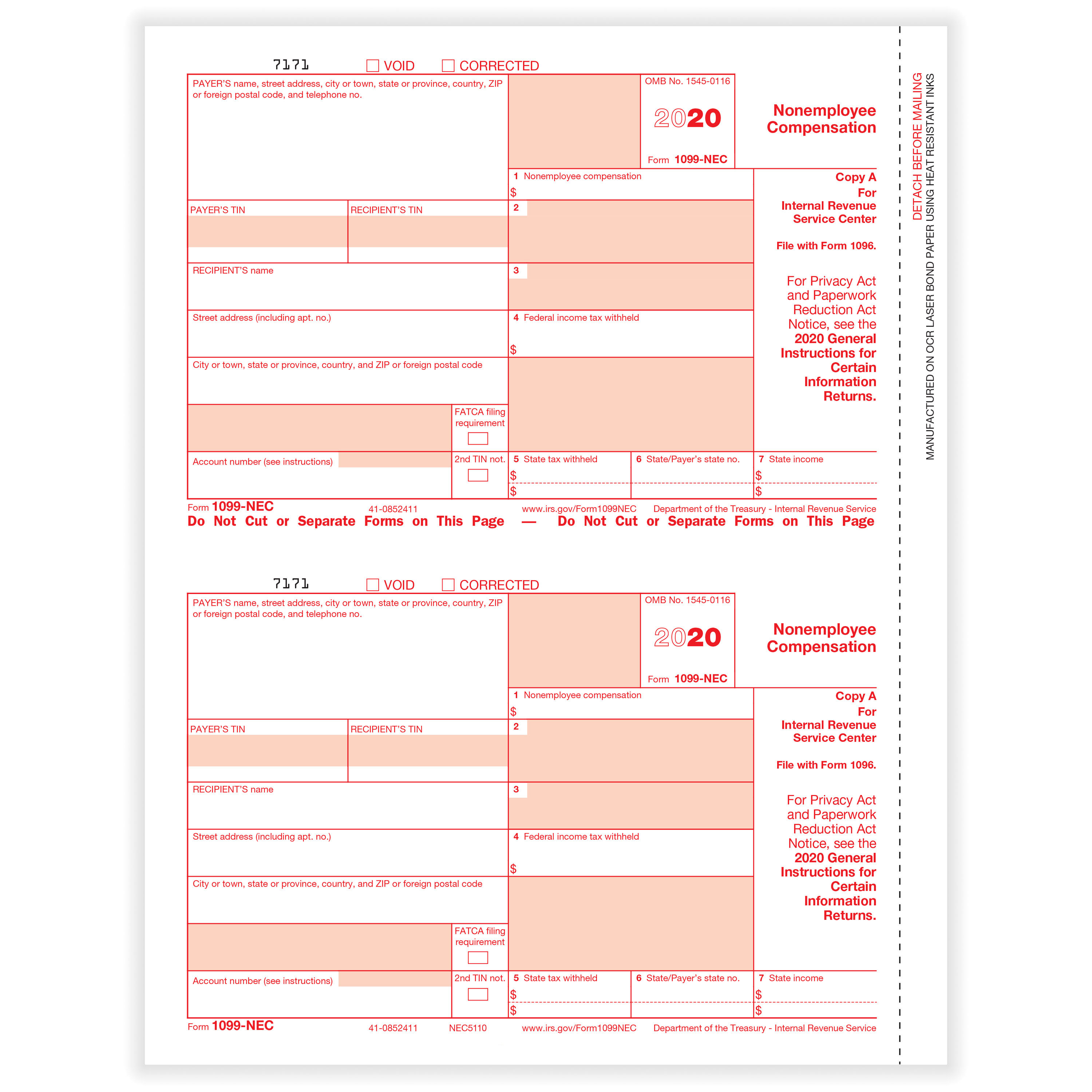

1099 Nec Federal Copy A Cut Sheet Hrdirect

1099 Nec Federal Copy A Cut Sheet Hrdirect

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Do You Want To Track Your 1099 Payments In Wave Accounting Yes You Say Well Here Is A Blog Post Just Fo Wave Accounting Business Read Bookkeeping Software

Do You Want To Track Your 1099 Payments In Wave Accounting Yes You Say Well Here Is A Blog Post Just Fo Wave Accounting Business Read Bookkeeping Software

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

Rules For When To Issue A 1099 Form To A Vendor The Dancing Accountant

1099 For International Contractors Safeguard Global

What Is A 1099 Misc Form W9manager

What Is A 1099 Misc Form W9manager

Account Ability Includes Electronic Filing The Irs And Social Security Administration Ssa Require Filers Of Efile Accounting Social Security Administration

Account Ability Includes Electronic Filing The Irs And Social Security Administration Ssa Require Filers Of Efile Accounting Social Security Administration

Irs Update New Form 1099 Nec Alfano Company Llc

Irs Update New Form 1099 Nec Alfano Company Llc

Ready For The 1099 Nec Farkouh Furman Faccio Llp Certified Public Accountants Advisors

Ready For The 1099 Nec Farkouh Furman Faccio Llp Certified Public Accountants Advisors

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager