Qualified Business Income Deduction Simplified Worksheet 2019

When the taxpayers income including taxpayers that are considered Specified Service Businesses is below 157500 or 315000 for Married Filing Jointly the QBID will be the lesser of 1 20 of the net Qualified Business Income or Loss from all sources plus 20 of any qualified REIT dividends and Publicly Traded Partnerships PTP income or loss recognized on the tax return or 2. You have QBI qualified REIT dividends or qualified PTP income or loss.

Https Exactax Com Documents Workshops 2018 20exactax 20workshop Pdf

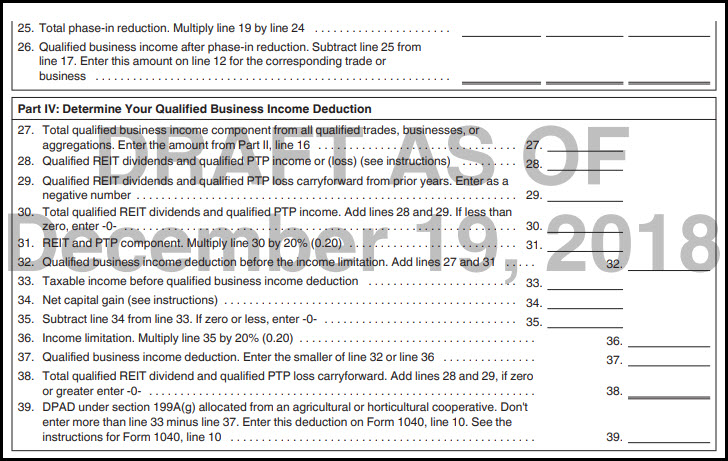

However beginning in 2019 this deduction is calculated on two tax forms.

Qualified business income deduction simplified worksheet 2019. If your 2019 taxable income before the QBI deduction is less than or equal to 160700 160725 if. Information about Form 8995 Qualified Business Income Deduction Simplified Computation including recent updates related forms and instructions on how to file. 9 9 qualified business income deduction before the.

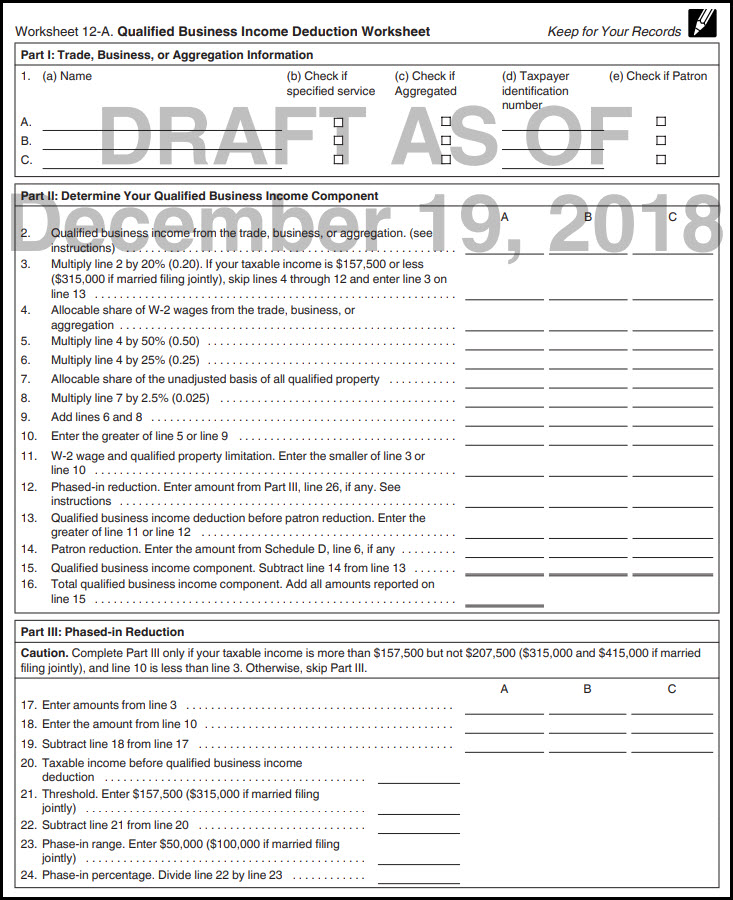

Chapter 12 covers the qualified business income QBI deduction including guidance worksheets and instructions in arriving at the new 20 percent deduction. You can claim the qualified business income deduction. You will recieve an email notification when the document has been completed by all parties.

Complete Form 8995 or Form 8995-A to claim the tax deduction. IRS Form 1040 Qualified Business Income Deduction Simplified Worksheet 2018. Youre a patron in a specified agricultural or horticultural cooperative.

Use Form 8995 to figure your qualified business income QBI deduction. Use Form 8995 to figure your qualified business income deduction. The Worksheet will compare your family taxable income with your business profit.

Are not a patron in a specified agricultural or horticultural cooperative. When attached to the ESBT tax worksheet the. Qualified Business Income Deduction Simplified Computation Attach to your tax return.

Pages 26 This preview shows page 18 - 22 out of 26 pages. Other parties need to complete fields in the document. Those who can claim the QBI deduction include sole proprietors the partners of a partnership the shareholders in S.

School Santa Rosa Junior College. The qualified business income deduction QBI deduction allows some individuals to deduct up to 20 of their business income REIT dividends or PTP income on their individual income tax returns. Subtract 14 from 13 Total QBI component.

9 9 Qualified business income deduction before the income limitation. Your 2019 taxable income before your QBI deduction is more than 160700 160725 if married filing separately or a married nonresident alien. This is your Qualified Business Income Deduction finally.

It will multiply the lower of these two numbers by 20 and put the result on Form 1040 line 9. Have taxable income less than 157500 315000 if Married Filing Jointly. The QBI deduction is up to 20 of QBI from a pass-through entity conducting a trade or business in the US.

You have successfully completed this document. The IRS released Publication 535 on Jan. This worksheet is for taxpayers who.

There are two forms being released Form 8995 and Form 8995-A. It also includes up to 20 of qualified real estate investment trust dividends and. Names shown on return.

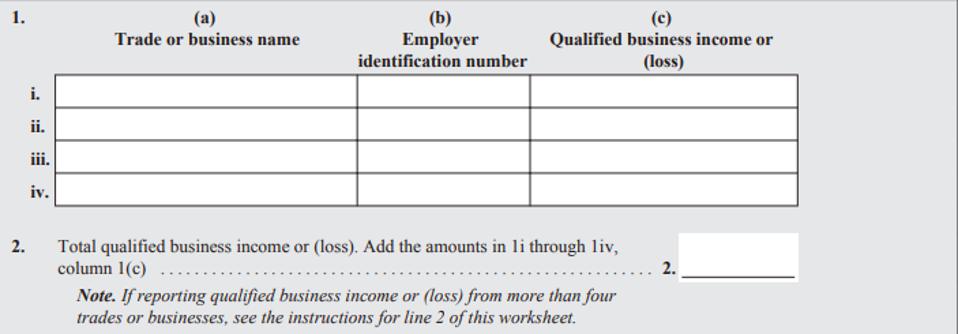

Qualified Business Income Deduction Simplified Computation Attach to your tax return. The actual calculation of the deduction was done in 2018 on one of two worksheets depending on the taxpayers income. 1 a Trade or business name b Employer identification number c Qualified business income or loss.

Tax worksheet filed with Form 1041. Form 8995 - Qualified Business Income Deduction Simplified Computation or Form 8995-A - Qualified Business Income Deduction. Purpose of Form.

Go to wwwirsgovForm8995 for instructions and the latest information. Course Title ACCOUNTING TAXATION. Go to wwwirsgovForm8995 for instructions and the latest information.

Qualified Business Income Deduction Simplified Computation Department of the Treasury. If you have qualified business income from a. The qualified business income deduction QBI is a tax deduction that allows eligible self-employed and small-business owners to deduct up to 20 of their qualified.

This document is locked as it has been sent for signing. Your taxpayer identification number. For taxpayers whose taxable income before the QBI deduction is less than certain thresholds ie.

Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20 of their net QBI from a trade or business including income from a pass-through entity but not from a C corporation plus 20 of qualified real estate investment trust REIT dividends and qualified. This one-page form mirrors the 2018 worksheet produced within tax software but allows both the taxpayer and preparer to follow more easily how the deduction. Names shown on return.

78 rows Qualified business income component. 160700 single 321400 married filing jointly Form 8995 Qualified Business Income Deduction Simplified Computation can be used. 321400 if married filing jointly.

40000 business profit 2826 one half of Social SecurityMedicare tax 37174. Qualified business income is the total amount of income gain deduction and loss with respect to any qualified trade or business of the taxpayer. Your taxpayer identification number.

Have qualified business income. The Qualified Business Income Deduction may be subject to limitations based on the type of trade or business the taxpayers taxable.

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

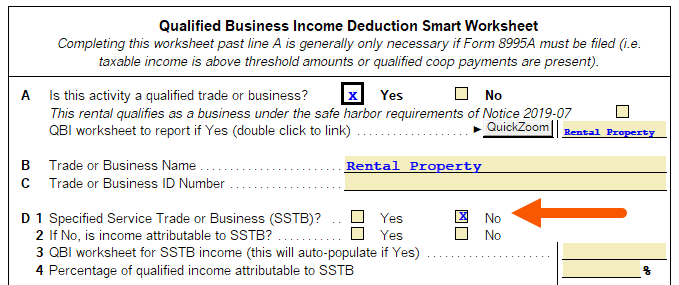

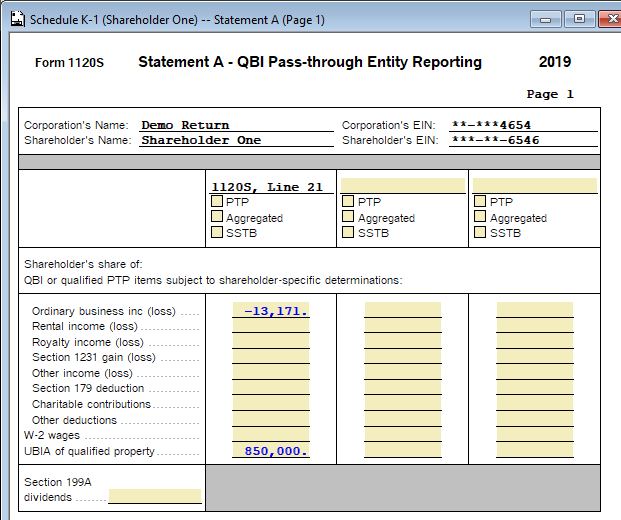

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Income Tax Deduction Worksheet Promotiontablecovers

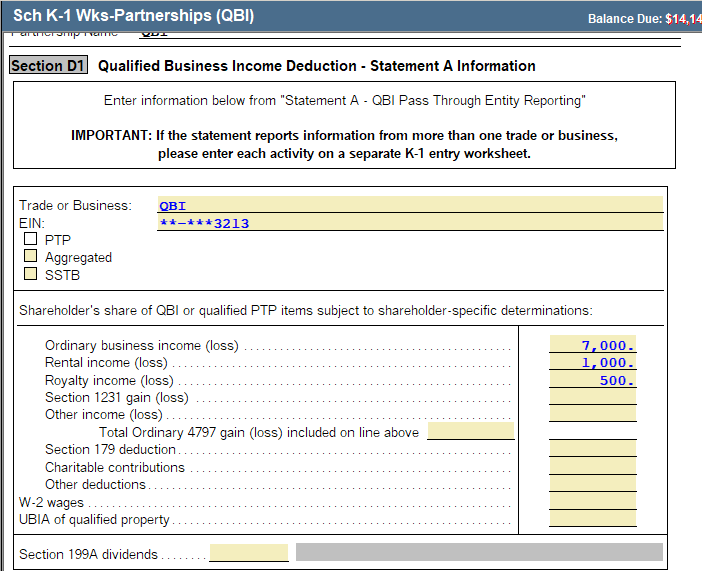

Overview Of The Qualified Business Income Qbi De Intuit Accountants Community

Overview Of The Qualified Business Income Qbi De Intuit Accountants Community

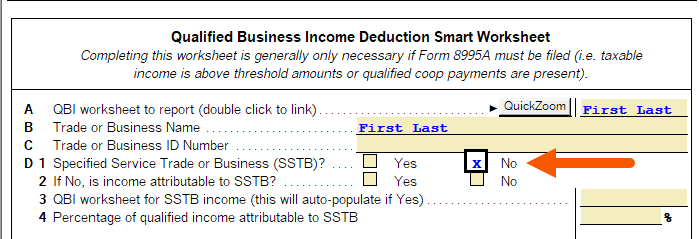

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Taxes From A To Z 2019 Q Is For Qualified Business Income

Taxes From A To Z 2019 Q Is For Qualified Business Income

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

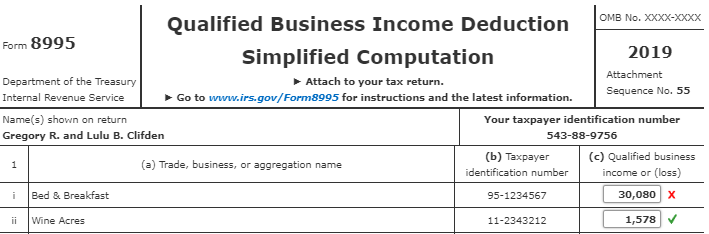

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community