How Do I Get My 1099 Int From Bank Of America

Keep in mind that your financial institution may not provide the form online before January 1 of each year. Log in to your online account and search for an electronic copy of your 1099-INT form.

Bank Of America Discounts 2018 For Customers Clients

Bank of America CDs IRAs customer service information is designed to make your banking experience easy and efficient.

How do i get my 1099 int from bank of america. If youre enrolled in Online Banking and you meet the IRS guidelines you can find your 1099-INT form by signing in to Online Banking selecting your deposit account and then selecting the Statements. 529B College Savings Accounts CESA Distributions. Certain financial institutions may opt to provide the form online for easy retrieval instead of mailing the form.

An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS. On the right side of the page youll see To receive paper tax documents for your banking accounts email us Selectemail usand fill out the email form. It should show all Forms 1099 issued under your.

Specifically it includes the following Forms. Original issue discount interest accretion not paid Jan. Contact your Relationship Manager.

Reportable dividends and distributions. If you receive at least 10 of interest during a calendar year from an individual bank or other entity you are required to complete a 1099-INT. Get answers to the most popular FAQs and easily contact us through either a secure email address a mailing address or our CDs IRAs customer service phone numbers.

If 1099 INT1099 MISC documents arent received by February 15 contact us at 800-872-2657 to request another copy. Under Subject select Stop e1099s. You can find the total amount of interest earned by looking at the last page of your December statement under Interest Earned Year to Date.

Where can I get my 1098 or 1099 tax information. Or if you dont know if you were supposed to get one phone your. The 1099-INT is a common type of IRS Form 1099 which is a record that an.

Select the Statements and Tax Information button inside online banking. If you earned more than 10 in interest from a bank brokerage or other financial institution youll receive a 1099-INT. Form 1099-INT interest income and Form 1099-R IRA distributions are only issued when aggregate amounts reported are 10 or more per taxpayer.

1099-DIV 1099-INT 1099-B 1099-OID and 1099-MISC. Thats because each bank financial institution or other entity that pays you at least 10 of interest during the year must. Open your return or continue if its not already open.

Multiple accounts The first mailing includes Consolidated Forms 1099 that we do not anticipate will have any additional updates or issuer-driven reclassifications ie reclassifications made by issuers such as mutual fund and Unit Investment Trust. If a 1099-INT for the current tax year is not there then you have earned less than 10 in interest and a 1099-INT was not generated. Answer Yes to Did you receive any interest income.

How do I get my 1099 C from Bank of America. Prepare a 1099-INT send you a copy by January 31 and file a copy with the IRS. In the upper right menu select and search for 1099-INT or 1099INT lower-case also works.

If youre enrolled in Online Banking and you meet the IRS guidelines you can find your 1099-INT form by signing in to Online Banking selecting your deposit account and then selecting the Statements Documents tab. If trust agency custody or IRA tax documents are not available. If you see Review your 1099-INT info select Add another 1099-INT or.

Under Account or Service select an account number. Select the Jump to link in the search results. Tax documents for 1099-INT are not currently available online.

Although you didnt get a 1099-INT report the interest in the 1099-INT section. We only report interest paid on your Bank of America accounts and mail a 1099-INT if you. A bank doesnt have to send a 1099-INT if the amount was less than 10 but you still have to report the interest even if below 10.

Under the Statements tab click on View Tax Form. Ascent Wealth Management Wealth Management Reserve or Wealth Management accounts. Additionally the form is issued by all payers of interest income to investors at year end and includes a breakdown of all types of interest income and related expenses.

If you have online banking with BOA youd have to look in your account to see if you were paid any interest and if so whether they allow people to download a 1099-INT from a tax forms section.

Bank Of America 3 Int The Shocking Revelation Of Bank Of America 3 Int Recipe Cards Template Calendar Design Template Templates Free Design

Bank Of America 3 Int The Shocking Revelation Of Bank Of America 3 Int Recipe Cards Template Calendar Design Template Templates Free Design

/Form1098-5c57730f46e0fb00013a2bee.jpg) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

What Is A 1099 Int Tax Form How Do I File It

What Is A 1099 Int Tax Form How Do I File It

Didn T Receive A Form 1099 Don T Ask

Didn T Receive A Form 1099 Don T Ask

/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

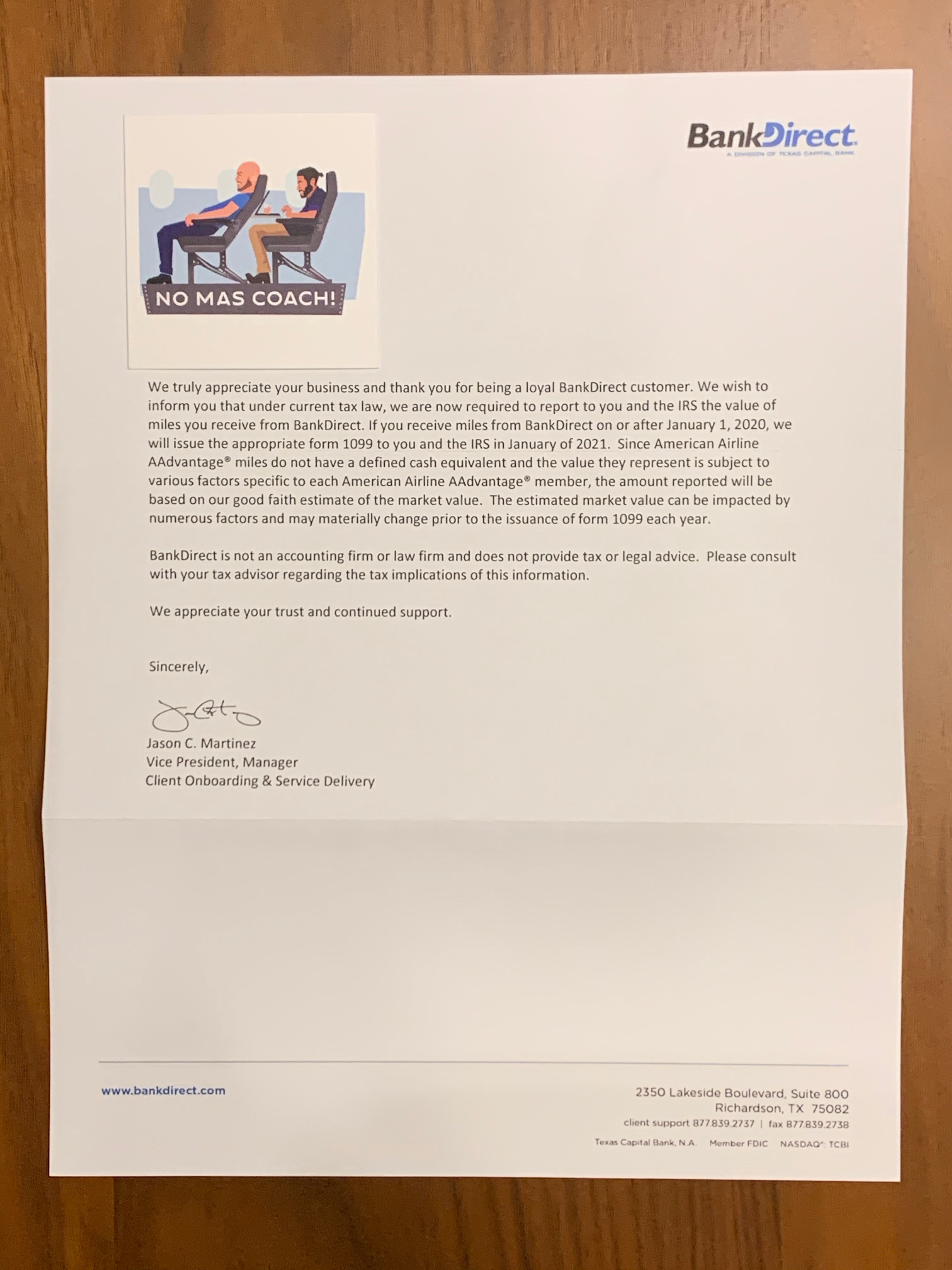

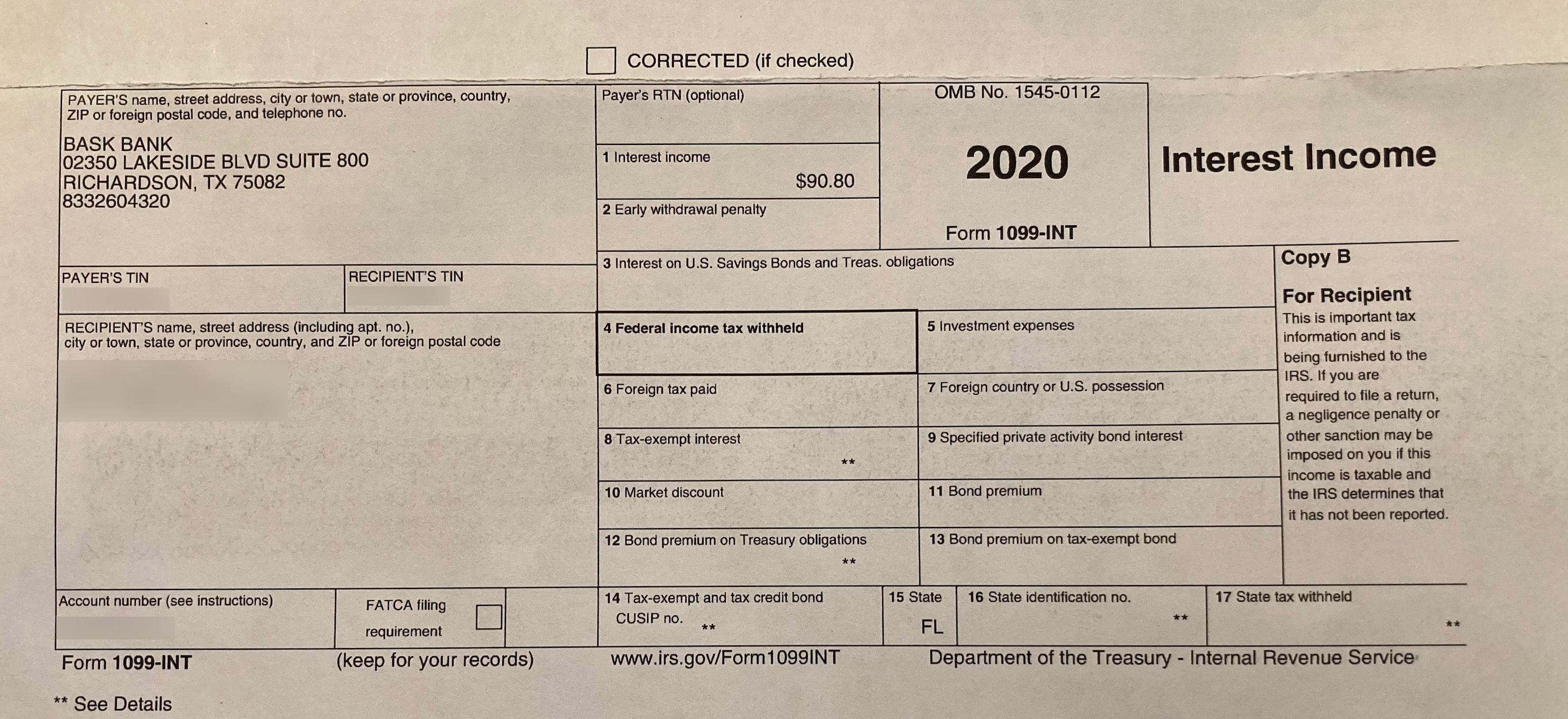

Bask Bank Sending Out 1099 Forms And They Re Not Bad No Mas Coach

Bask Bank Sending Out 1099 Forms And They Re Not Bad No Mas Coach

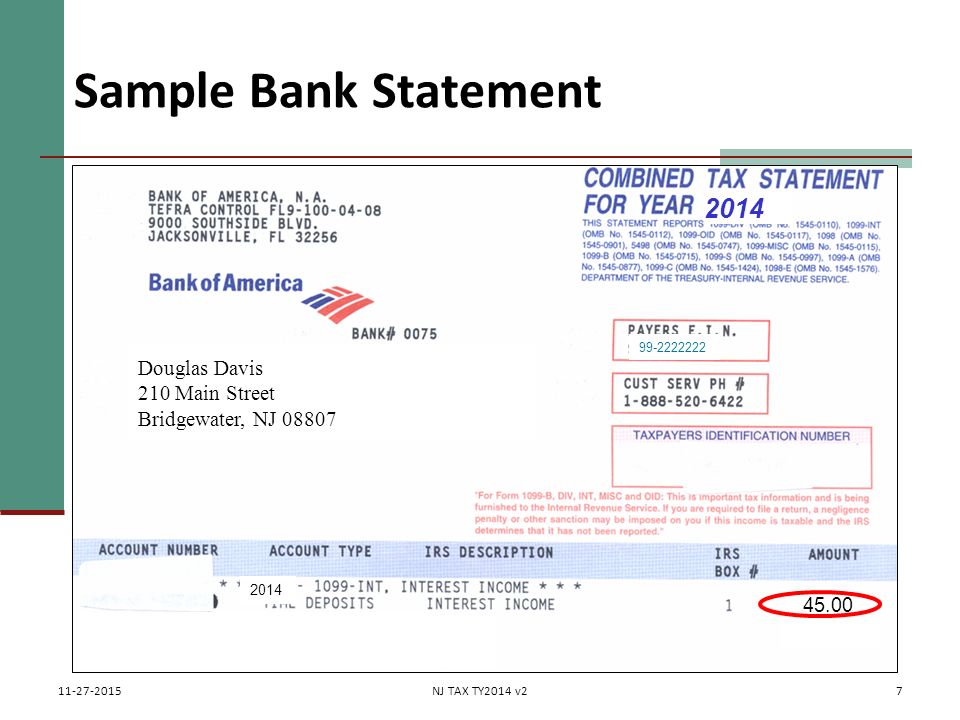

Interest Dividends Pub 17 Chapters 7 8 Pub 4012 Tab D Ppt Download

Interest Dividends Pub 17 Chapters 7 8 Pub 4012 Tab D Ppt Download

:max_bytes(150000):strip_icc()/1099c-5606545f559b4f28883a0de35905889b.jpg) Form 1099 C Cancellation Of Debt Definition

Form 1099 C Cancellation Of Debt Definition

Enter Your Foreign Interest As If You Had A 1099in

Enter Your Foreign Interest As If You Had A 1099in

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

Https Www Irs Gov Pub Irs Pdf I1099int Pdf

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

Complete Guide To Paying Taxes On Credit Card Rewards

Complete Guide To Paying Taxes On Credit Card Rewards

Should You Report Income From Bank Interest Bonuses Mybanktracker

Should You Report Income From Bank Interest Bonuses Mybanktracker

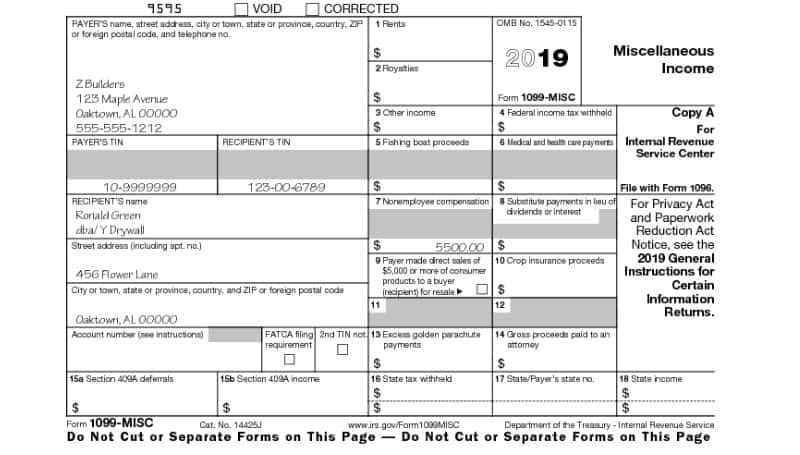

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Prudential Retirement 1099 R Fill Out And Sign Printable Pdf Template Signnow

Prudential Retirement 1099 R Fill Out And Sign Printable Pdf Template Signnow

Bank Of America Forms Fill Out And Sign Printable Pdf Template Signnow

Bank Of America Forms Fill Out And Sign Printable Pdf Template Signnow