What Does A 1099 K Mean

A PSE makes a payment in settlement of a reportable payment transaction that is any payment card or third party network transaction if the PSE submits the. This form endeavors to.

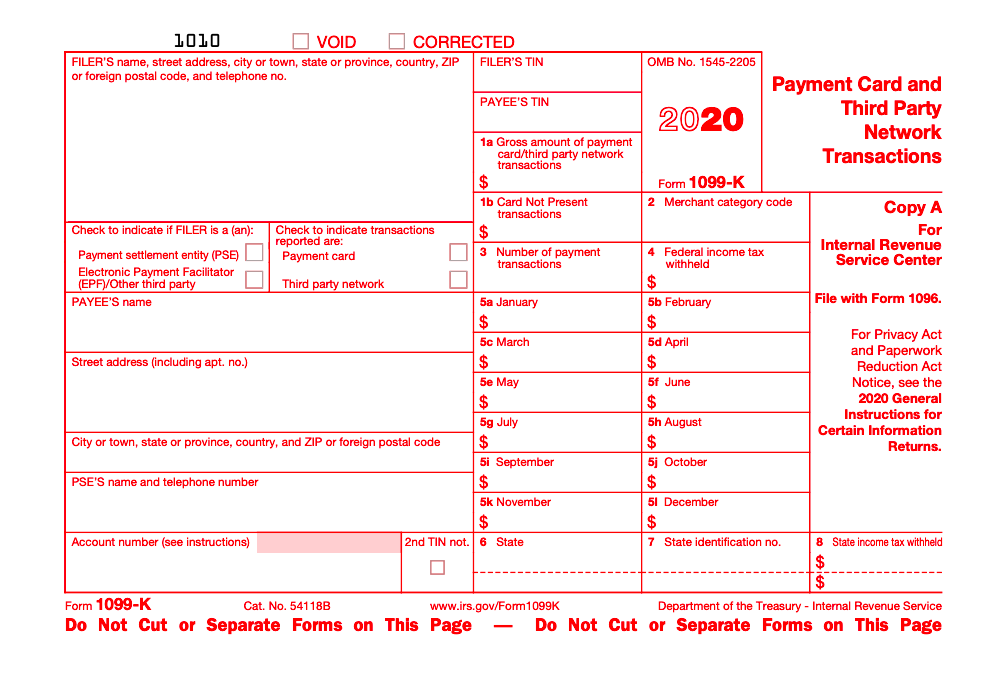

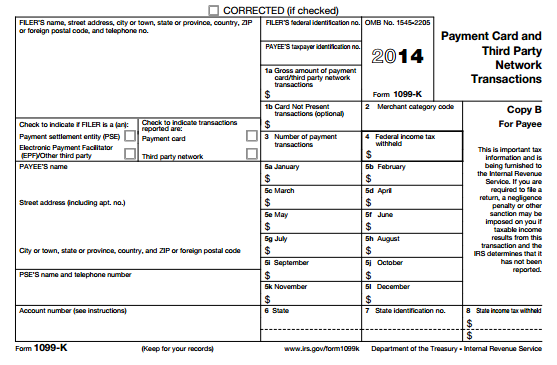

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

Simply put if you use a service to process credit or debit card transactions that service is a payment settlement entity and the amount of those types of transactions for the year should be reported on the Form 1099-K.

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

What does a 1099 k mean. On my 1099-K there is an amount amount in 1a. In other words the 1099-K shows that you made that money even when you ended up refunding the money to the customer. Form 1099-K is a new IRS form aimed at individuals that earn an income online.

A 1099 form is an information filing form that proves some other entity besides your employer paid you money. Form 1099-K also called Payment Card and Third Party Network Transactions is used by credit card companies and third-party processors like PayPal and Amazon to report the payment transactions they process for retailers or other third parties. This code indicates the monies are taxable in a prior tax year as opposed to Code 8 with the distribution taxable the year of the 1099-R form.

The transaction limit has been lifted with the new update. Instead of relying on individuals to self-report online income the IRS is now forcing third-party payment processors such as PayPal or a merchant account to report income that is flowing through their networks to you. 1b do I include both in my income or is the amount in 1b already totaled in 1a.

There are many different types of 1099 forms. Your 1099-K does not account for returns and refunds. Each 1099K tax form indicates the total amount transacted on the platform and does not indicate total gains or losses.

A 1099 form is a tax document filed by an organization or individual that paid you during the tax year. The 1099-K is a tax form that lets companies like PayPal and Amazon report how much money you made through them with your online store. Youll need to report both boxes in TurboTax.

Dividends distributed from an. IRS Form 1099-K came into existence as part of the 2008 Housing Assistance Tax Acteven though it has nothing to do with housing. A payment settlement entity PSE must file Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year.

Well there isnt really an and here. And youre probably asking. The 1099K is a standard tax document that tells the taxpayer what information needs to be provided to the IRS.

This income needs to be included in your total business earnings. 1 Early Distribution 2 Early Distributionnot subject to 10 early distribution tax 4 Death B Designated Roth Code U. Form 1099-K Payment Card and Third Party Network Transactions is used to report transactions that are made via a payment settlement entities.

This is the equivalent of a W-2 for a person thats not an employee. The transaction amount has been lowered from 20000 to 600. Form 1099-K is used by credit card companies and third-party payment processors like PayPal also referred to as third party settlement organizations or TPSOs for short to report the payment transactions they process for retailers or other third parties.

If youre self-employed or an independent contractor you report 1099-K income on Schedule C of your. Form 1099-K is the IRS form that taxpayers receive to report certain payment transactions. The boxes report different amounts based on how the credit card data was entered by the customer.

About Form 1099-K Payment Card and Third Party Network Transactions. Now if you are a Payment Settlement Entity this new update means you are required to file a 1099-K and send a copy of the form to the IRS and the customer for processing transactions amounting to 600 or more in a year. What is a 1099-K.

For example you may get one if your bank paid you interest or you earned income as a contract or freelance worker. This makes it all the more important for you to have meticulously tracked your finances since these amounts will likely reduce the amount of taxes you owe. Form 1099-K is used to report income received from electronic payments such as credit cards debit cards PayPal and other third party payers.

In most cases the payment settlement entity PSE will send you a 1099-K by January 31. Thats all the form does.

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Form 1099 K Everything You Need To Know Bench Accounting

Form 1099 K Everything You Need To Know Bench Accounting

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Can Tax Form 1099 K Derail Your Ecommerce Taxes Taxjar Blog

Amazon Seller Income Tax And Sales Tax Reporting The Ultimate Guide

Amazon Seller Income Tax And Sales Tax Reporting The Ultimate Guide

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

![]() Received Form 1099 K Here S What To Do With It Bookkeeping Support

Received Form 1099 K Here S What To Do With It Bookkeeping Support

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

1099 Misc 1099 K Explained Help With Double Reporting Paypal And Coinbase Youtube

1099 Misc 1099 K Explained Help With Double Reporting Paypal And Coinbase Youtube

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org