Unreimbursed Employee Business Expenses 2019

The amount of employment-related expenses that may be subtracted is limited to the amount actually used in computing the federal credit for child and dependent care expenses. Certain qualified educator expenses are.

Can I Deduct Unreimbursed Employee Business Expenses In 2019

Can I Deduct Unreimbursed Employee Business Expenses In 2019

Review the General Guidelines for Unreimbursed Expense Documentation for a complete list.

Unreimbursed employee business expenses 2019. A teacher instructor counselor principal or aide who teaches. Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators. The unreimbursed business expense change doesnt have an effect on the unreimbursed business expenses that non-wage-earning self-employed.

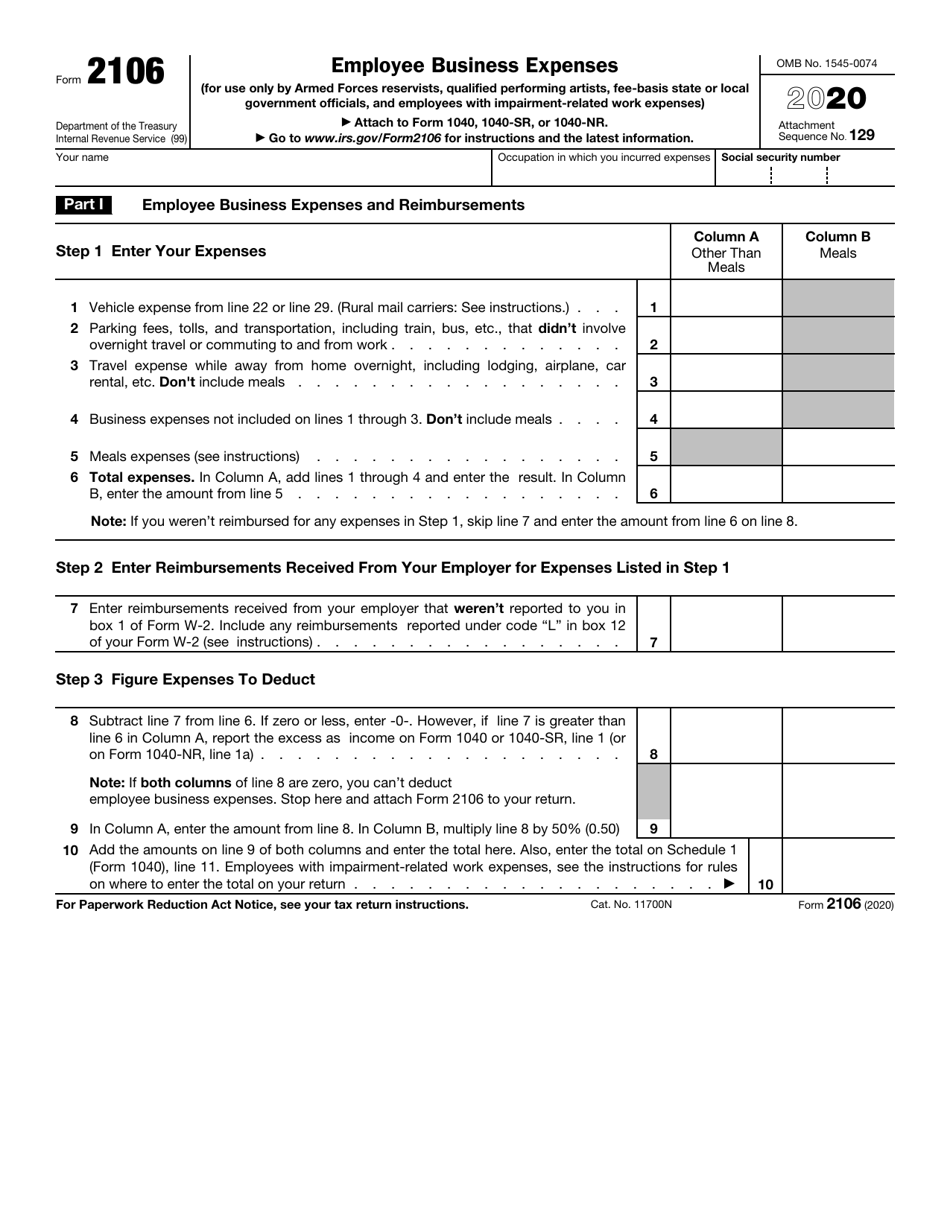

The IRS classifies employee expenses as ordinary and necessary expenses. Enter the amount from line 10 of federal Form 2106 on line 19. The Tax Cuts and Jobs Act TCJA introduced many new changes to the tax law.

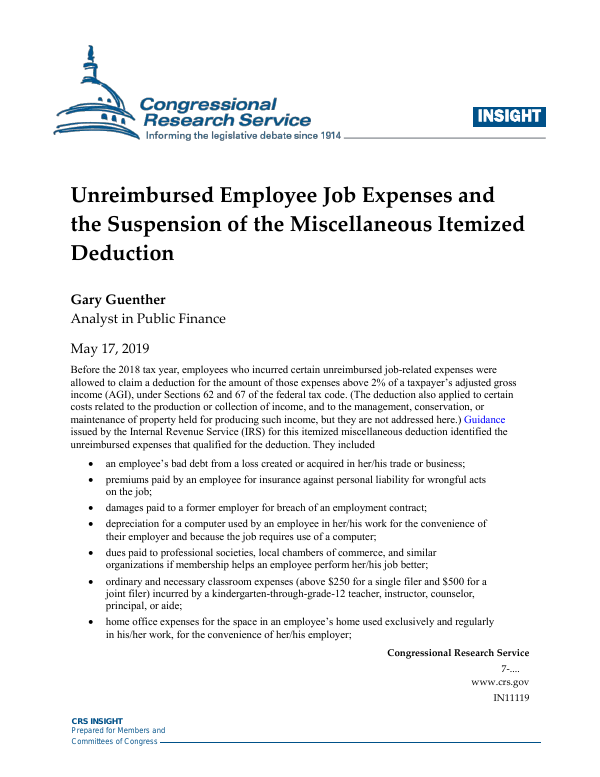

One of these changes is that unreimbursed employee business-related expenses are no longer deductible as an itemized deduction on your Federal tax return. If you were an employee who was used to deducting your unreimbursed employee business expenses EBE you might have been unpleasantly surprised while preparing your 2018 federal tax return when you realized this deduction had gone away. Qualified employees listed in one of the categories above must complete Form 2106 to take the deduction.

Jan 03 2021 The rate was 535 cents per mile in 2017 545 cents per mile in 2018 58 cents per mile in 2019 and 575 cents per mile in 2020. This has been a significant deduction for many of my clients in the past. Prepare federal Form 2106 reflecting your employee business expense using California amounts ie following California law.

To claim unreimbursed travel expenses reservists must be stationed away from the general area of their job or business and return to their regular jobs once released. They must complete Form 2106 Employee Business Expenses. Jun 05 2019 Appears that even though the Standard Deduction is taken for the federal 1040 when you click on Forms there is a Miscellaneous Itemized Deductions Worksheet which has certain fields ungrayed so one can key in Unreimbursed Employee Business Expenses which would then carry over to the CA state 540.

Ordinary expenses are those that are common and accepted in your trade business or profession while necessary expenses are appropriate and helpful to your business. Unreimbursed employee expenses are those expenses for which the employer has not paid you back or given you an allowance for. Unreimbursed employee expenses for individuals in these categories of employment are deducted as adjust-ments to gross income.

Expenses are deductible only if the reservists pay for meals and lodging at their official military post and only to the extent the expenses exceed Basic. Feb 22 2018 Self-employed taxpayers may continue to deduct ordinary and necessary business expenses against self-employment income on Schedule C or Schedule F. Mar 17 2020 Part of the Tax Cut and Jobs Act of 2017 was to eliminate almost all deductions for unreimbursed employee business expenses.

Unless you are in a very small group of employees the amounts you entered were reduced to zero on your federal return although some states still allow the deductions so its good to enter them. 2 days ago This article was published by the IRS. Include your entertainment expenses if any on line 5 of federal Form 2106 for California purposes.

But if you have unreimbursed business expenses as an employee what used to be known as Employee Business Expenses EBE then those expenses are generally no longer deductible for the 2019 tax year on. Union dues agency fees or initiation fees. Employees with impairment-related work expenses.

Line 19 - Unreimbursed Employee Expenses. You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year for carrying on your trade or business of being an employee and ordinary and necessary. Jan 31 2020 If you are organized under another business form then the business may deduct the ordinary and necessary expenses of operating or conducting that business.

Exception to Unreimbursed Business Expenses. As a general rule you are limited to a maximum of 3000 for one child and 6000 if you are claiming the expenses. It increases to 56 cents a mile in 2021 if youre an employee who still qualifies for this deduction under the terms of the TCJA.

Unreimbursed Employee Business Expenses was a tax form issued by the Internal Revenue Service IRS for use by employees who wished to deduct ordinary and necessary expenses related. An expense is ordinary if it is common and accepted in your trade business or profession. For many employees this ability to deduct employment-related exp.

Oct 06 2020 The educator expense deduction marks one of the few unreimbursed employee expenses that taxpayers can still deduct on their returns. Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator. Uniforms required by the employer that are not suitable for street wear Small tools.

Based on the information from Form 2441 Jon and Mary will subtract 4000 on their Virginia return - the expenses on which they based their credit. Dec 23 2019 December 23 2019 by Carolyn Richardson EA MBA.

Employee Business Expenses Commuting Doesn T Count Alloy Silverstein

Employee Business Expenses Commuting Doesn T Count Alloy Silverstein

Https Singlefamily Fanniemae Com Media Document Pdf Glance Selling Guide Updates Related Tax Cuts And Jobs Act

Unreimbursed Employee Expenses

Unreimbursed Employee Expenses

Unreimbursed Employee Job Expenses And The Suspension Of The Miscellaneous Itemized Deduction Everycrsreport Com

Unreimbursed Employee Job Expenses And The Suspension Of The Miscellaneous Itemized Deduction Everycrsreport Com

Can I Deduct Work Expenses In 2019 In 2020

Can I Deduct Work Expenses In 2019 In 2020

Https Www 3iscorp Com School Wp Content Uploads Pdf Courses Self Study California Module 3 Study Text Pdf

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Https Www 3iscorp Com School Wp Content Uploads Pdf Courses Self Study California Module 3 Study Text Pdf

2106 Employee Business Expenses 2106 Schedule1

2106 Employee Business Expenses 2106 Schedule1

Deducting Employee Business Expenses Under The New Tax Law Businesswest

Deducting Employee Business Expenses Under The New Tax Law Businesswest

Can I Deduct Unreimbursed Job Expenses The Official Blog Of Taxslayer

Can I Deduct Unreimbursed Job Expenses The Official Blog Of Taxslayer

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

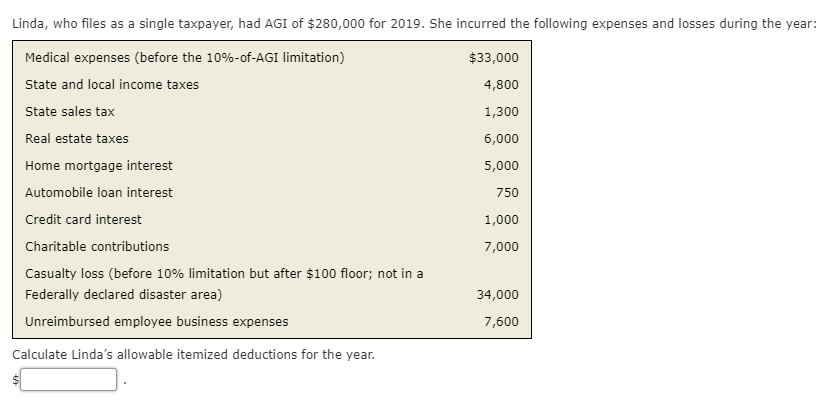

Solved Linda Who Files As A Single Taxpayer Had Agi Of Chegg Com

Solved Linda Who Files As A Single Taxpayer Had Agi Of Chegg Com

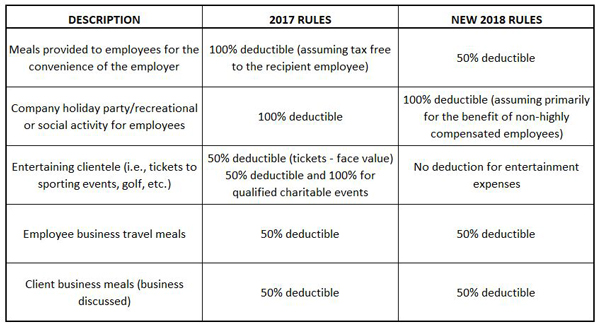

Reduced Tax Benefits For Meals Entertainment In 2018 Kruggel Lawton Cpas

Reduced Tax Benefits For Meals Entertainment In 2018 Kruggel Lawton Cpas

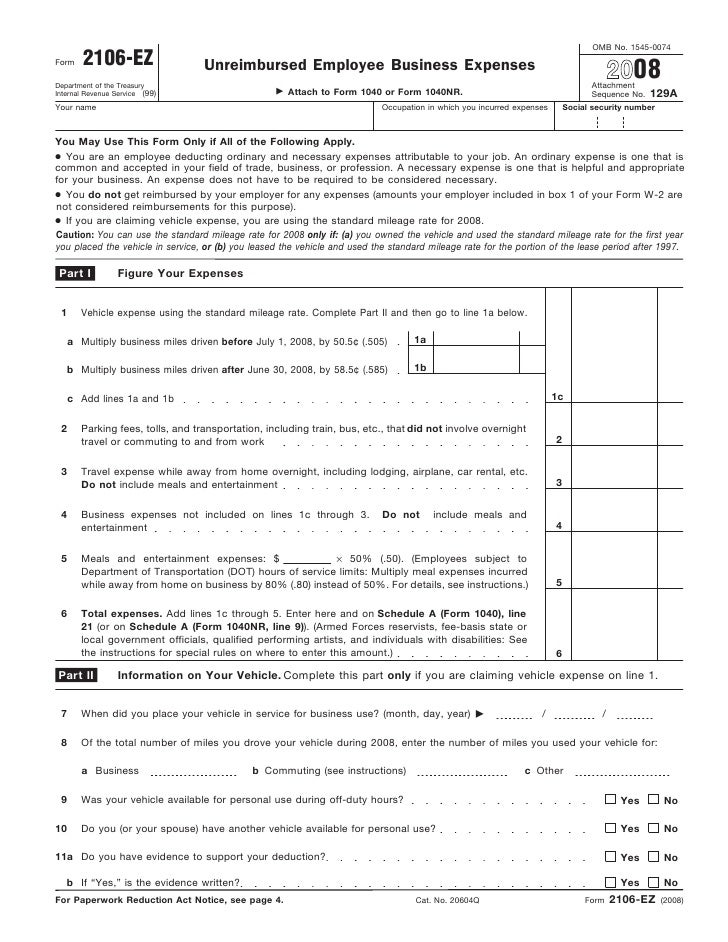

Form 2106ez Unreimbursed Employee Business Expenses

Form 2106ez Unreimbursed Employee Business Expenses

Https Www House Leg State Mn Us Hrd Bs 91 Hf1122 Pdf

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet