Small Business Loan Covid 19 Government Of Canada

Up to 1 million The guarantee covers amounts ranging from 25000 to 1 million to ensure a degree of continuity for your business through the pandemic. Small businesses continue to face challenges and uncertainty during the COVID-19 pandemic and the government is providing support to ensure they can stay in business.

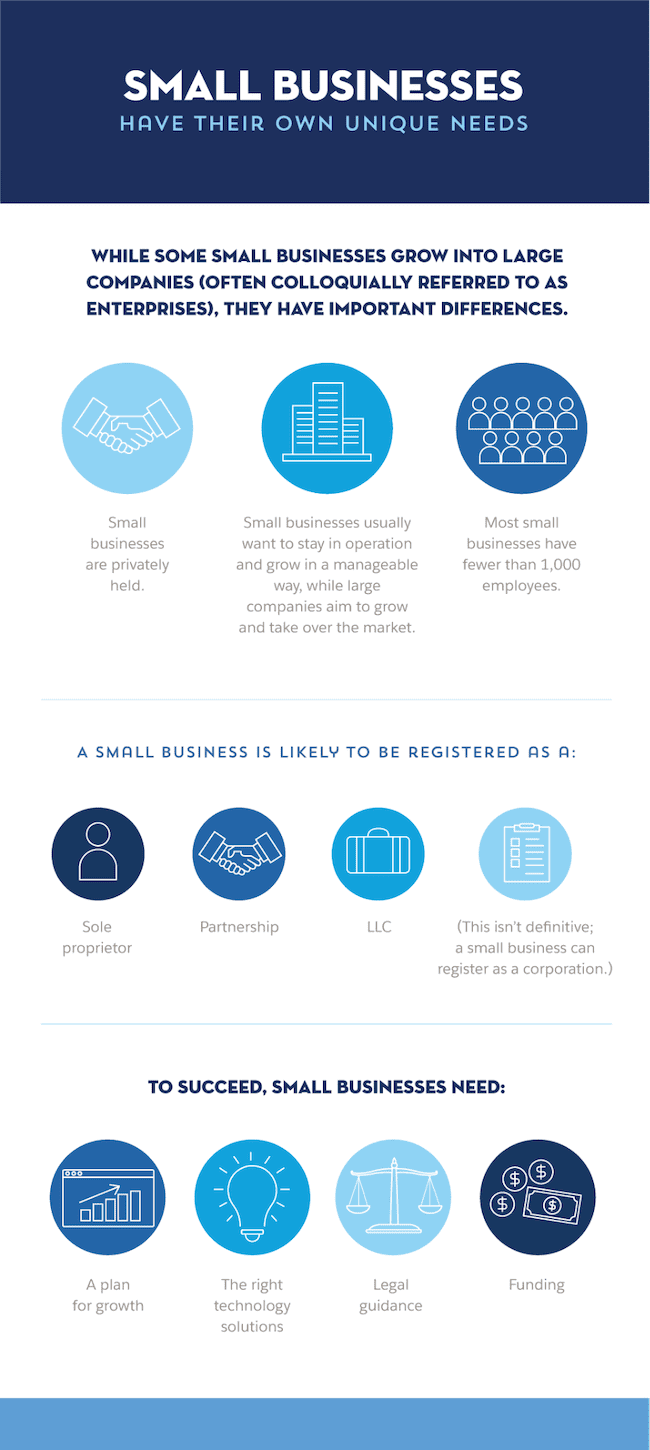

Small Business Definition What Is A Small Business Salesforce Com

Small Business Definition What Is A Small Business Salesforce Com

The Government of Canada is providing 3068 million to Aboriginal Financial Institutions to provide interest-free loans and non-repayable contributions to help small and medium-sized Indigenous businesses unable to access the governments existing COVID-19 support measures Indigenous-owned businesses httpspmgccaennewsnews-.

Small business loan covid 19 government of canada. December 4 2020 - Ottawa Ontario - Department of Finance Canada. These loans are for small and medium-sized businesses that have seen their revenues decrease by 50 or more as a result of COVID-19. CERS Canada Emergency Rent Subsidy Open Rent and mortgage support for qualifying organizations affected by COVID19.

The Canada Emergency Business Account CEBA provides interest-free partially forgivable loans of up to 60000 to small businesses and not-for-profits that have experienced diminished revenues due to COVID-19 but face ongoing non-deferrable costs such as rent utilities insurance taxes and wages. Businesses can qualify for loans up to 40000 to help cover operating costs. SBA has issued special guidance for federal small business contractors impacted by COVID-19.

The CSBFP is committed to its service standards. Canada Emergency Business Account CEBA Up to 60000 interest-free loans for small businesses and not-for profits with a 2019 payroll between 20000 and 15 million available through most financial institutions extended. The Government of Canada is making additional investments to support Canadian businesses from the economic impacts of COVID-19.

75 to 80 of the loan guaranteed by the Federal Government through the EDC dependent on financing amount. A one-stop resource operated by Small Business BC SBBC for businesses with questions about the supports available from governments and organizations. SBBC advisors are available Monday to Friday from 900 am.

Check out the interactive business benefits finder at innovationcanadaca. The federal government has unveiled a new loan program aimed at helping businesses survive COVID-19 with up to 1 million in funding for eligible. The EDC BCAP includes.

These new investments provide support to financial institutions and allow them to quickly provide credit and liquidity options for a range of businesses. Support and loans Small Business Loan. Business COVID-19 Support Service.

Canada Emergency Business Account for small businesses. For more information on other government programs and services. The minimum and maximum annual payroll required to access a CERB loan was recently changed to a minimum of 20000 from 50000 and maximum of.

Financing you can use to. Export Development Canadas Business Credit Availability Program BCAP offers eligible customers with credit financing to help sustain operations impacted by COVID-19. Open Interestfree loans for small businesses and notforprofits.

By phone email and live chat. An operating credit of up to CAD 80 million. Since the spring the Canada Emergency Business Account has helped almost 800000 small businesses and not-for-profits in.

26 2021 Canadas Minister of Small Business Export Promotion and International Trade announced a new government loan guarantee program targeting businesses most affected by the COVID-19 pandemic. Support is available in several languages. March 27 2020 Businesses will be able to access interest free loan of 40000 through their financial institutions and 25 of the loan up to 10000 will be eligible for forgiveness.

Our Small Business Loan is designed to help you quickly and easily access the funds you need with flexible terms you can afford. Canada Emergency Business Account CEBA interest-free loans. The Canada Emergency Business Account CEBA was created to help small businesses who are financially struggling because of COVID-19.

214 Calgary small business owners react to COVID-19 relief grant Alberta is expanding a program to provide financial support to small and medium-sized businesses affected by. The Highly Affected Sectors Credit Availability Program HASCAP first introduced in the federal governments 2020 Fall Economic Statement will involve the Business. Purchase equipment software or hardware without using cash you need for everyday activities.

Check out the resources to help manage your business during COVID-19. If a situation occurs that will prevent small businesses with government contracts from successfully performing their contract they should reach out to their contracting officer and seek to obtain extensions before they receive cure notices or threats of termination. HASCAP Highly Affected Sectors Credit Availability Program Open Low-interest loans to cover operational needs for hardhit businesses.

The CEBA loan has supported over 774000 Canadian small businesses and not-for-profits and with this change an even greater number of small business owners will be able to access this important financial lifeline. You can apply for a CEBA loan through the financial institution where your primary Business Operating Account is held. Small business owners are resilient and our government will continue to be there to help them.

8 Options For Small Business Startup Loans Nav

8 Options For Small Business Startup Loans Nav

Sba Economic Injury Disaster Loans Loan Advance Program Nic North American Interfraternity Conference

Sba Economic Injury Disaster Loans Loan Advance Program Nic North American Interfraternity Conference

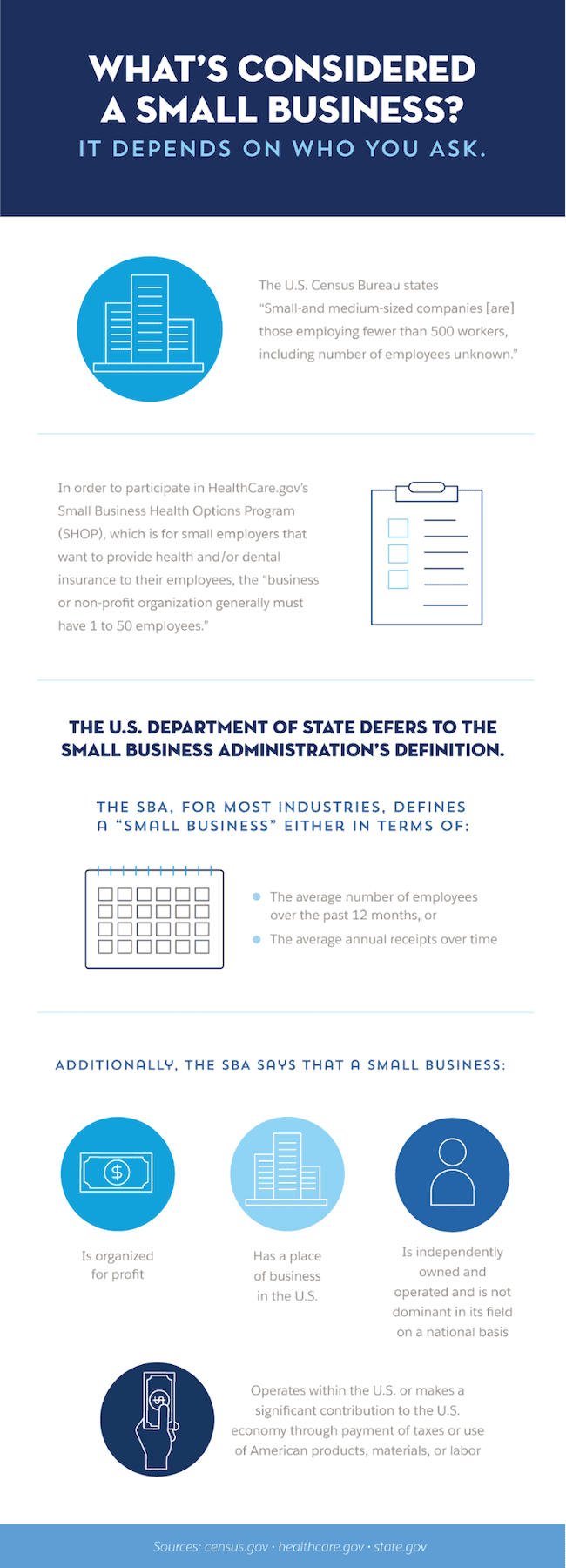

Small Business Definition What Is A Small Business Salesforce Com

Small Business Definition What Is A Small Business Salesforce Com

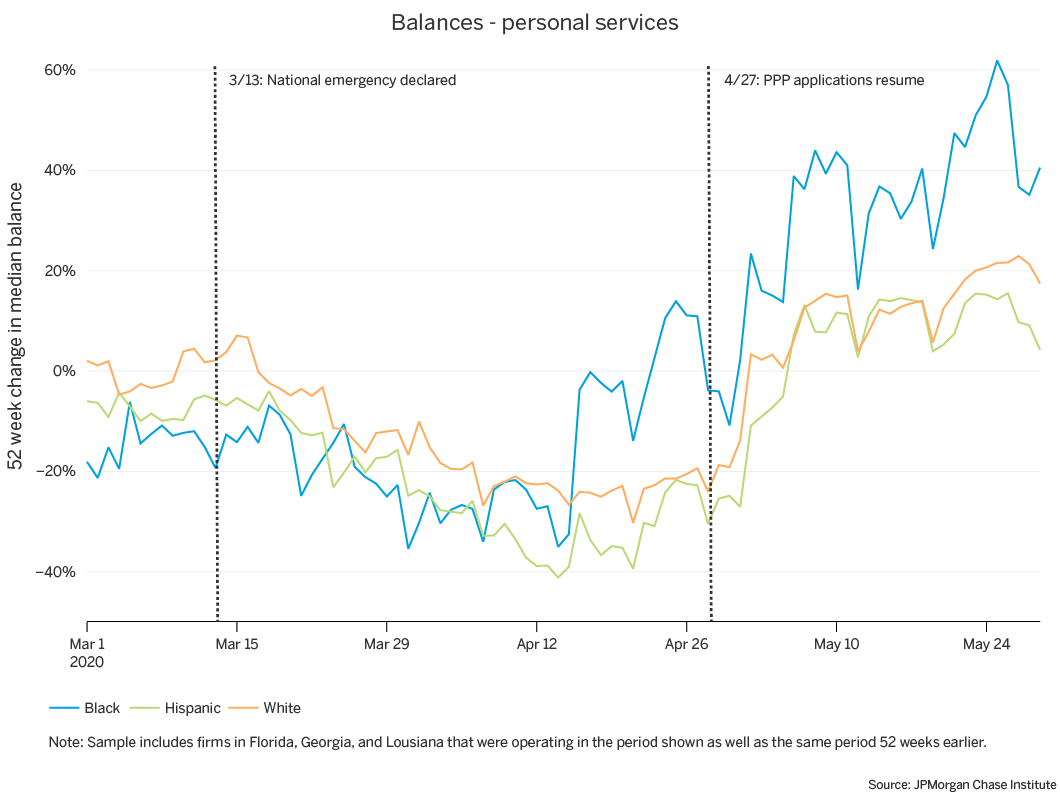

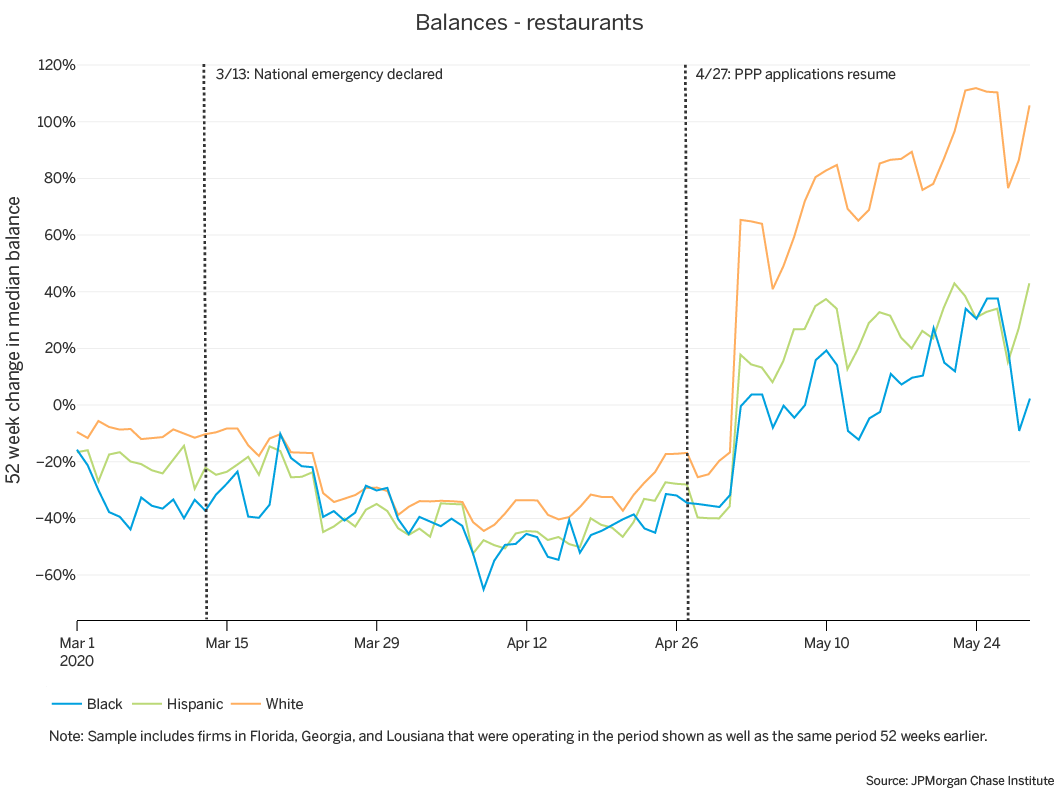

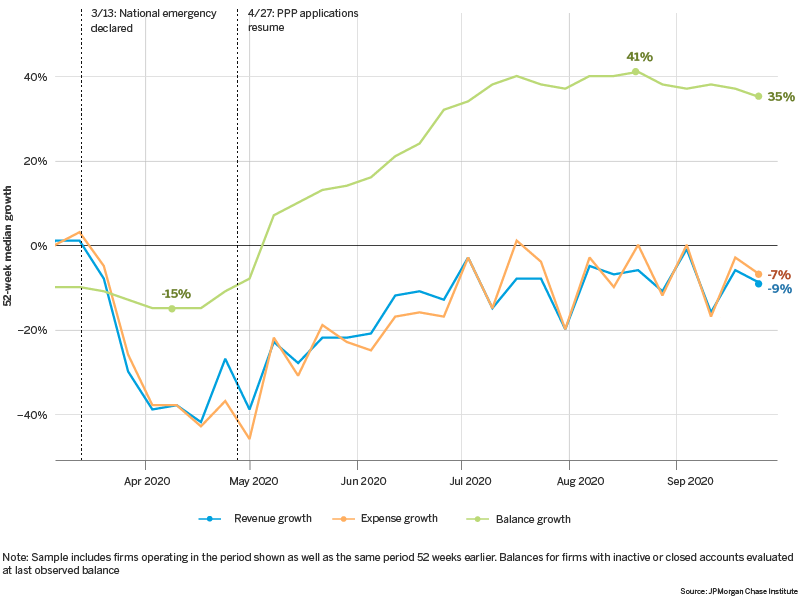

Small Business Financial Outcomes During The Covid 19 Pandemic

Small Business Financial Outcomes During The Covid 19 Pandemic

Sf Office Of Small Business Sfosb Twitter

Sf Office Of Small Business Sfosb Twitter

29 Of Small Businesses Say They Will Start Using A Website In 2020 Revealing How Many Businesses Have Yet To Maximize Their Online Presence

29 Of Small Businesses Say They Will Start Using A Website In 2020 Revealing How Many Businesses Have Yet To Maximize Their Online Presence

Canada United Small Business Relief Fund Occ

Canada United Small Business Relief Fund Occ

29 Of Small Businesses Say They Will Start Using A Website In 2020 Revealing How Many Businesses Have Yet To Maximize Their Online Presence

29 Of Small Businesses Say They Will Start Using A Website In 2020 Revealing How Many Businesses Have Yet To Maximize Their Online Presence

Small Businesses Now Have Until April 7 To Apply For Ontario Small Business Support Grant Kawarthanow

Small Businesses Now Have Until April 7 To Apply For Ontario Small Business Support Grant Kawarthanow

Small Business Grants Through Salesforce Care

Small Business Grants Through Salesforce Care

How To Pay Off A Small Business Loan Fora Financial Blog

How To Pay Off A Small Business Loan Fora Financial Blog

Small Business Financial Outcomes During The Covid 19 Pandemic

Small Business Financial Outcomes During The Covid 19 Pandemic

Small Business Definition What Is A Small Business Salesforce Com

Small Business Definition What Is A Small Business Salesforce Com

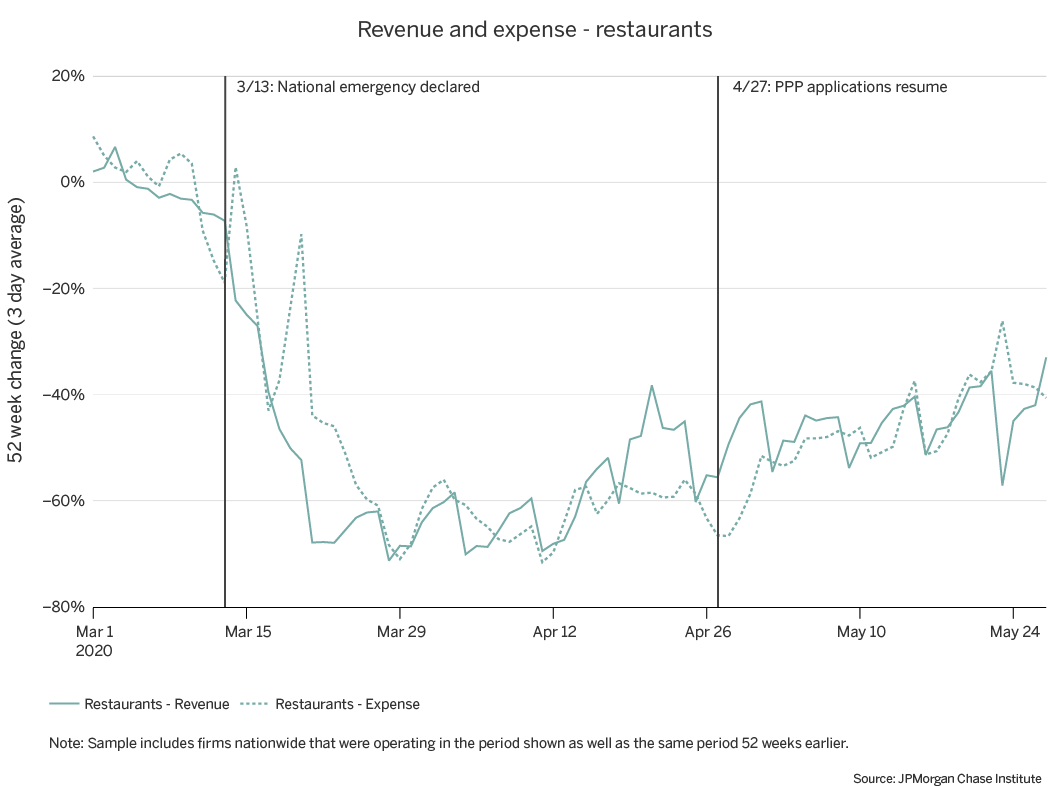

Small Business Expenses During Covid 19

Small Business Expenses During Covid 19

Small Business Financial Outcomes During The Covid 19 Pandemic

Small Business Financial Outcomes During The Covid 19 Pandemic

Small Business Definition What Is A Small Business Salesforce Com

Small Business Definition What Is A Small Business Salesforce Com

Sba To Provide Small Businesses Impacted By Coronavirus Covid 19 Up To 2 Million In Disaster Assistance Loans

Sba To Provide Small Businesses Impacted By Coronavirus Covid 19 Up To 2 Million In Disaster Assistance Loans