How To Make W2 For Church Employees

Yes you can create a W-2 form for your employees online. Select the appropriate tax exemptions.

The Pastor is not the only employee of a Church.

How to make w2 for church employees. Select Save and close. Each local church or charge should have its own Employer Identification Number EIN. Consult IRS website if.

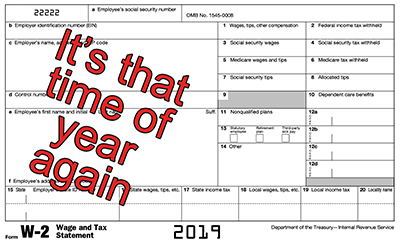

To insure you have it in time the IRS requires your church to send you a W-2 no later than January 31 following. Box A Control Number does not have to be completed. Often times better benefits will make employees accept a slightly lower salary.

Therefore an employee of an exempt church pays 124 of their income for Social Security. E If the employee including ministers made tax-deferred salary reduction contributions to a 403b retirement plan enter E and that amount. There are many instances in which an EIN is necessary.

QuickBooks Online Payroll Enhanced. Paid musicians paid Praise and Worship Leaders and anyone else who works on the inside of the Church and paid by the Church must receive a W-2. Start Filing 1099 W-2 Forms Online W-2 and 1099 Filing Every church that pays remuneration for services performed by an employee must file a Form W-2 for each non-clergy and clergy employee.

Treated as an employee rather than an independent contractor see Resource 1. Churches need to report each employees taxable income and withheld income taxes as well as Social Security and Medicare taxes on Form W-2 and furnish copies B C and 2 of the 2020 Form W-2 to each employee by February 1 2021. While churches dont pay taxes that doesnt mean employees get a free ride from Uncle Sam.

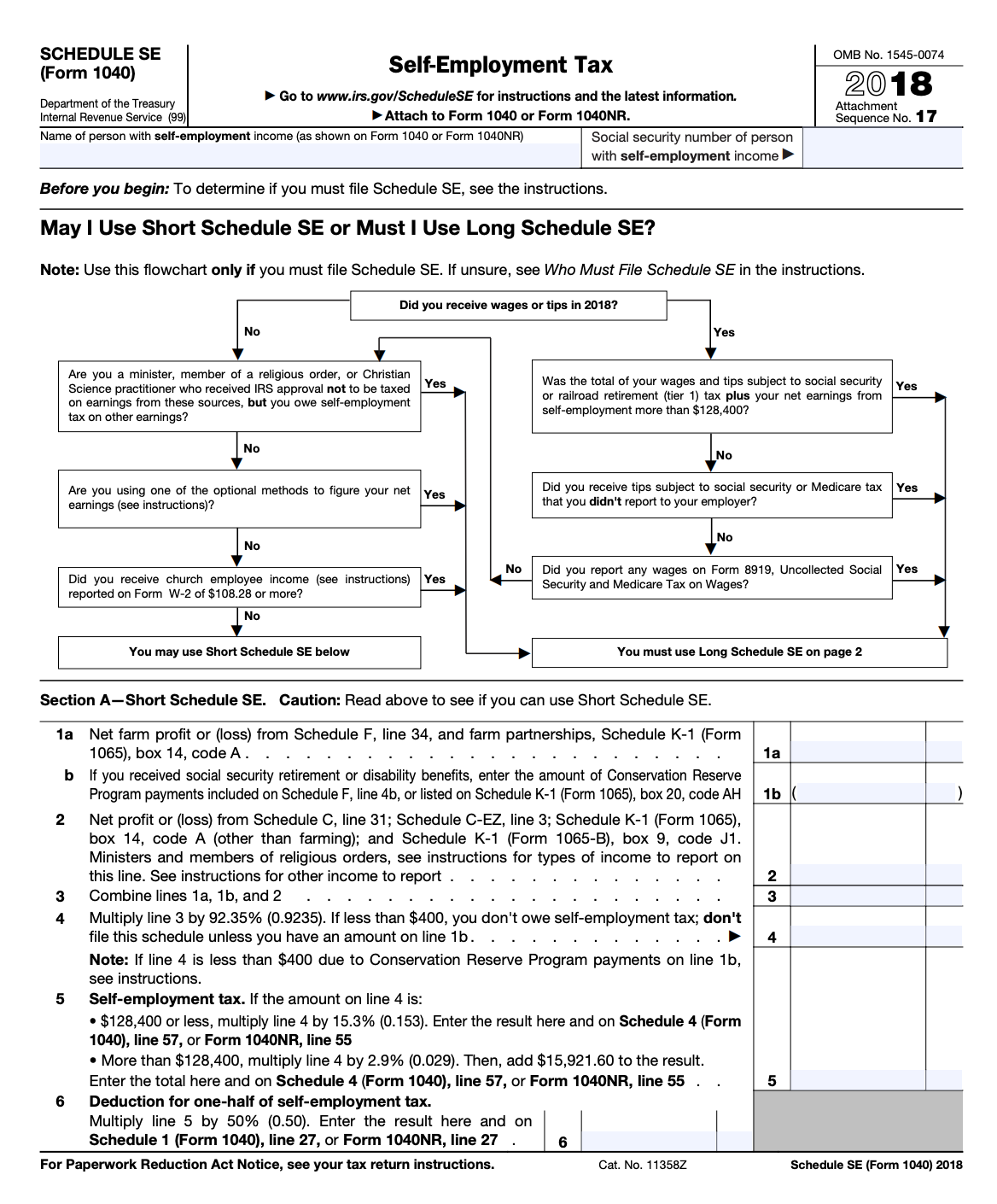

However the employee unless otherwise exempt will be subject to self-employment tax on the income. As a non-clergy or clergy employee the information on your W-2 is extremely important when preparing your tax return. Your W-2 also reports the amount of your housing federal and state withholdings.

In the Taxes and Exemptions box select Edit. In the Exemptions section select Edit. The total FICA tax for an employee of an exempt church is 153 of their income.

For most churches the mere thought of year-end reporting can cause headaches. The IRS requires churches to report wage and salary information for employees on Form W-2. Whether youre a pastor choir director youth minister or any other paid church employee you.

Copy A should be submitted to the Social Security Administration SSA by February 1 2021 along with Form W-3 Transmittal of Wage and Tax. For example a church needs an EIN when it opens a bank account to be listed as a subordinate in a group ruling or if it files returns with the IRS for example Forms W-2 1099 990-T. Notify the contractor in writing of the immediate need to convert him to an employee.

Other box 12 entries may sometimes be needed but are not common to most church employee W-2 forms. More specific instructions on completing Form W-2 are available at the IRS website wwwirsgov. The current rate for Medicare is 145 each for the employer and employee so exempt church employees pay 29.

Select the employees name. Tification number whether or not the organization has any employees. Dont forget when preparing your W-2 forms that income is reported in the year it is paidnot when it is earned.

Our W-2 generator is perfect for this as well guide you through the steps to make sure you dont miss anything. If you are one of these stop that practice. Before you start preparing your W-2 forms verify with the Social Security Administration that each employees name matches the social security number you have on file for them at Social Security Number Verification Service SSNVS 2.

For instance offering vacation time doesnt cost your church as much as a regular salary as your staff can come together to cover another employees position for a few days or a week. Identify all contractors who worked for you that will receive a 1099 at the end of the tax year and need to be converted to a W-2 under the same guidelines. Employer Identification Numbers can be obtained.

Many Churches are attempting to find loopholes to misclassify employees to avoid withholding taxes and FICA. For non-ministers it is included in Box 3. Effect on Employees If a church or qualified church-controlled organization has made an election payment for services performed for that church or organization other than in an unrelated trade or business will not be subject to FICA taxes.

After answering a few questions youll only need to download print and file filled copy of the form by mail. This amount is not included in Box 1. How Are The Taxes Paid.

Box B is the Employer Identification Number. Select the employees name.

Help For Churches Filing W 2 Forms South Carolina United Methodist Conference

Help For Churches Filing W 2 Forms South Carolina United Methodist Conference

W 2 Filing For Clergy And Church Employees Alliance Benefits

20 Work From Home Jobs That Offer W2 Employment Work From Home Jobs Working From Home Home Jobs

20 Work From Home Jobs That Offer W2 Employment Work From Home Jobs Working From Home Home Jobs

W 2 Filing For Clergy And Church Employees Alliance Benefits

W 2 Filing For Clergy And Church Employees Alliance Benefits

Employee Vs Independent Contractor Us The Network

Employee Vs Independent Contractor Us The Network

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

What Is A W 3 Form And How Do I File It Gusto

What Is A W 3 Form And How Do I File It Gusto

Complete Guide To Print W2 Forms In Quickbooks Online Payroll Quickbooks Online Quickbooks Payroll

Complete Guide To Print W2 Forms In Quickbooks Online Payroll Quickbooks Online Quickbooks Payroll

File W 2 W2c And 1099 Forms For Churches

File W 2 W2c And 1099 Forms For Churches

How To Prepare W 2s For Church Employees Including Ministers Church Law Tax

How To Prepare W 2s For Church Employees Including Ministers Church Law Tax

Churches Need Help Filing W 2 Forms South Carolina United Methodist Conference

Churches Need Help Filing W 2 Forms South Carolina United Methodist Conference

Filing A Form W 2 For A Church

Filing A Form W 2 For A Church

Pin On Pay Stubs For The Business

Pin On Pay Stubs For The Business

We Make One Customized Paycheck Stub Any Fast Food Restaurant Of Your Choice With Logo We Will Need The Following Information Payroll Checks Paycheck Payroll

We Make One Customized Paycheck Stub Any Fast Food Restaurant Of Your Choice With Logo We Will Need The Following Information Payroll Checks Paycheck Payroll

This Is The True Recipe To Success You Need A Plan Of Action With Goal Driven Dreams We Are Currently Hiring Accoun Motivation Inspiration How To Plan Words

This Is The True Recipe To Success You Need A Plan Of Action With Goal Driven Dreams We Are Currently Hiring Accoun Motivation Inspiration How To Plan Words

Churches Need Help Filing W 2 Forms South Carolina United Methodist Conference

Churches Need Help Filing W 2 Forms South Carolina United Methodist Conference