Do I Have To Pay Taxes On Paypal Business Account

If the IRS audits you and thinks you are committing fraud they may ask for both your PayPal and bank account records. All business owners pay taxes.

How To Update Your Paypal Settings Timely

It is not wrong for the PayPal to generate the form.

Do i have to pay taxes on paypal business account. Visit our PayPal Average Sales Tax Rates chart page and enter the average rate for that state - If you do this youll need to use a tool like TaxJars Expected Sales Tax Due report to ensure you are remitting the right amount of sales tax to the state. Only those customers that meet the 1099-K eligibility requirements will see the 1099-K available for download in their account. PayPal business accounts allow you to integrate your payment systems with their payout system to create a seamless accounting system you can use to easily monitor sales and profits as well as expenses.

Actually you can have more than one Business Account assuming you have your businesses registered they each have their own emails bank accounts and credit cards. The IRS has a threshold for the third party platform to issue but there is no regulation to prevent the platform to issue below that threshold. For Small-to-Medium Business However you do business PayPal fits.

If you use this option the IRS will receive your tax payment right away. Business 2018 sales tax filing dates. However you can claim legitimate business expenses.

If you buy stuff and then resell you are running abusiness and you need to complete IRS form1040C to determine your profit or loss and then report that on 1040. Favorite Answer The type of paypal acct you have doesnt affect whether your sales are taxable or not. Many people especially those shopping online prefer to pay using PayPal.

PayPal did not do wrong. Keep in mind that we provide an average rate so once in awhile one of your customers may be charged more sales tax than they are. But a bit of research by you and your accounting professionals can help you avoid paying more in tax than you absolutely have to.

If youre just selling your old stuff for less than you paid for them you dont owe tax. Filing your taxes has nothing to do with a 1099-K from PayPal. PayPal does not withhold taxes.

Internal Revenue Code IRC Section 6050W states that all US payment processors including PayPal are required by the Internal Revenue Service IRS to provide information to the IRS about certain customers who receive payments for the sale of goods or services through PayPal. Everything starts with your Business account Join over 28 million. You are responsible for filing your accurate income with the IRS using 1040 form and all neccessary supporting forms.

You have to pay tax on all your earnings. Your customers can pay the way they want quickly and easily. Opening a separate PayPal business account will make it easier to calculate profits and expenses when it comes time to file taxes.

If you cross the IRS thresholds in a given calendar year PayPal will send Form 1099-K to you and the IRS for that tax year the following year. Customer support wont answer any questions or propose a resolution. You can access your 1099-K from your PayPal account by January 31st annually.

So you can have a business account without registering a business name but if you want real business name then you would need to register the name or the business. In a physical storefront or even on-the-go. Using a PayPal business account you can accept online payment via PayPal as well as in your store or business office through a mobile card reader and by phone.

Grow on an all-in-one platform. Payment made from a US based PayPal account 5 of the transaction total a fixed fee based on the currency used Payment made from a PayPal account based outside of the US 65 of the transaction total a fixed fee based on the currency used. Yes you have to report any income received on your tax returns to the IRS through PayPal.

I also cant pay my 50 employees as todays payday and all of my savings are stuck for 6 months. With your Business account you get an entire commerce platform. In this case the charges are as follows.

PayPal is required to report gross payments received for sellers who receive over 20000 in gross payment volume AND over 200 separate payments. As you are operating a business just go through the appropriate steps in your state to regsiter to collect sales tax. Yes qualifying US.

Over a million in revenue no disputes at all for a month 10 years of business woke up today to having my Paypal banned. You do have the option to keep your Personal Account and also open either a Business Account or a Premier Account as PayPal does allow users to have 2 Accounts.

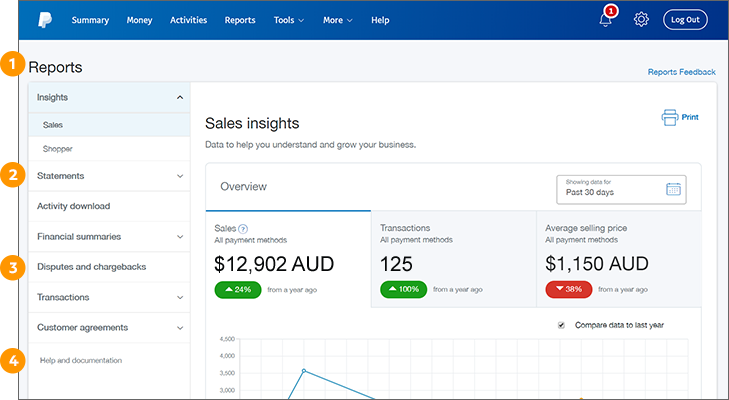

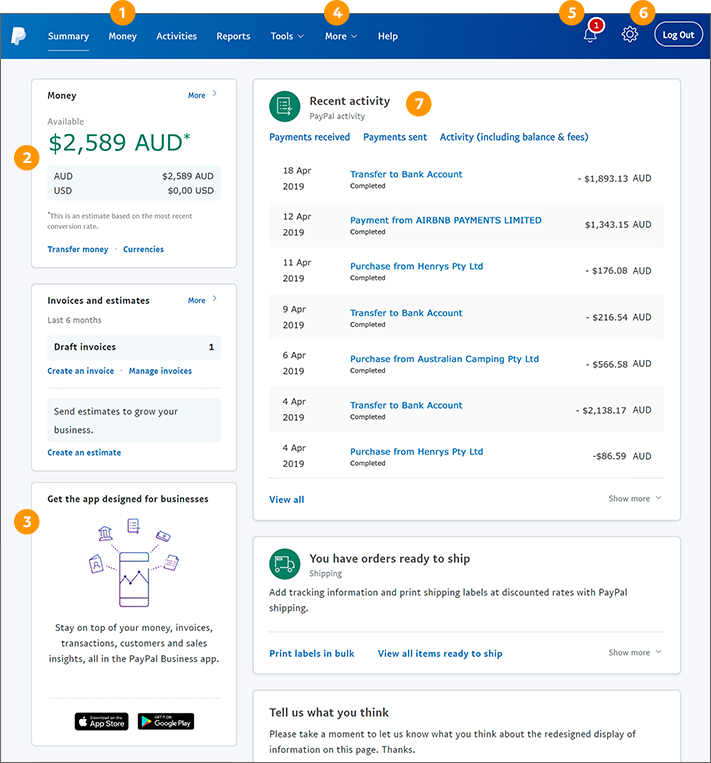

Get To Know Your Paypal Account Paypal Australia

Get To Know Your Paypal Account Paypal Australia

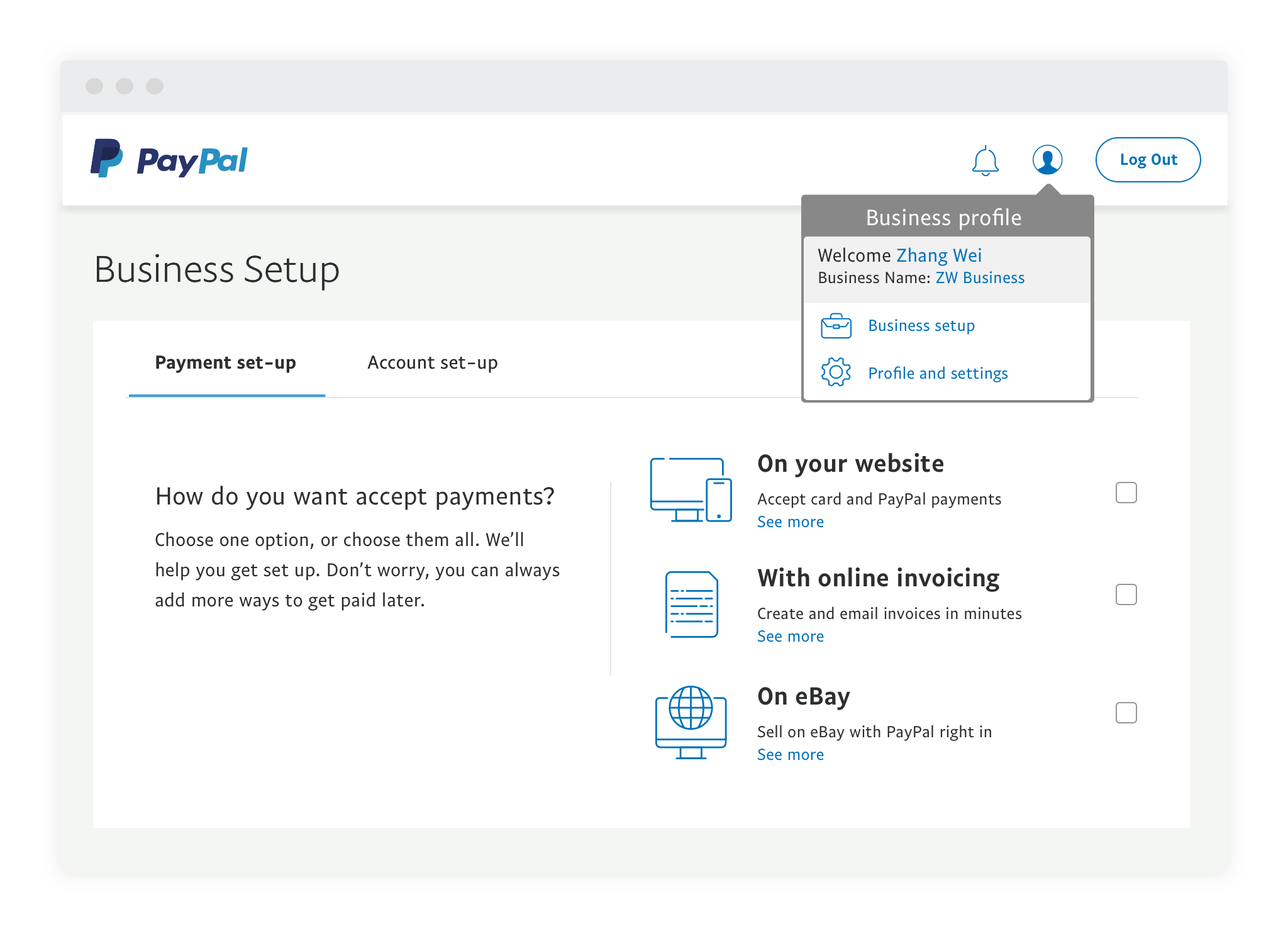

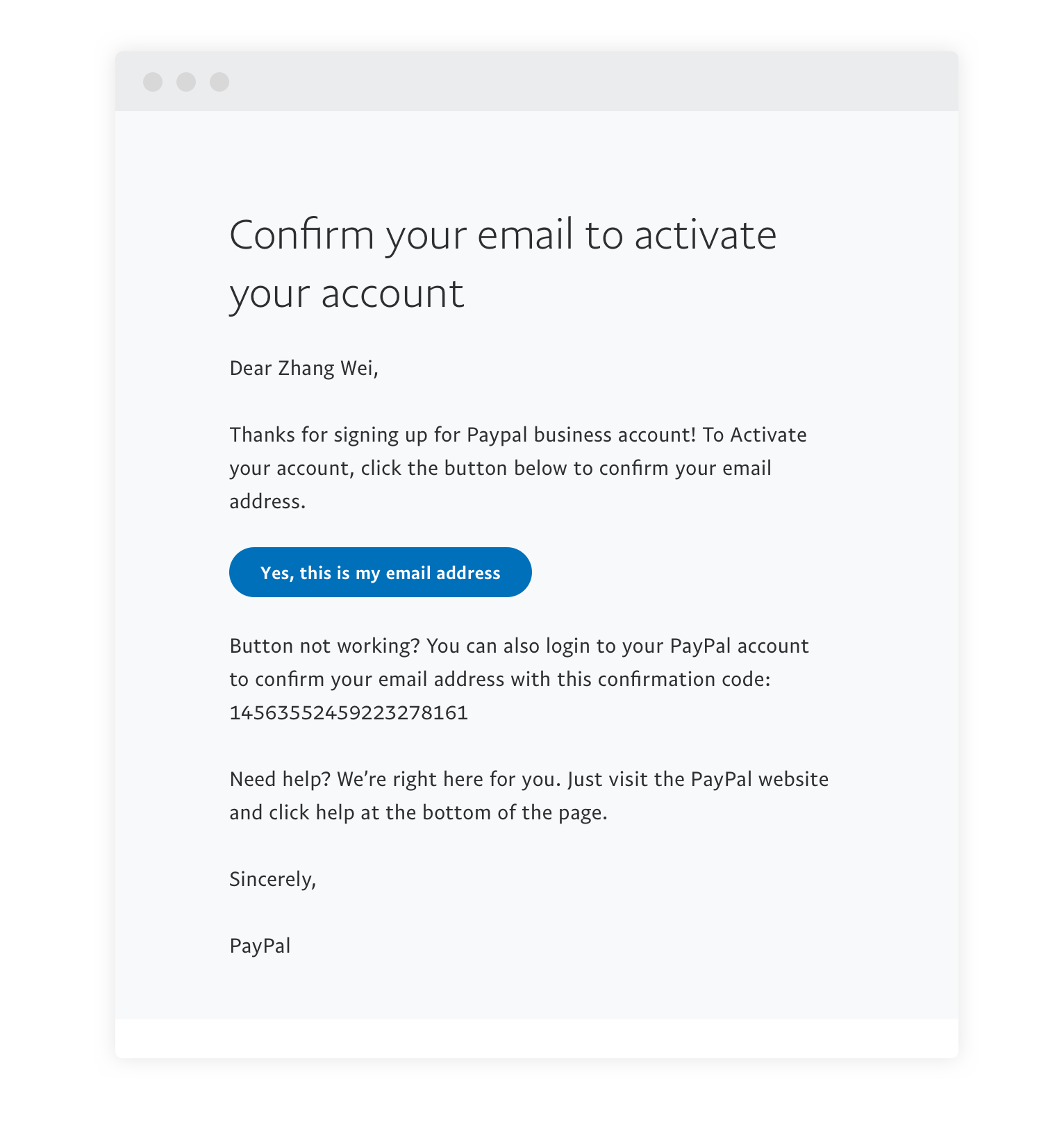

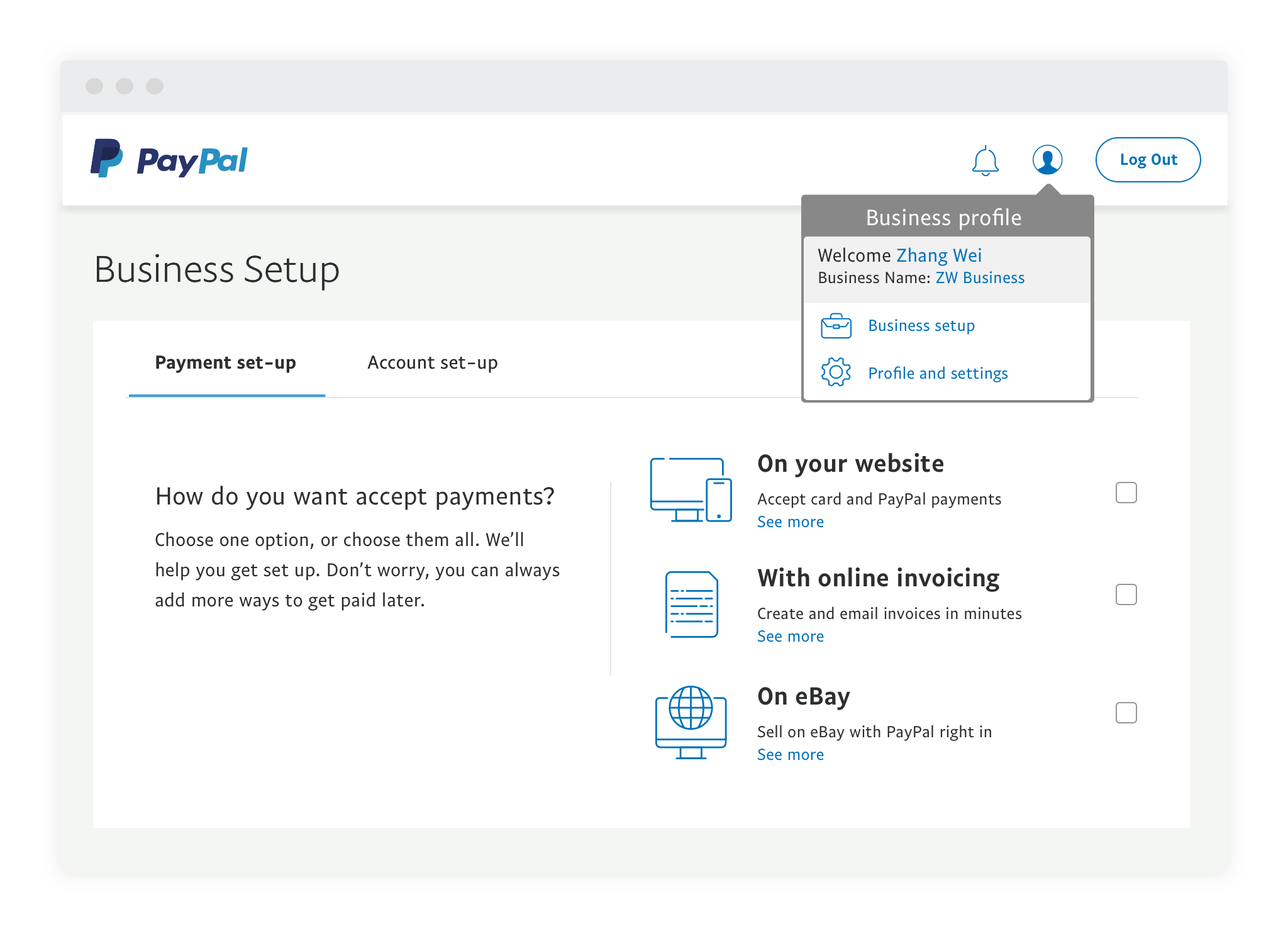

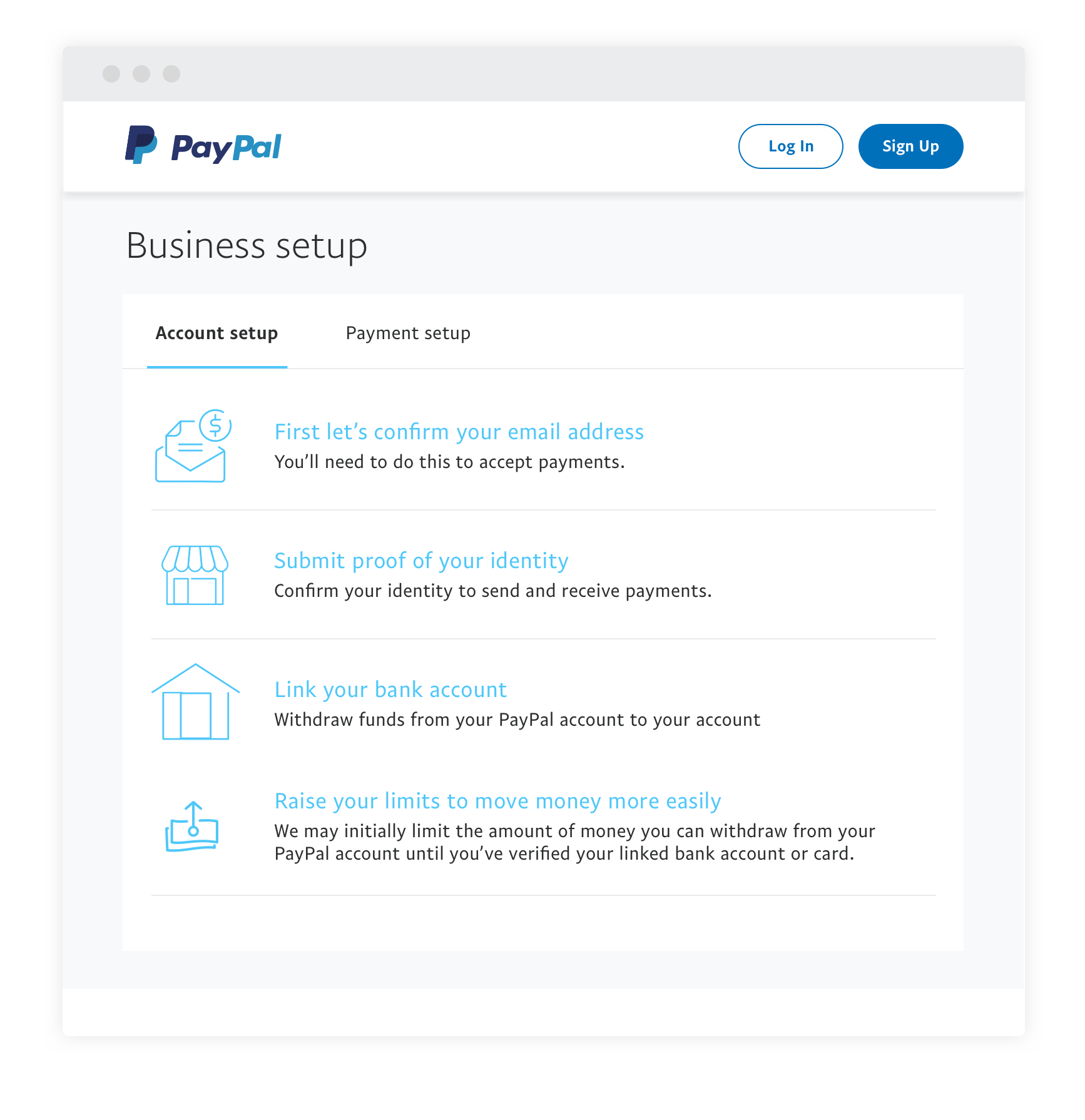

How To Activate Your Business Account Paypal

How To Activate Your Business Account Paypal

Which Paypal Account Is Best For You Jean Galea

Which Paypal Account Is Best For You Jean Galea

Paypal Invoicing Everything You Need To Know In 2019 Zipbooks

Should I Have A Paypal Business Account Legalzoom Com

Should I Have A Paypal Business Account Legalzoom Com

How To Activate Your Business Account Paypal

How To Activate Your Business Account Paypal

How To Change Paypal From Business To Personal 7 Steps With Screenshot Tik Tok Tips

How To Change Paypal From Business To Personal 7 Steps With Screenshot Tik Tok Tips

Get To Know Your Paypal Account Paypal Australia

Get To Know Your Paypal Account Paypal Australia

How To Activate Your Business Account Paypal

How To Activate Your Business Account Paypal

Can I Have A Paypal Business Account Without A Business Quora

Paypal Checkout Woocommerce Docs

Paypal Checkout Woocommerce Docs

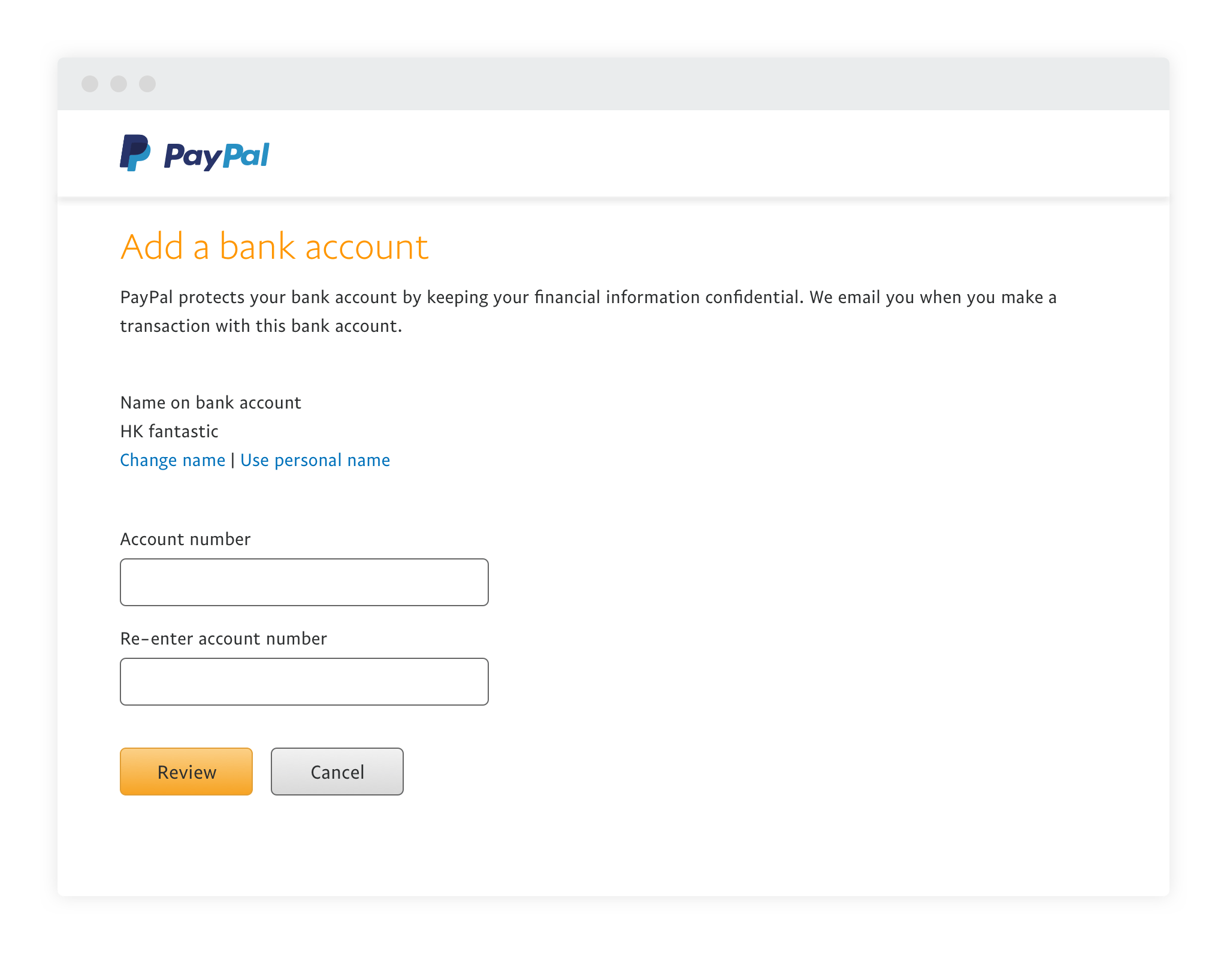

How To Sign Up For A Business Account Paypal

How To Sign Up For A Business Account Paypal

![]() Do You Have To Report Paypal Income To Irs Mybanktracker

Do You Have To Report Paypal Income To Irs Mybanktracker

How To Update Your Paypal Settings Timely

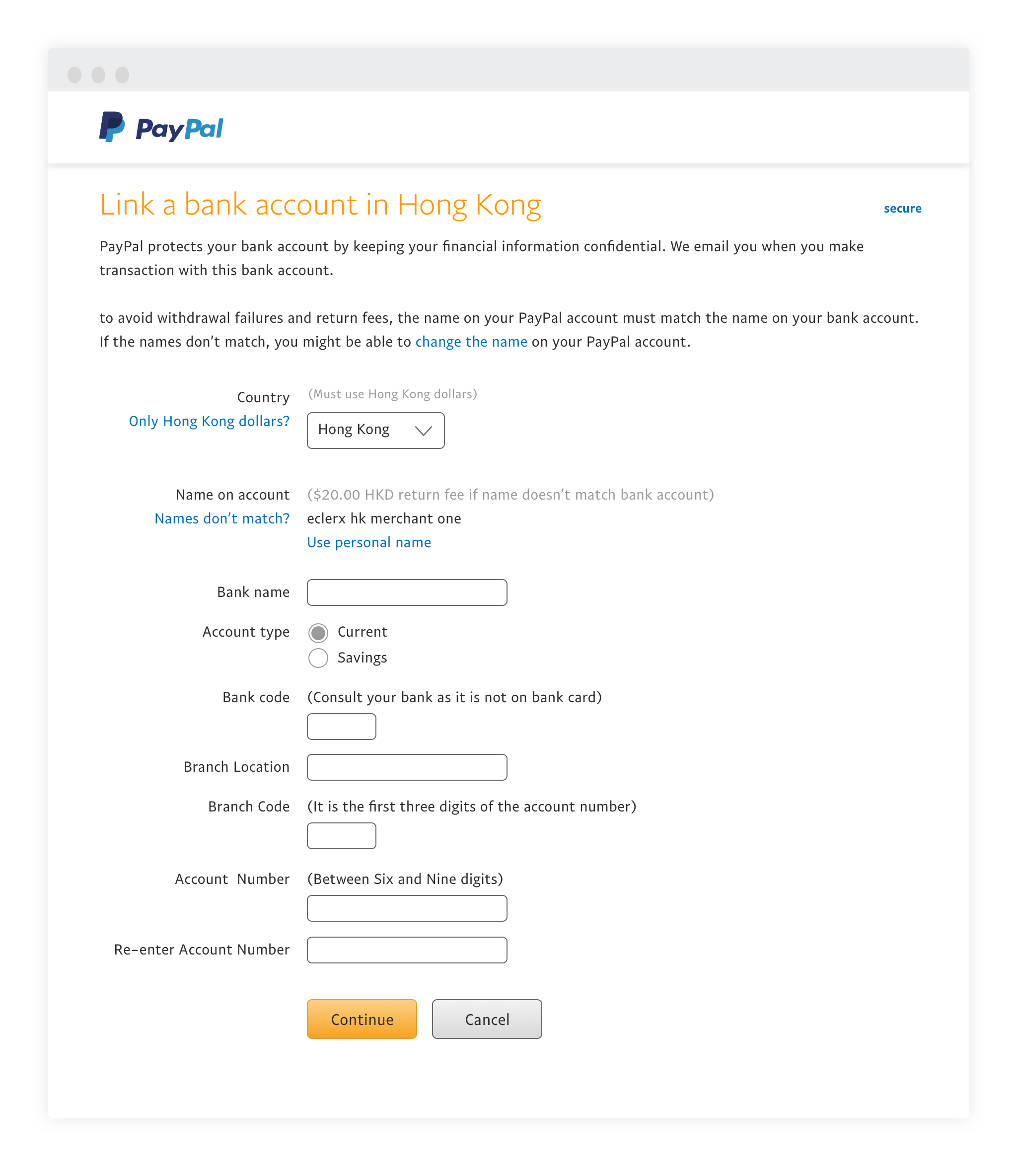

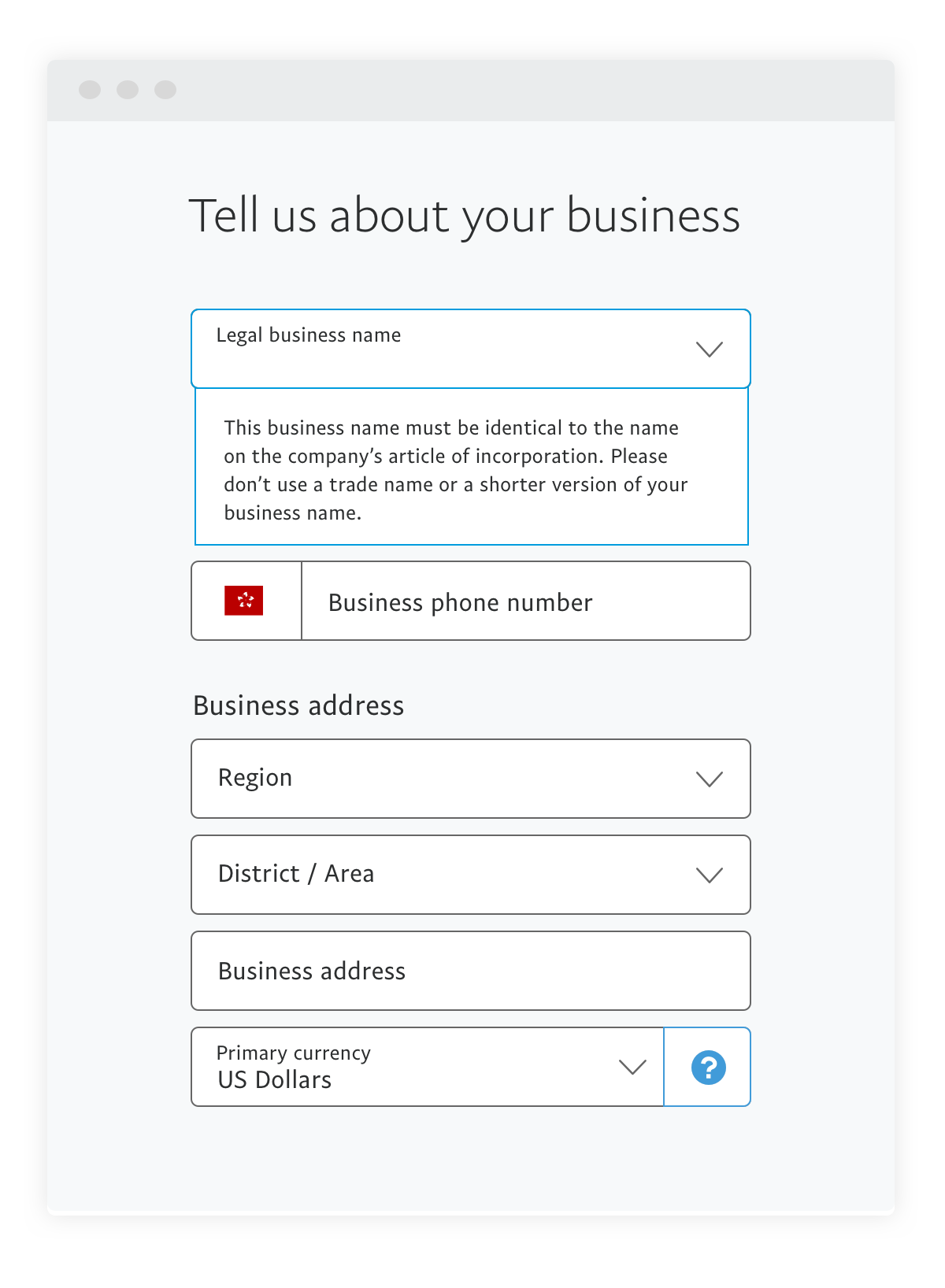

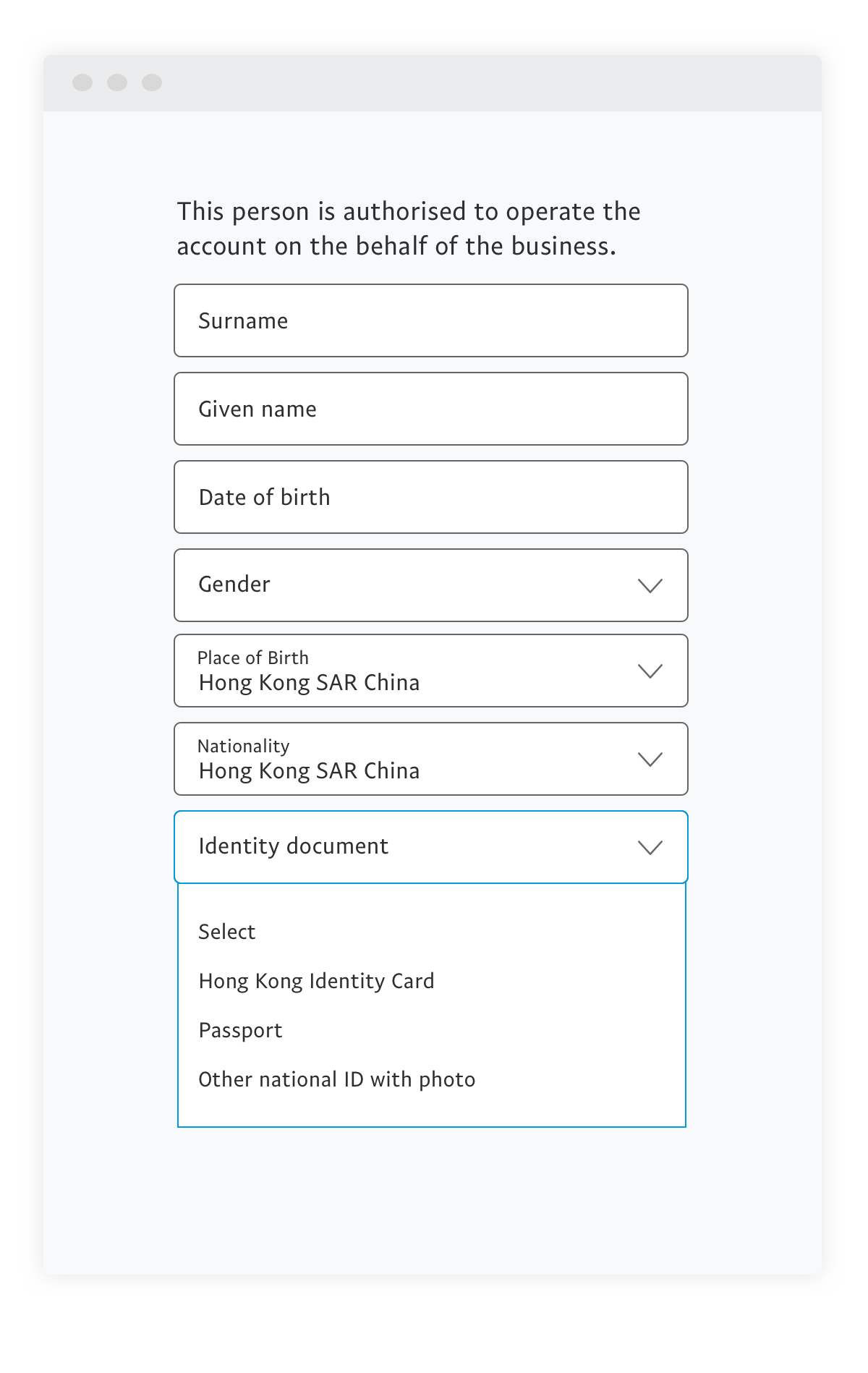

How To Sign Up For A Business Account Paypal Philippines

How To Sign Up For A Business Account Paypal Philippines

How To Sign Up For A Business Account Paypal

How To Sign Up For A Business Account Paypal

How To Activate Your Business Account Paypal

How To Activate Your Business Account Paypal

How To Sign Up For A Business Account Paypal

How To Sign Up For A Business Account Paypal

4 Ways To Accept Payments On Paypal Wikihow

4 Ways To Accept Payments On Paypal Wikihow