Best Business Type For Partnership

Return of Partnership Income PDF PDF. Risks and rewards are generally shared proportionately to ownership.

Comparison Chart Of Business Entities Startingyourbusiness Com Business Sole Proprietorship Comparison

Comparison Chart Of Business Entities Startingyourbusiness Com Business Sole Proprietorship Comparison

Flexibility most types of partnerships are easy to form manage and run especially if you use my recommended vendor LegalZoom for your partnership formation save 10 with our exclusive promo code BEST4B19.

Best business type for partnership. Limited liability partnerships LLP have much more in common with limited liability companies LLC than they do other types of business partnerships. Multiple individuals who start a business are automatically classed as a general partnership unless they opt for a limited partnership format which does require some paperwork. When one partner leaves the business it is dissolved unless there is.

They are less strict and much less regulated than corporations and other types of business structures. They have invested in the business but they dont participate on a day-to-day basis in the. The sole proprietorship and the partnership are the most straightforward business organization types.

No special business record-keeping or registration is required. However if the second spouse has an equal say in the affairs of the business provides substantially equal services to the business and contributes capital to the business then a partnership type of relationship exists and the businesss income should be reported on Form 1065 US. Types of businesses that typically form LLC partnerships.

For this option there is no legal distinction between the business and the owner. Limited partners are passive. Companies whose owners want liability protection from the business while still being involved in the day-to-day management and operations.

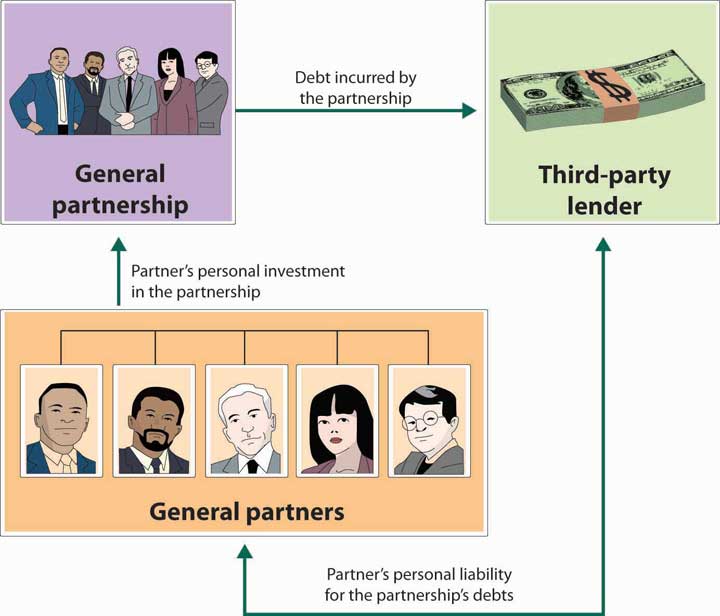

A sole proprietorship is a type of business entity thats run and owned by a single person. Two Types of Partners General partners are active in the business doing the work of the company being CPAs for example but also. Lastly a partnership is a joining of individuals in which the partners share profits or losses.

Since LLC partnerships can be formed by most types of businesses theyre generally a good fit for most people. With an LLP partners will receive the same beneficial taxation provided by a general partnership and will also be. Limited liability partnership LLP.

Business organization attorneys often recommend forming an LLC and then elect S-corporation status to maximize tax benefits. Businesses with multiple owners can combine the flexibility of using an LLC with the tax advantages of an S-corporation.

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

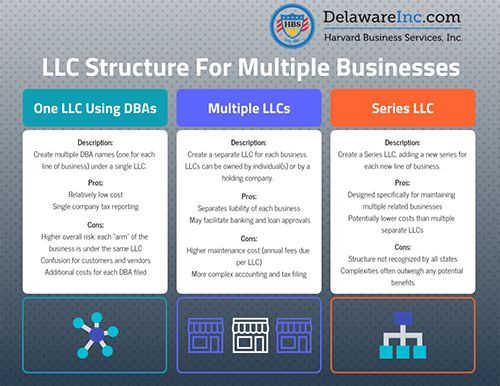

Operate Multiple Businesses Under One Llc Holding Company Harvard Business Services

Operate Multiple Businesses Under One Llc Holding Company Harvard Business Services

5 Types Of Business Structures Business Structure Sole Proprietorship Business

5 Types Of Business Structures Business Structure Sole Proprietorship Business

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Types Of Businesses Overview Of Different Business Classifications

Types Of Businesses Overview Of Different Business Classifications

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

Partnership Overview Of Different Types Of Partnerships

Partnership Overview Of Different Types Of Partnerships

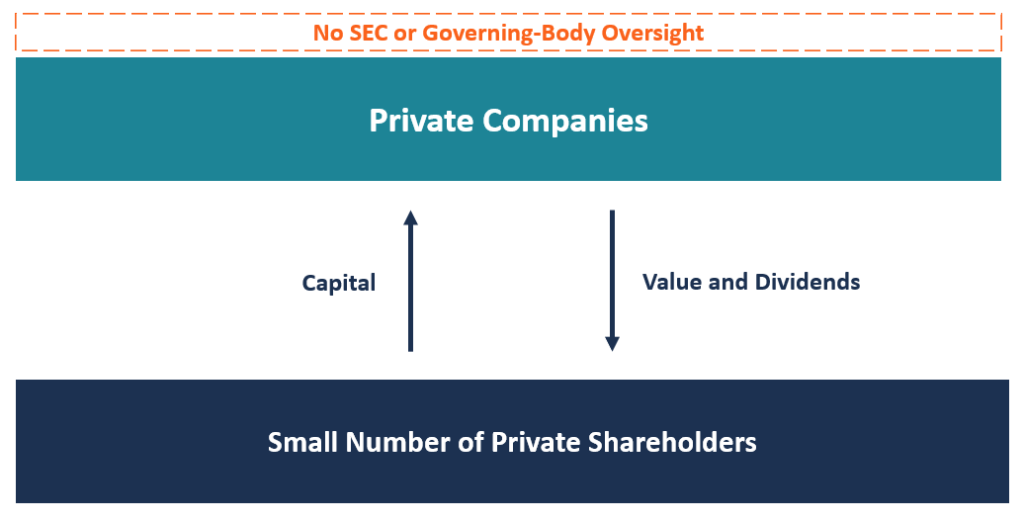

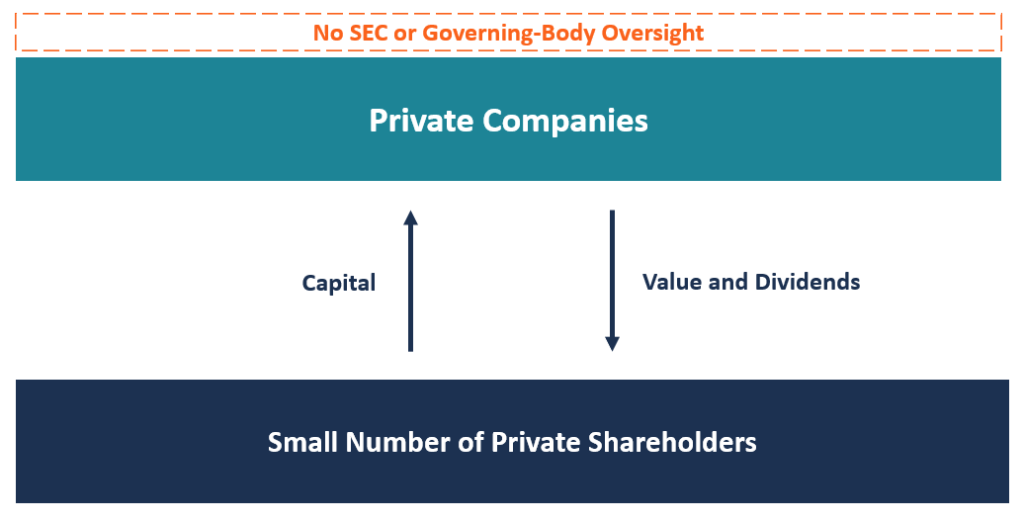

Private Company Overview Types Why Stay Privately Held

Private Company Overview Types Why Stay Privately Held

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

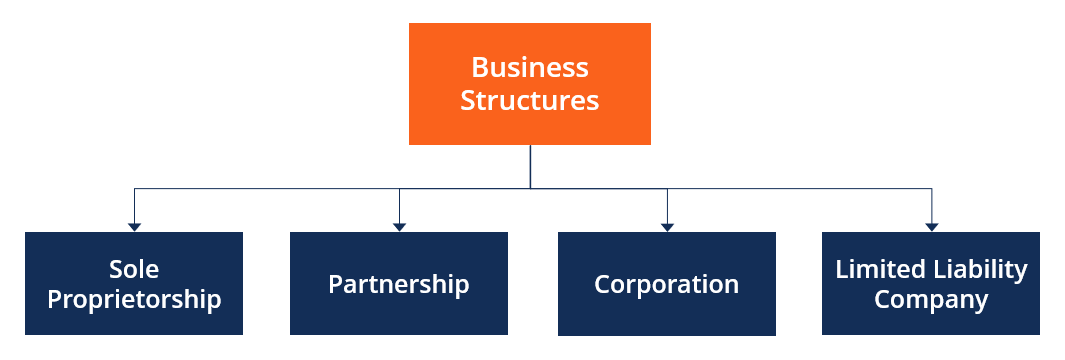

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

4 Types Of Business Partnerships Which Is Best For You Score

4 Types Of Business Partnerships Which Is Best For You Score

Types Of Partnership Business And Their Characteristics General Partnership Business Small Business Finance

Types Of Partnership Business And Their Characteristics General Partnership Business Small Business Finance

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

Partnership Agreement Template Free Business Letter Format Throughout Template For Business Partnership Ag Business Letter Format Contract Template Lettering

Partnership Agreement Template Free Business Letter Format Throughout Template For Business Partnership Ag Business Letter Format Contract Template Lettering

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Business Ownership Structure Types Business Structure Business Basics Business Ownership

6 Types Of Corporations Which Is Best For Your Startup Brex

6 Types Of Corporations Which Is Best For Your Startup Brex

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More