1099 Business Expenses 2020

See Line I later and the 2020 General Instructions for Certain Information Returns for details and other payments that may require you to file a Form 1099. Any income appearing in box 7 of a 1099-MISC prior to 2020 is automatically considered to be self-employment income by the IRS.

The reason youll receive an IRS Form 1099 is if you earned income as an independent contractor sole proprietor sole owner of an LLC or a self-employed person.

1099 business expenses 2020. 1099 Reporting for Independent Contractors at Year-end. As a self-employed individual there are certain filing. The good news is that also like a business you get to deduct expenses to lower the amount you pay in taxes.

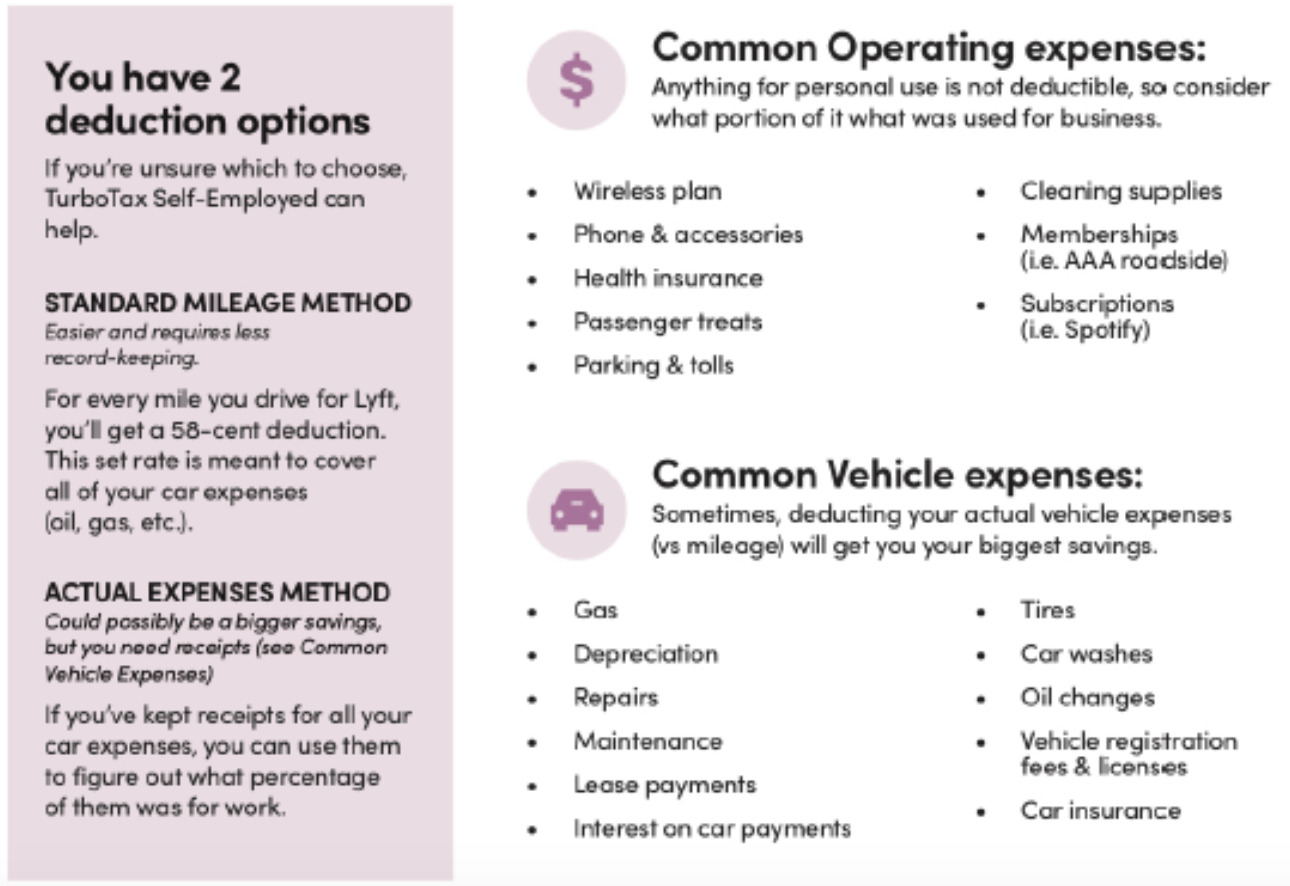

Contractors have two options when it comes to this deduction. Get ideas on common industry-specific business expenses people in your profession use. Depreciation of Assets.

Running a bit behind on taxes this year. Even if an individual is not formally issued a 1099 for contract work any non. To qualify as work-related travel your trip must meet the following conditions.

You can reference the IRS website for a full list of deductible business travel expenses. You can elect to deduct or amortize certain business start-up costs. File Form 1099-MISC Miscellaneous Income for each person to whom you have paid during the year in the course of your trade or business at least 600 in rents prizes and awards other income payments.

You may simply perform services as a non-employee. One of the largest expenses available to contractors to deduct is mileage. During 2020 an organization pays a speaker who is a sole proprietor 1000 of which 600 was substantiated as related travel expenses.

How to time business income and expenses at the end of a tax year to place the income or expense in the best tax year for minimizing business taxes. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. As a self-employed worker with a small business this year you mightve spent quite a bit of money on it.

This is the first year I have had to file with a 1099-NEC. Publication 535 - Introductory Material. By ordinary it means that the expense is common and accepted in an industry.

Also when you track your 1099 expenses and it comes to claiming hardware its wise to use a percentage to calculate the business deduction. There is no requirement to issue a. Their actual car expenses like the cost of gas maintenance insurance car payments and.

Start for free today to. If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. Beginning with tax year 2020 use Form 1099-NEC to report nonemployee compensation.

Use the TurboTax Self-Employed Expense Estimator to find common self-employment tax deductions write-offs and business expenses for 1099 filers. 201 accelerated the due date for filing Form 1099 that includes nonemployee compensation NEC from February 28 to January 31 and eliminated the automatic 30-day extension for forms that include NEC. The PATH Act PL.

After excluding the substantiated expenses of 600 the remaining 400 is less than the annual 600 limit. Refer to chapters 7 and 8 of Publication 535 Business Expenses. When you calculate quarterly or year-end 1099 taxes you can itemize deductions which factor into your business profit or loss as reported on the Schedule C.

Interest payments made on all loans lines of credit and other liabilities incurred for your trade or business are tax. Business interest on the debt for trade or business. After you calculate your 1099 tax rate you may be worried about how much youll owe to Uncle SamNow you would like to know what you can deduct so you can reduce your taxable income on your tax form and pay the least tax you can in a legal manner.

For use in preparing 2020 Returns. All expenses related to business travel can be written off at tax time including airfare hotels rental car expenses tips dry cleaning meals and more. 1099-NEC using TurboTax business expenses.

Publication 535 2020 Business Expenses. Taxpayers who have already filed their 2020 tax return and who have excess APTC for 2020 do not need to file an amended tax return or contact the IRS. Tax Return Due Dates for 2020 Small Business Taxes.

Taxes for leased business property. Car Expenses. As a sole proprietor you work for yourself while small business owners who run LLCs partnerships or corporations may hire employees independent contractors or both.

However if you have an expense for something that is used partly for business and partly for personal purposes divide the total cost between the. Businesses are generally allowed to deduct the costs of carrying on the trade or business. Personal versus Business Expenses.

The IRS has reissued the form 1099-NEC for the 2020 tax season to replace box 7 on the 1099-MISC which up until recently was standard for reporting non-employee payments. If you received cash of more than 10000 in one or more related transactions in your trade or business you may have to file Form 8300. To be deductible the Internal Revenue Code requires that the business expenses be ordinary and necessary.

And by necessary it means that the expense is helpful and appropriate. Taxes paid to a lessor on leased office space equipment and vehicles used for business purposes are a deductible business expense. The IRS will reduce the excess APTC.

While you may have purchased that laptop solely for work purposes a 100 deduction might be a flag for the IRS and you want to. Generally you cannot deduct personal living or family expenses.

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Deducting Business Expenses Which Expenses Are Tax Deductible

Deducting Business Expenses Which Expenses Are Tax Deductible

1099 Forms And More At Everyday Low Prices Zbpforms Com

1099 Forms And More At Everyday Low Prices Zbpforms Com

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

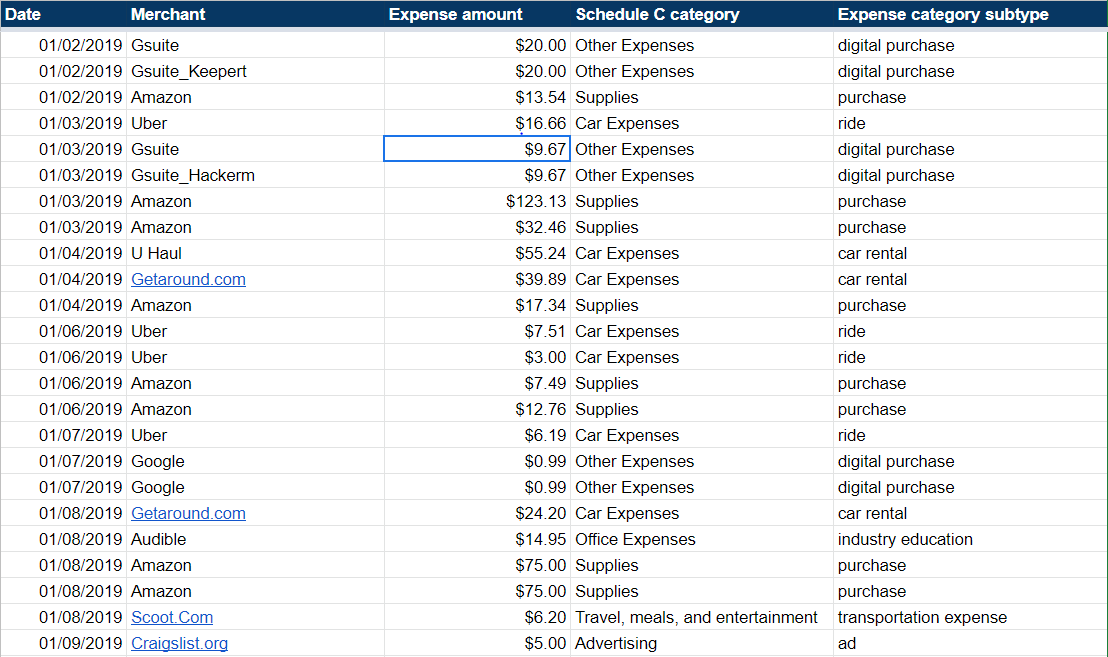

Small Business Tax Spreadsheet Small Business Tax Business Tax Deductions Small Business Expenses

Small Business Tax Spreadsheet Small Business Tax Business Tax Deductions Small Business Expenses

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

Https Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income 4012 Pdf

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments