How Much Does It Cost To Get Vat Registered

So how much do you have to earn to be VAT registered. The VAT registration threshold in the UK currently stands at 85000.

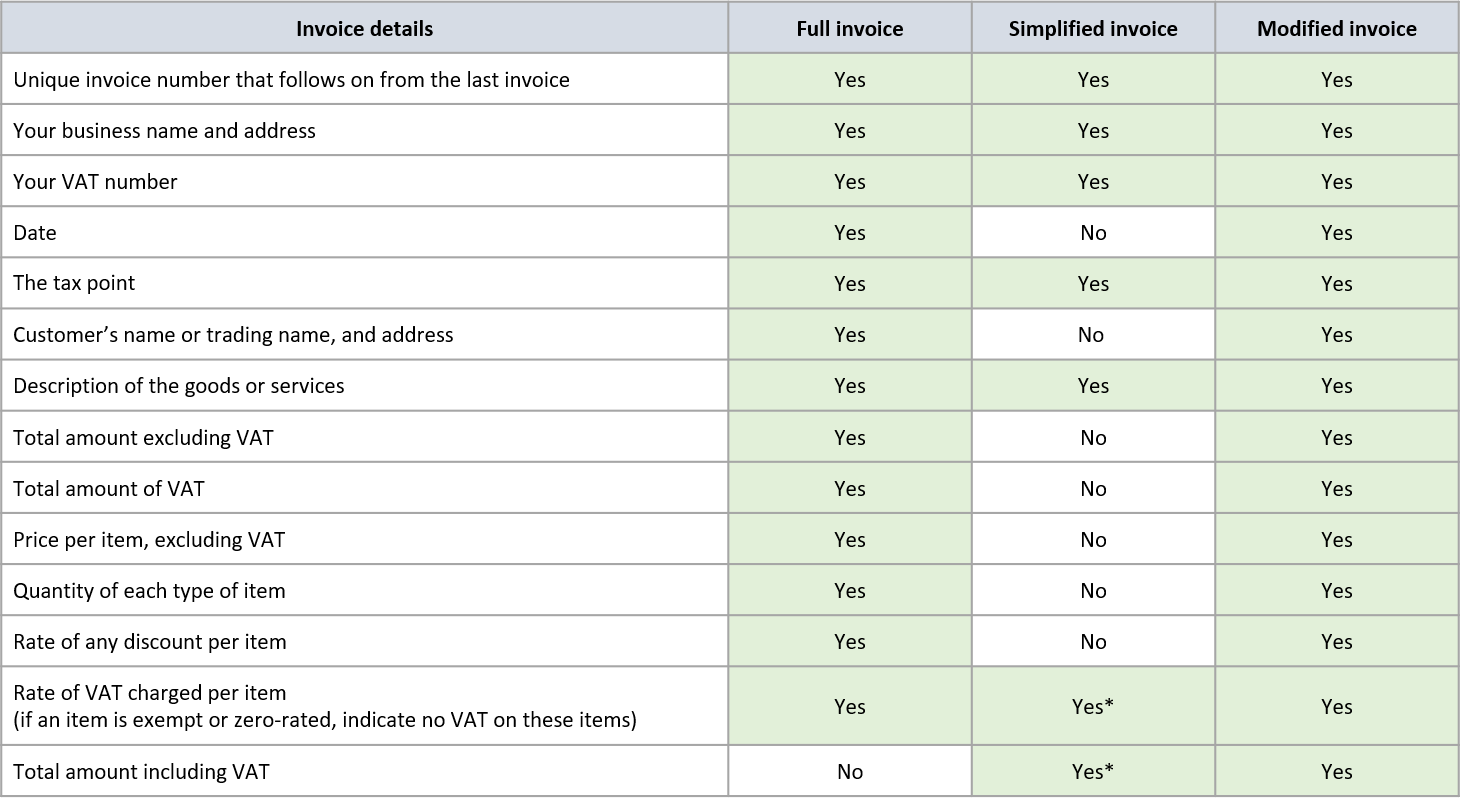

Can I Invoice Without A Vat Number Debitoor Invoicing Software

Can I Invoice Without A Vat Number Debitoor Invoicing Software

Most VAT registered businesses that earn over 85000 must also follow the rules for Making Tax Digital for VAT.

How much does it cost to get vat registered. It helps you find your CA online within your budget. Choose a specific EU country and register through their national VAT MOSS. VAT registration is not mandatory until the entity or individual has made taxable supplies of goods and services of at least 30000 CAD in a quarter.

Total Costs You are looking at a total estimated cost of 800 - 900 plus VAT including Ashfords fees and all official fees if your trade mark application proves straightforward and covers goodsservices in one class only. The charges for getting the registration is Based on the experience and location of the professional. This works out at about 80-90 plus VAT per year.

Estimated VAT taxable turnover for next 12 months is 150000 excluding VAT or less. The Lowest Cost is 7000 Rs. In the UK you need to register your business for Value Added Tax VAT if your VAT taxable turnover exceeds 85000.

You can register for VAT at anytime in the capacity of an individual sole trader or Limited Company. You can register voluntarily if your business turnover is below 85000. The cost to register for an Arkansas sales tax permit is currently 50.

Submit the registration form to your local SARS branch within 21 days from date of exceeding R1 million. Once youve registered HMRC will send you a VAT registration certificate confirming. If your business annual turnover exceeds this threshold you must register for VAT.

The cost to register or renew an Arizona transaction privilege tax license is currently 12 per business location. R 9990 Once off. The tax rate was 14 until 31 March 2018.

VAT is an indirect tax on the consumption of goods and services in the economy. 1 ID Documents Passport 2 South African Business Address. Company Registration number Immediately.

A person or business is required to register for VAT in Canada at the moment they start to make taxable supplies. If and when you become VAT registered you will add 20 VAT to your charge so you wil now charge the customer 120 and they will recover the 20 VAT. If you fail to do.

Actually if you do little bit homework for documentation you dont need CA to make application for VAT and CST. 21 February 2018 - Budget 2018 announcement. VAT is levied at a standard rate of 15 on the supply of goods and services by registered vendors.

Get Your VAT Company Now. Note that the timeframes above are the official timeframes from SARS but during the Covid Pandemic these timeframes may differ as SARS builds up a backlog each time. While you wait You cannot charge or show VAT on your invoices until you get.

You have the right to register in any of the 28 member states. You can find out more about VAT by referring to our detailed guide on VAT. You must pay HMRC any VAT you owe from the date they register you.

If however your turnover reaches 85000 or is predicted to do so in the near future then it will become compulsory to register for VAT. So the net cost to the customer remains 100. 0605 for every separate or distinct establishment or place of business before the start of their business following existing issuances on.

Charges for VAT CST registration is Based on the experience and location of the professional. The manufacturer charges the retailer 120 x 110 132 and pays the government 012 minus 010 002 leaving the same gross margin of 132 110 002 020. A vendor making taxable supplies of more than R1 million per annum must register for VAT.

The cheapest can range from INR 6000-INR 7000. It is worth noting that trusts and associations are also required to register for VAT in Canada in case they sell goods or services. A separate city license fee may be required.

Inputs from My Corporation. For most foreign businesses the Irish VAT MOSS is the best choice because its all in English with an easy-to-use design. VAT is now levied at the standard rate of 15 on the supply of goods and services by registered vendors.

TPT licenses are valid for one calendar year and must be renewed annually by January 1. Alternatively 1st Formations provides an affordable VAT Registration Service at a cost of 3999 plus VAT. More to the point though if you are becoming a wholesale provider to retail outlets you are going to hit the VAT threshold quite quickly I imagine.

Pay VAT based on a fixed percentage of your sales the percentage used depends on the type of business ran and you may also have to consider the amount of. New VAT taxpayers shall apply for registration as VAT Taxpayers and pay the corresponding registration fee of five hundred pesos P50000 using BIR Form No.

Vat Registration Things You Should Know Before Register For Vat In Uae In 2021 Things To Know Vat In Uae Tax Refund

Vat Registration Things You Should Know Before Register For Vat In Uae In 2021 Things To Know Vat In Uae Tax Refund

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

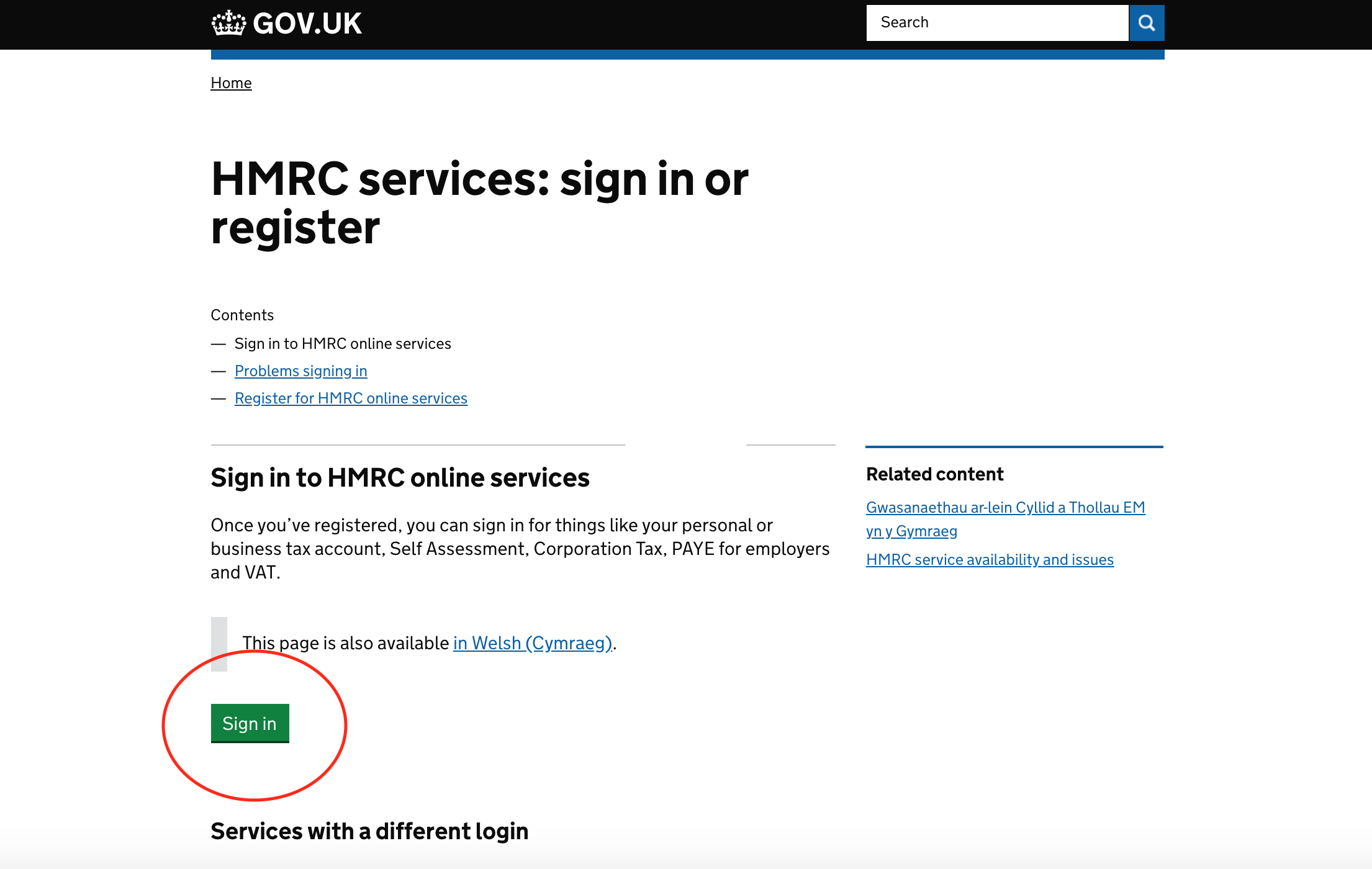

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

How To View Your Vat Certificate Online In 2020 Updated For 2020 Unicorn Accounting

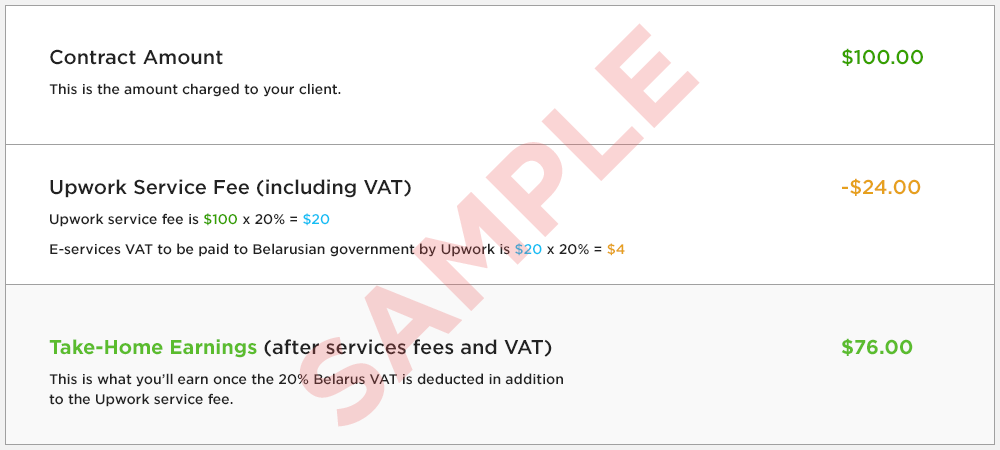

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Vat Registration Requirements List In South Africa 2021

Vat Registration Requirements List In South Africa 2021

The 4 Big Benefits Of Being Vat Registered

The 4 Big Benefits Of Being Vat Registered

Reach Us To Find The Accounting Outsourcing In Dubai Accounting Firms Bookkeeping And Accounting Accounting

Reach Us To Find The Accounting Outsourcing In Dubai Accounting Firms Bookkeeping And Accounting Accounting

Are You Based In The Us And Selling Goods To Customers In Europe Here S How To Give Them A Better Buying Experience Selling Online The Outsiders Online

Are You Based In The Us And Selling Goods To Customers In Europe Here S How To Give Them A Better Buying Experience Selling Online The Outsiders Online

Step By Step Guide To Vat Registration In Uae 971 529751160 Vat In Uae Uae Registration

Step By Step Guide To Vat Registration In Uae 971 529751160 Vat In Uae Uae Registration

Sample Invoice Non Vat Registered Serversdb Example Invoice Not Vat Registered Invoicing Invoice Template Invoice Template Word

Sample Invoice Non Vat Registered Serversdb Example Invoice Not Vat Registered Invoicing Invoice Template Invoice Template Word

Uber Vat Compliance For Uk Partner Drivers

Uber Vat Compliance For Uk Partner Drivers

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

If Your Business Taxable Supplies And Imports Exceed Aed 375000 You Should Get It Vat Registered And Collect The Tax From In 2021 Law Firm Goods And Services Business

If Your Business Taxable Supplies And Imports Exceed Aed 375000 You Should Get It Vat Registered And Collect The Tax From In 2021 Law Firm Goods And Services Business

85k Vat Threshold Explained 19 Vat Things You Need To Know

85k Vat Threshold Explained 19 Vat Things You Need To Know

Vat Specialist Accountants From Tpcguk Accounting Proactive Assessment

Vat Specialist Accountants From Tpcguk Accounting Proactive Assessment

How To Apply For De Registration Of Vat In Uae Vat In Uae How To Apply Audit Services

How To Apply For De Registration Of Vat In Uae Vat In Uae How To Apply Audit Services

Register For Vat In Canada Updated For 2021